As global markets navigate a landscape marked by interest rate expectations and the ongoing artificial intelligence boom, major indices like the Dow Jones Industrial Average and S&P 500 have reached new record highs. Amid these dynamic conditions, dividend stocks continue to capture investor attention due to their potential for providing steady income streams, particularly in an environment where economic uncertainties persist.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.11% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.24% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.41% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.78% | ★★★★★★ |

| NCD (TSE:4783) | 4.13% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| Daicel (TSE:4202) | 4.34% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.49% | ★★★★★★ |

Click here to see the full list of 1328 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, and sale of industrial valves both in China and internationally, with a market cap of CN¥29.47 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates revenue primarily from its valve industry segment, amounting to CN¥6.80 billion.

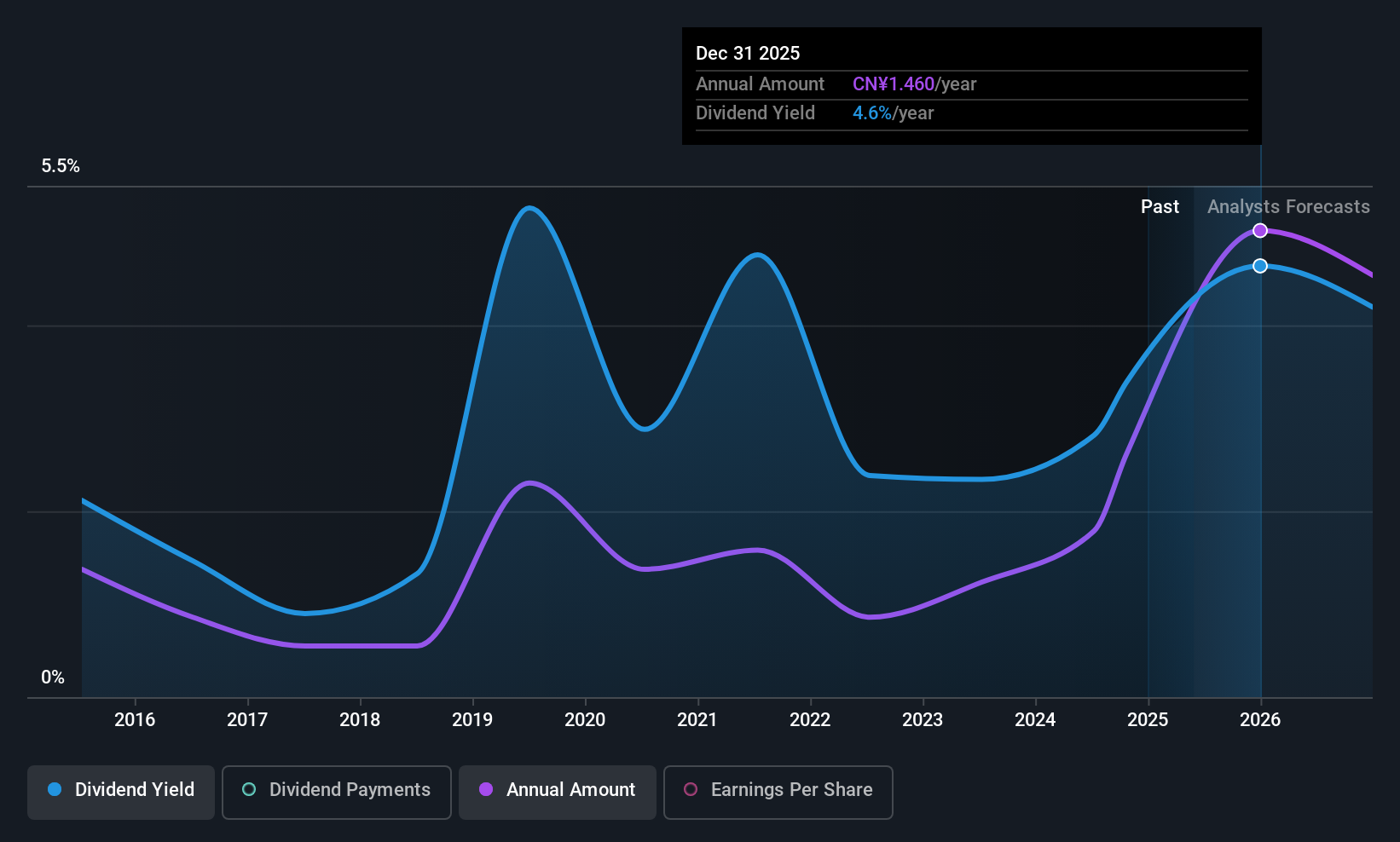

Dividend Yield: 3.8%

Neway Valve (Suzhou) has shown significant earnings growth, with revenue reaching CNY 3.40 billion and net income at CNY 636.75 million for the first half of 2025. Despite a dividend yield in the top 25% of the CN market, dividends have been volatile and are not well covered by earnings due to a high payout ratio of over 100%. However, cash flows are sufficient to cover dividends with a cash payout ratio of 66.3%.

- Unlock comprehensive insights into our analysis of Neway Valve (Suzhou) stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Neway Valve (Suzhou) shares in the market.

Japan Process Development (TSE:9651)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Process Development Co., Ltd. offers system integration and software development services in Japan, with a market cap of ¥14.96 billion.

Operations: Japan Process Development Co., Ltd. generates revenue through various segments including Control System (¥1.71 billion), Embedded System (¥1.48 billion), Automotive Systems (¥2.41 billion), Industry / ICT Solution (¥3.09 billion), and Specific Information System (¥1.79 billion).

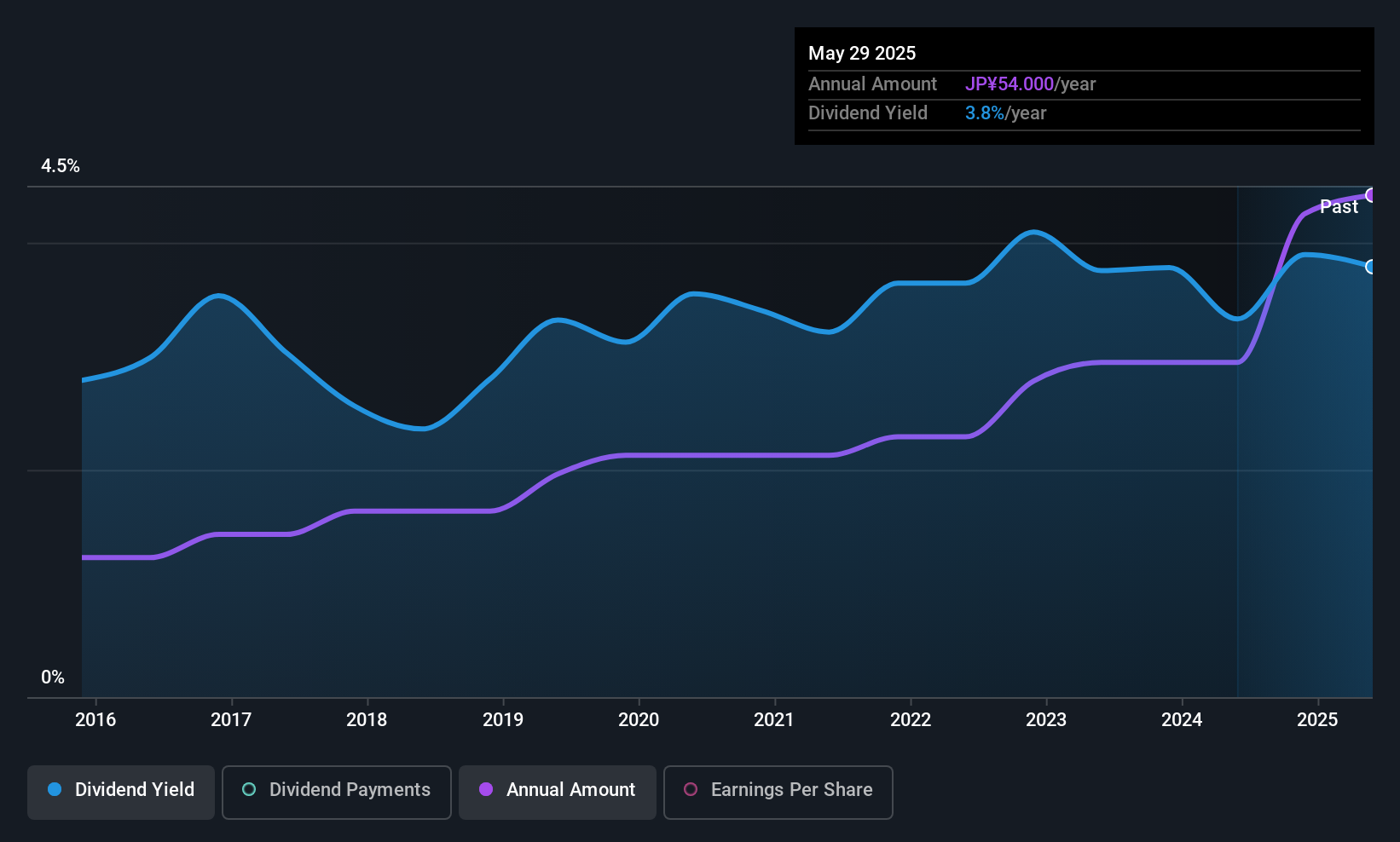

Dividend Yield: 3.6%

Japan Process Development has demonstrated a stable and growing dividend history over the past decade, though recent guidance indicates a decrease to JPY 33 per share for the upcoming quarter. Despite a low price-to-earnings ratio of 10.7x, suggesting good value, dividends are not well covered by cash flows due to a high cash payout ratio of 118.4%. While earnings have grown significantly by 102.5% in the past year, sustainability concerns remain due to insufficient free cash flow coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Process Development.

- Insights from our recent valuation report point to the potential overvaluation of Japan Process Development shares in the market.

Miroku Jyoho Service (TSE:9928)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miroku Jyoho Service Co., Ltd. offers systems and solutions to tax accounting and CPA firms, their client companies, and small to mid-sized companies in Japan, with a market cap of ¥56.66 billion.

Operations: Miroku Jyoho Service Co., Ltd. generates revenue through providing systems and solutions primarily to tax accounting firms, CPA firms, and small to mid-sized businesses in Japan.

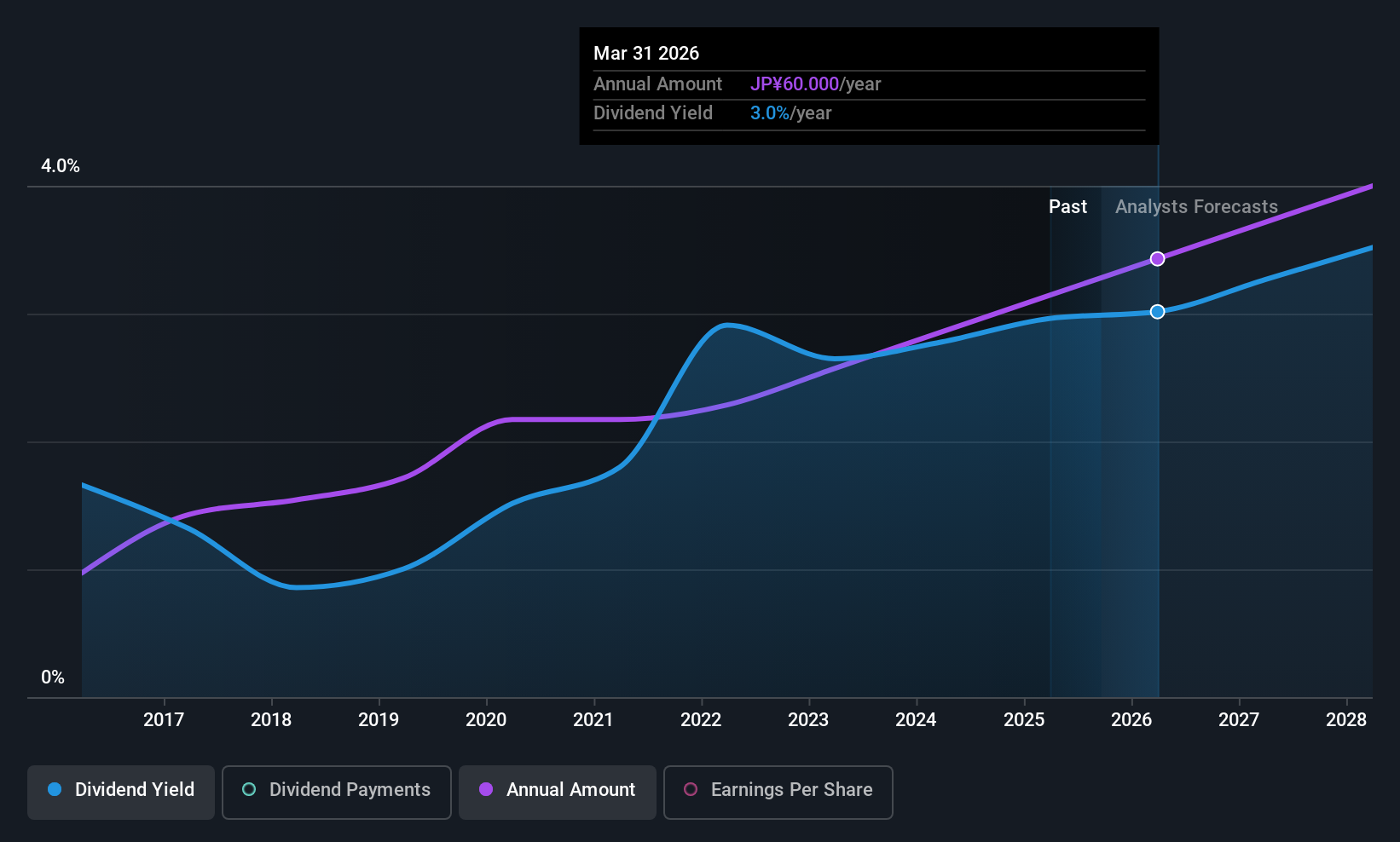

Dividend Yield: 3%

Miroku Jyoho Service offers a stable dividend history over the past decade with growth in payments, yet its 3.02% yield is below the top tier of JP dividend payers. The price-to-earnings ratio of 14.3x indicates good value against the market average, but dividends are not well covered by cash flows due to a high cash payout ratio of 109.6%. While earnings cover dividends with a low payout ratio of 39.6%, sustainability concerns persist without sufficient free cash flow coverage.

- Click to explore a detailed breakdown of our findings in Miroku Jyoho Service's dividend report.

- According our valuation report, there's an indication that Miroku Jyoho Service's share price might be on the cheaper side.

Where To Now?

- Unlock our comprehensive list of 1328 Top Global Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9651

Japan Process Development

Provides system integration and software development services in Japan.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives