- Australia

- /

- Professional Services

- /

- ASX:SIQ

Top ASX Dividend Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the Australian market continues to navigate a flat trading environment with mixed sector performances, dividend stocks remain a focal point for investors seeking steady income amid economic uncertainties. In light of strong export data from China and fluctuating commodity prices, identifying robust dividend stocks on the ASX can offer stability and potential growth in an otherwise unpredictable landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.77% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.28% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.27% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.67% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.59% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.13% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.90% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.08% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.67% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited, with a market cap of A$260.12 million, offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia.

Operations: Lindsay Australia Limited generates revenue primarily from its Transport segment (A$573.35 million), followed by Rural (A$160.92 million) and Hunters (A$100.09 million).

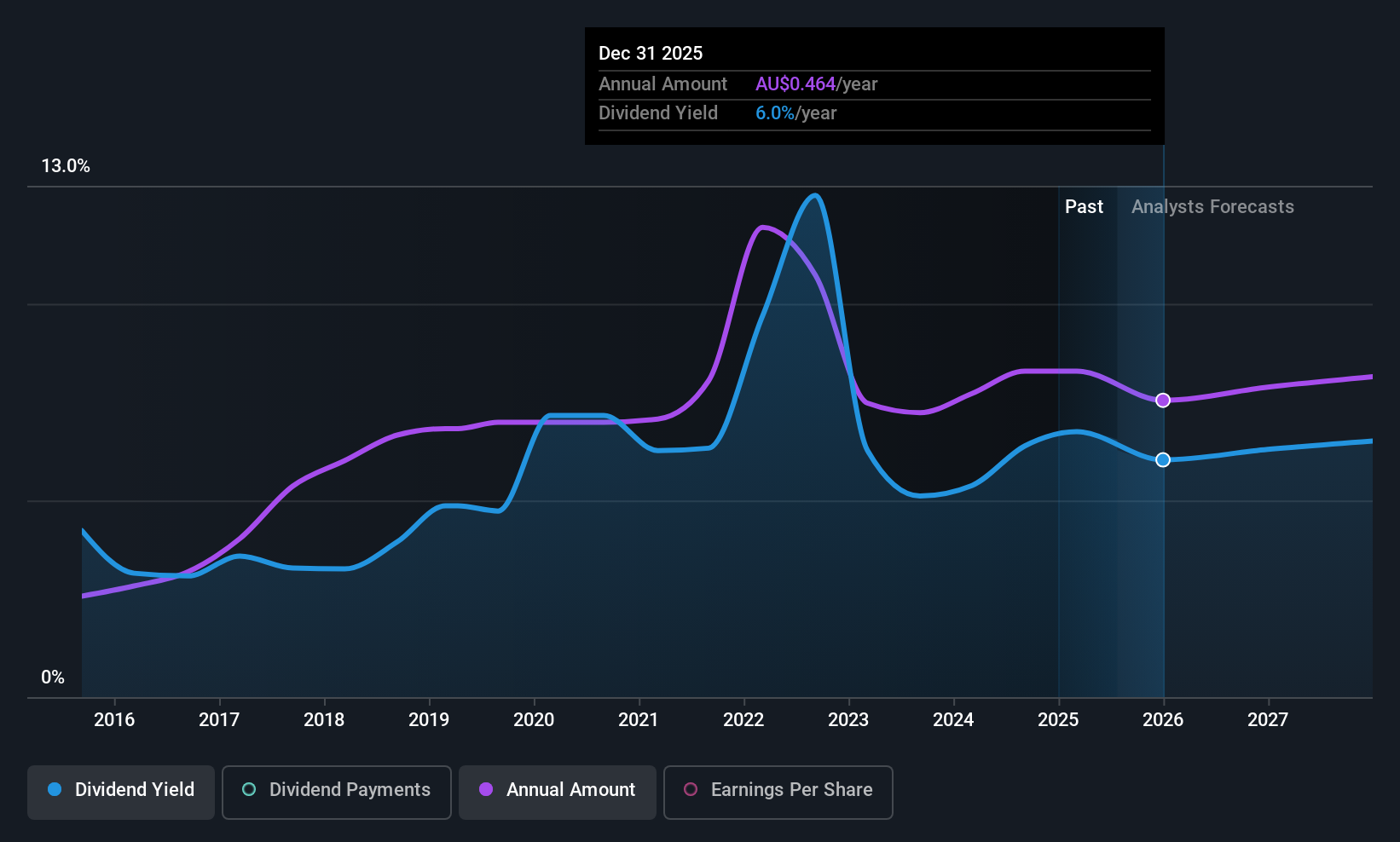

Dividend Yield: 7.1%

Lindsay Australia's dividend yield is in the top 25% of Australian payers, supported by a low cash payout ratio of 26.1%, indicating coverage by free cash flow. However, dividends have been volatile over the past decade, lacking reliability and stability. Recent leadership changes, including appointing Mr. Robert Miller as executive director and acquiring SRT Logistics, may influence strategic decisions impacting future dividend consistency and growth potential despite current profit margins declining to 2.9%.

- Delve into the full analysis dividend report here for a deeper understanding of Lindsay Australia.

- Insights from our recent valuation report point to the potential undervaluation of Lindsay Australia shares in the market.

Smartgroup (ASX:SIQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smartgroup Corporation Ltd, with a market cap of A$1.03 billion, provides employee management services in Australia.

Operations: Smartgroup Corporation Ltd generates revenue from its Vehicle Services segment, contributing A$21.87 million, and Outsourced Administration services, which bring in A$287.87 million.

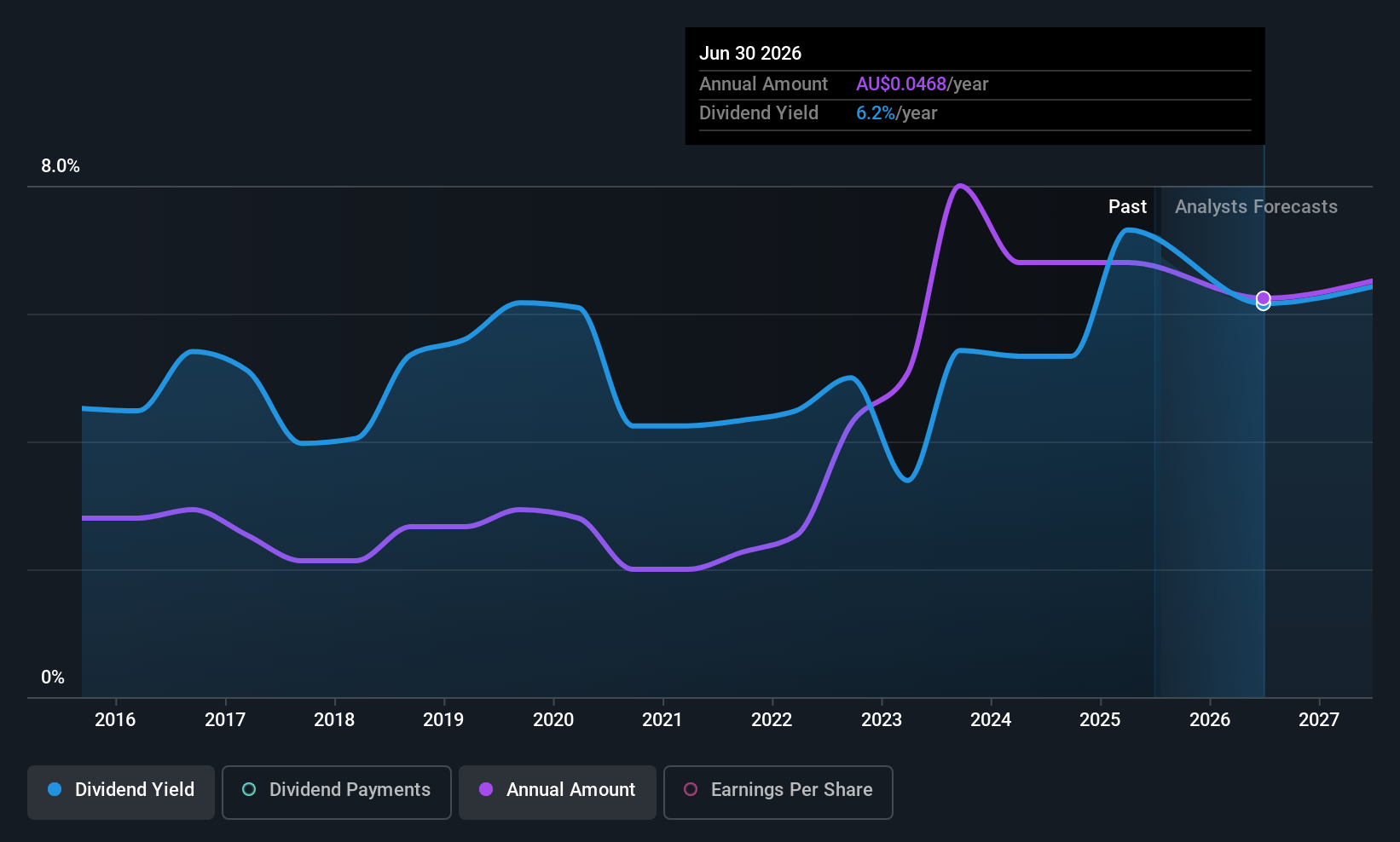

Dividend Yield: 6.5%

Smartgroup's dividend yield of 6.52% ranks within the top 25% of Australian payers, yet its dividends have been volatile over the past decade, lacking reliability. While earnings cover the payout ratio at 64.4%, a high cash payout ratio of 135.6% indicates insufficient free cash flow coverage, raising sustainability concerns despite recent earnings growth of 22.1%. The company recently changed its registered office to Darling Park Tower in Sydney as of June 2025.

- Dive into the specifics of Smartgroup here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Smartgroup is priced lower than what may be justified by its financials.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited offers electrical, instrumentation, communications, security, and maintenance services to the resources, commercial, and infrastructure sectors in Australia with a market cap of A$457.43 million.

Operations: Southern Cross Electrical Engineering Limited's revenue primarily comes from the provision of electrical services, amounting to A$693.73 million.

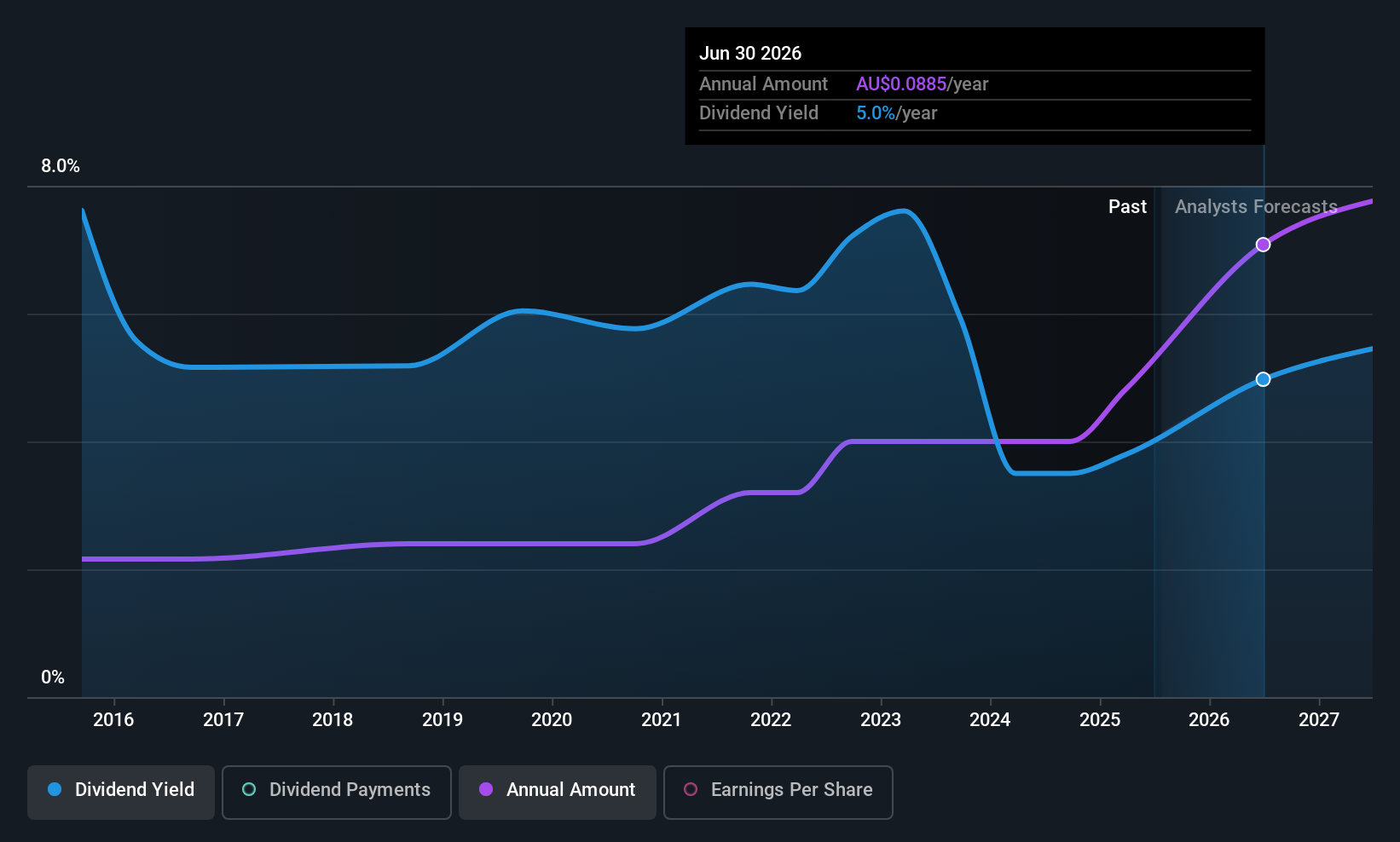

Dividend Yield: 4.3%

Southern Cross Electrical Engineering's dividend yield of 4.34% is below the top 25% in Australia, and its dividends have been volatile over the past decade, indicating unreliability. However, with a payout ratio of 69.4%, dividends are covered by earnings and well-supported by cash flows with a cash payout ratio of only 26.9%. Despite a history of instability in dividend payments, analysts anticipate significant stock price appreciation and forecast earnings growth at 18.8% annually.

- Click here to discover the nuances of Southern Cross Electrical Engineering with our detailed analytical dividend report.

- Our valuation report here indicates Southern Cross Electrical Engineering may be undervalued.

Make It Happen

- Explore the 27 names from our Top ASX Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIQ

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives