As global markets continue to navigate a landscape of evolving trade negotiations and mixed economic signals, the Asian markets have shown resilience, with China's stock indices experiencing gains despite ongoing challenges. In this environment, dividend stocks in Asia present an intriguing option for investors seeking income stability; these stocks often provide consistent returns through dividends while offering potential growth opportunities within a dynamic market.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Soliton Systems K.K (TSE:3040) | 4.05% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.09% | ★★★★★★ |

| NCD (TSE:4783) | 4.22% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.31% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.67% | ★★★★★★ |

| Daicel (TSE:4202) | 4.93% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 5.98% | ★★★★★★ |

Click here to see the full list of 1218 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

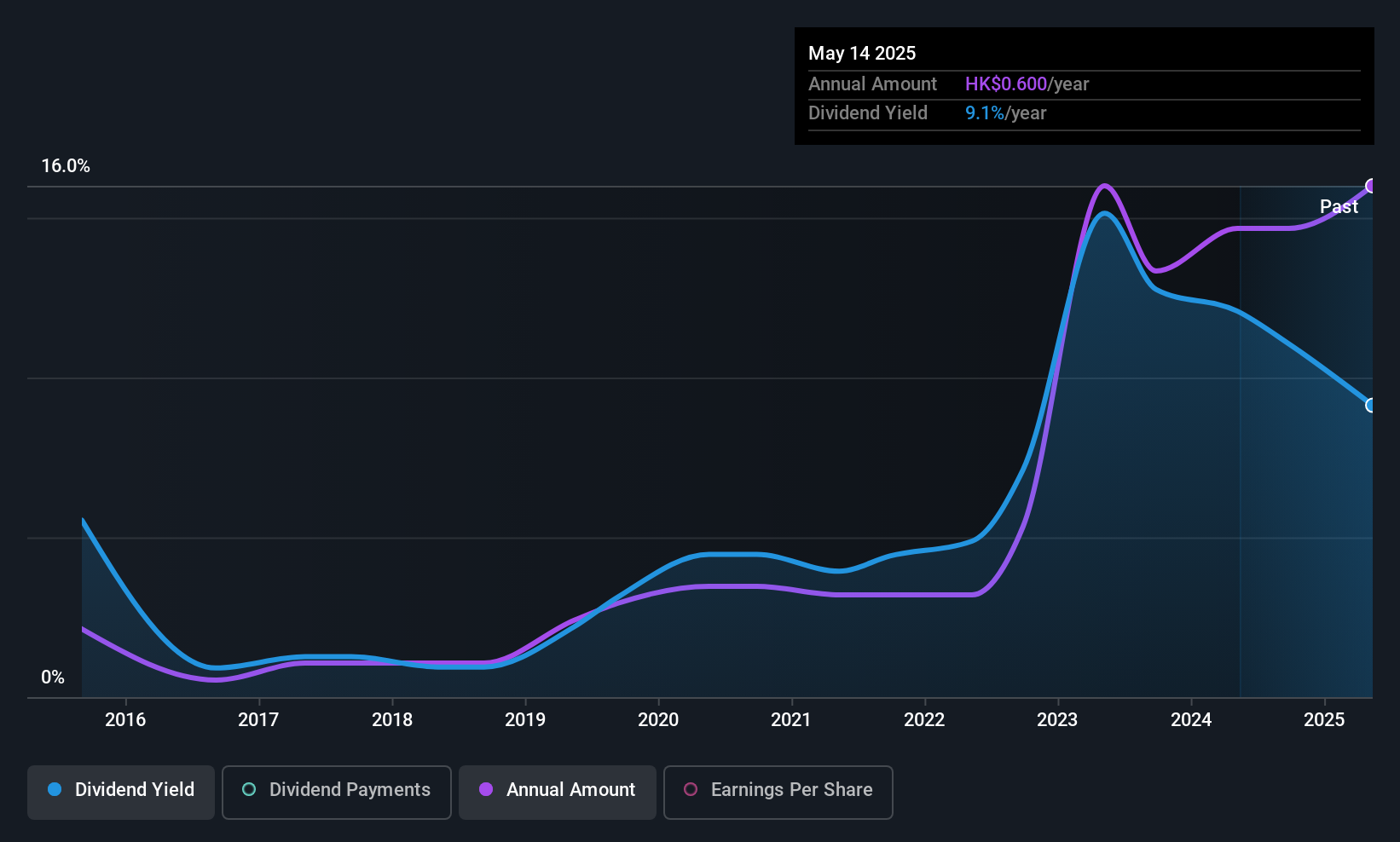

Dream International (SEHK:1126)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dream International Limited is an investment holding company that specializes in designing, developing, manufacturing, and selling plush stuffed toys, plastic figures, dolls, die casting products, and fabrics with a market cap of HK$7.82 billion.

Operations: Dream International Limited generates revenue from several segments, including HK$2.31 billion from plastic figures, HK$2.77 billion from plush stuffed toys, and HK$373.31 million from tarpaulin.

Dividend Yield: 5.2%

Dream International recently approved a final dividend of 40 HKD cents per share for 2024, highlighting its commitment to returning value to shareholders. However, the company's dividend history has been volatile and unreliable over the past decade. Despite this, dividends are currently well-covered by earnings with a payout ratio of 55% and cash flows at a cash payout ratio of 76.3%. The stock's P/E ratio is favorable compared to the Hong Kong market average.

- Click here to discover the nuances of Dream International with our detailed analytical dividend report.

- Our valuation report unveils the possibility Dream International's shares may be trading at a premium.

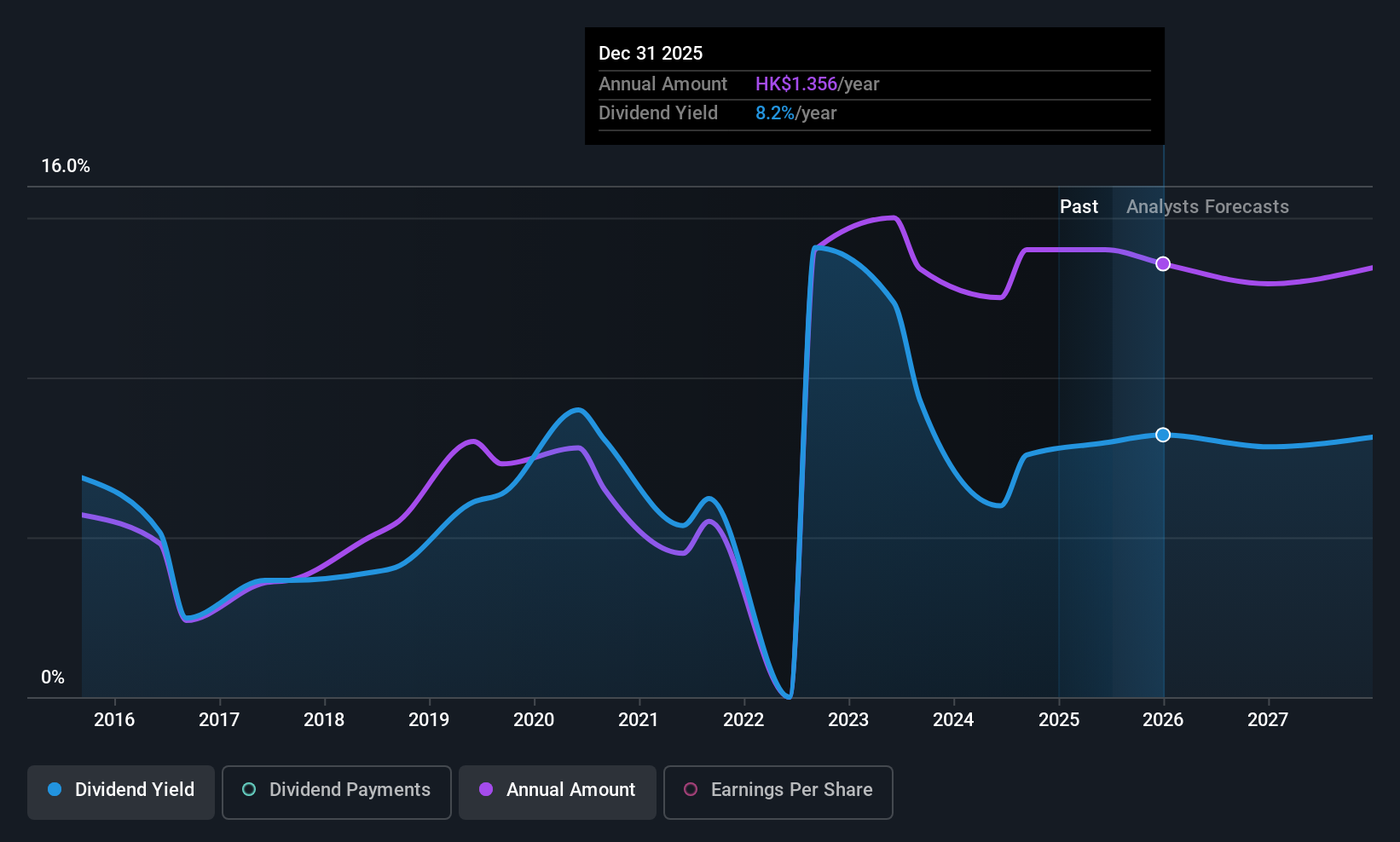

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas in China, Canada, and internationally with a market cap of HK$819.75 billion.

Operations: CNOOC Limited generates revenue primarily through its operations in the exploration, development, production, and sale of crude oil and natural gas across various regions including China and Canada.

Dividend Yield: 6.4%

CNOOC's dividend history has shown volatility over the past decade, yet its current dividends are well-covered by earnings and cash flows, with payout ratios of 46.5% and 61.9%, respectively. Although its dividend yield of 6.4% is below the top tier in Hong Kong, CNOOC trades at a significant discount to estimated fair value. Recent developments like the Weizhou 5-3 Oilfield project could potentially enhance production capacity, supporting future cash flow stability for dividends.

- Delve into the full analysis dividend report here for a deeper understanding of CNOOC.

- According our valuation report, there's an indication that CNOOC's share price might be on the cheaper side.

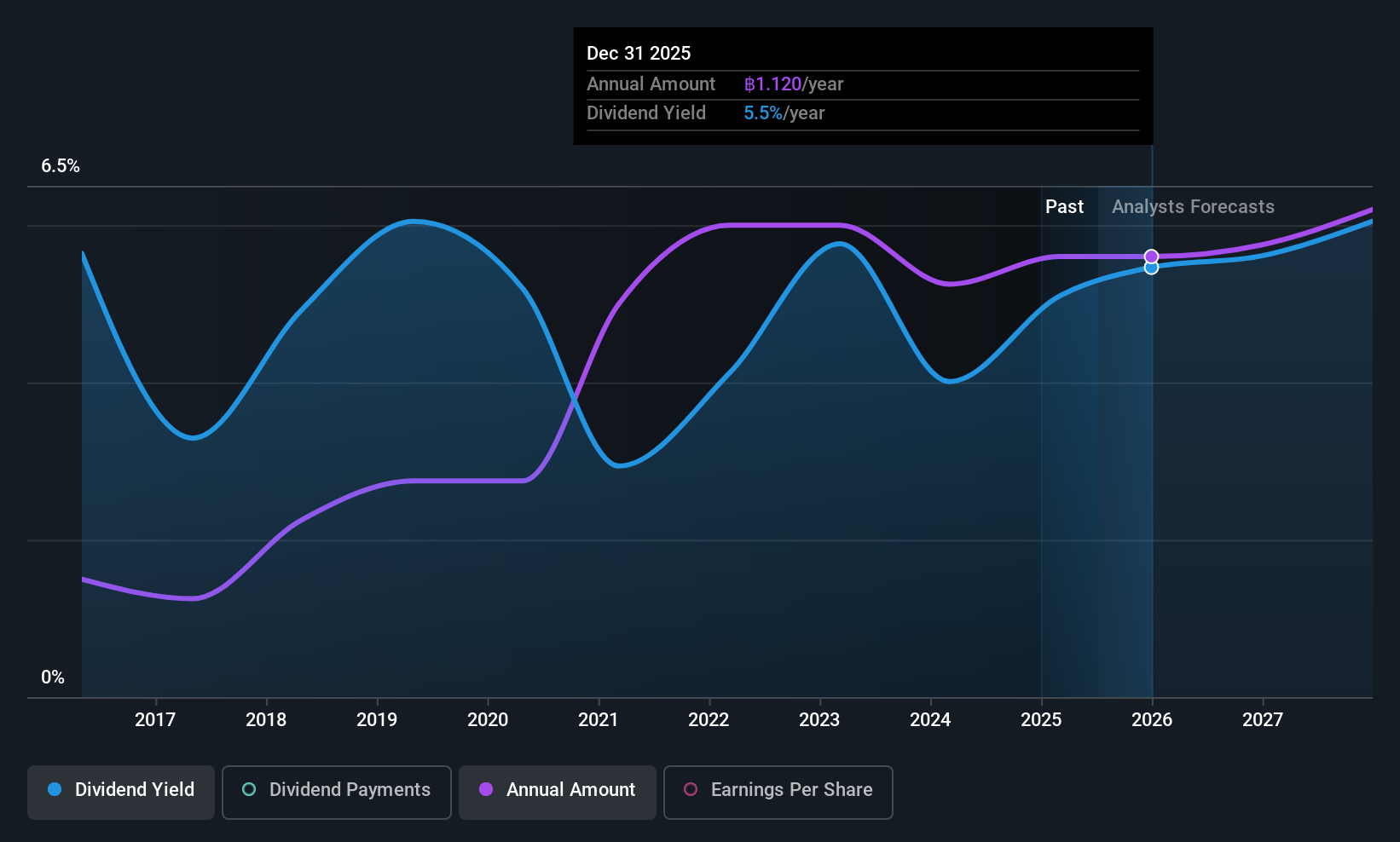

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, with a market cap of THB7.25 billion, operates in the distribution of computer components, smartphones, and office automation equipment in Thailand.

Operations: SiS Distribution (Thailand) Public Company Limited generates revenue from various segments, including Phones (THB4.95 billion), Consumer Products (THB9.13 billion), Value Add Products (THB4.91 billion), and Commercial Products (THB6.88 billion).

Dividend Yield: 5.4%

SiS Distribution (Thailand) has consistently increased and maintained stable dividends over the past decade. Its dividend yield of 5.41% is reliable but lower than Thailand's top payers, with a payout ratio of 54.4% supported by earnings and cash flows, evidenced by a cash payout ratio of 38.3%. The company trades at a favorable price-to-earnings ratio of 10x compared to the market average, while recent earnings growth underscores its capacity to sustain dividends.

- Navigate through the intricacies of SiS Distribution (Thailand) with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, SiS Distribution (Thailand)'s share price might be too optimistic.

Seize The Opportunity

- Discover the full array of 1218 Top Asian Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1126

Dream International

An investment holding company, designs, develops, manufactures, and sells plush stuffed toys, plastic figures, dolls, die casting products, and fabrics.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives