- Philippines

- /

- Banks

- /

- PSE:SECB

Top Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rally, with positive developments such as the U.S.-China trade deal boosting investor confidence, Asian stock markets have also shown resilience and growth. In this dynamic environment, dividend stocks in Asia offer an attractive option for investors seeking stable income streams amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.57% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.00% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.34% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.53% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.20% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.42% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.04% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.16% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

Security Bank (PSE:SECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Security Bank Corporation, along with its subsidiaries, offers a range of banking and financial products and services to both wholesale and retail clients in the Philippines, with a market capitalization of ₱51.77 billion.

Operations: Security Bank Corporation generates its revenue from several segments, including Retail Banking (₱23.94 billion), Business Banking (₱5.82 billion), Financial Markets (₱7.11 billion), and Wholesale Banking (₱12.43 billion).

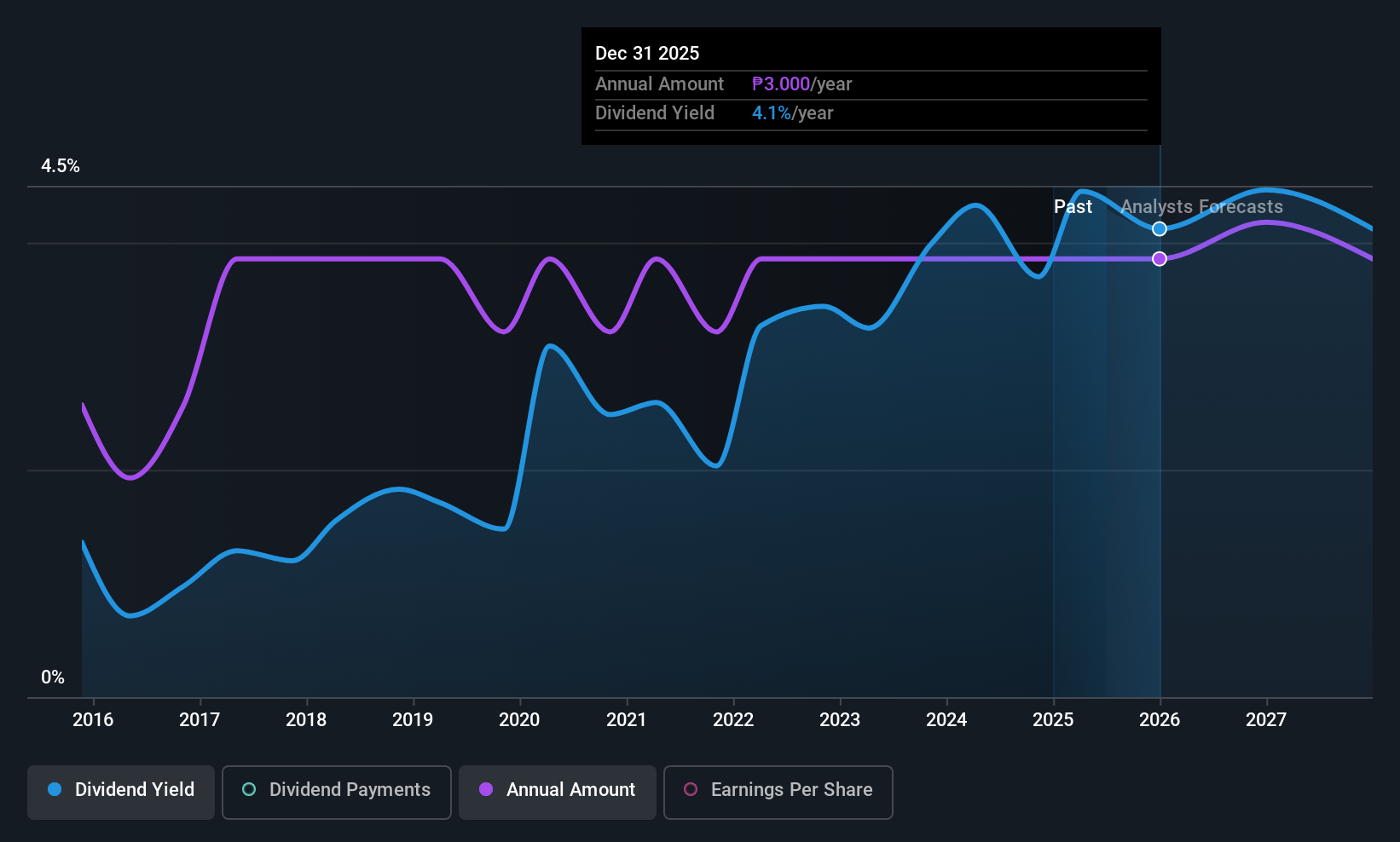

Dividend Yield: 4.4%

Security Bank's dividend yield of 4.37% is below the top tier in the Philippines, and its payments have been volatile over the past decade. However, dividends are well covered by earnings with a low payout ratio of 19.8%, and future coverage remains strong at 15.8%. Despite high bad loans at 2.9%, recent earnings growth of 22% suggests potential for improvement in financial health, supported by strategic executive changes effective July 2025.

- Unlock comprehensive insights into our analysis of Security Bank stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Security Bank shares in the market.

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both within China and internationally, with a market cap of CN¥5.55 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates revenue through its operations in intelligent manufacturing equipment and smart logistics systems, serving both domestic and international markets.

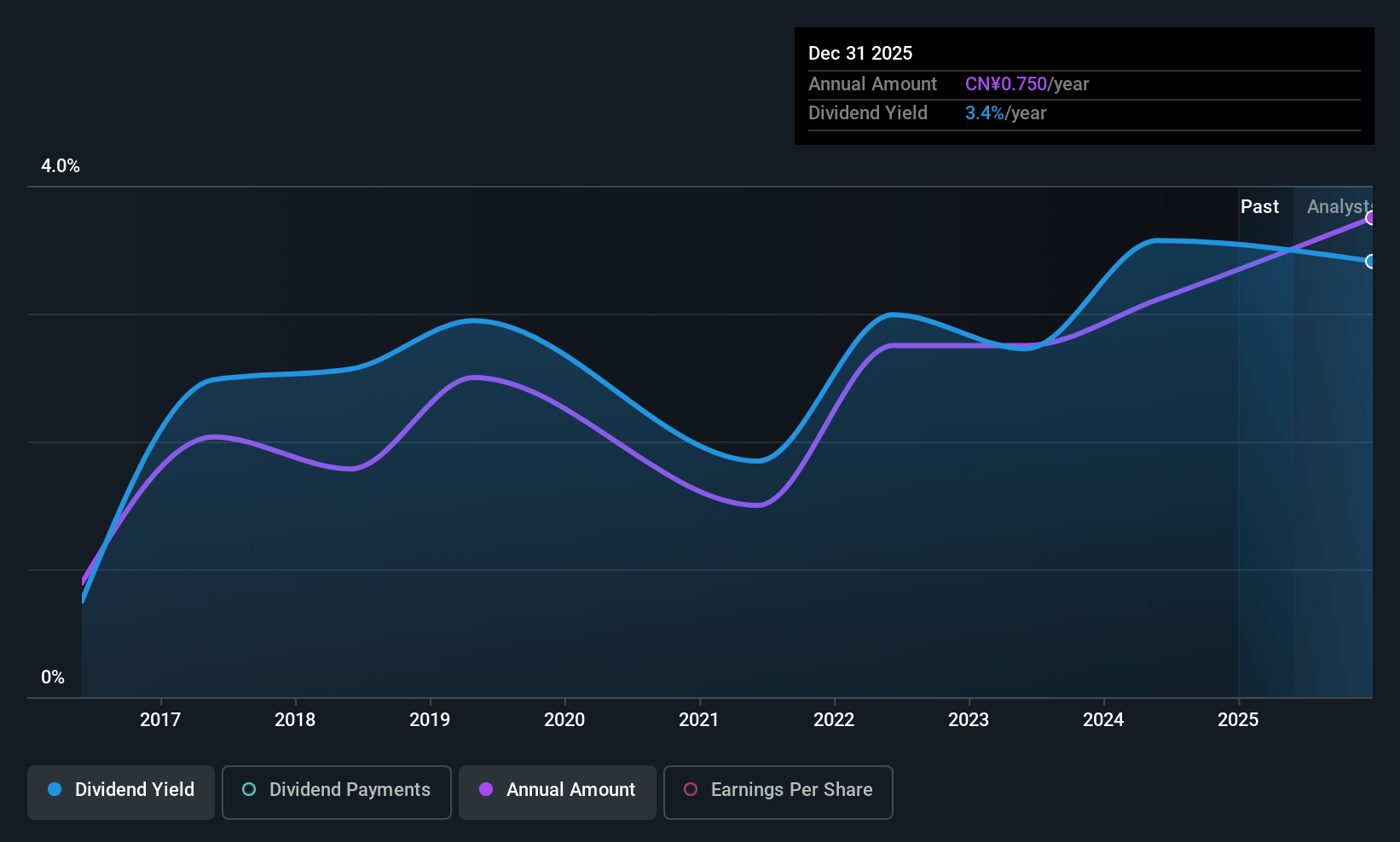

Dividend Yield: 4.2%

Noblelift Intelligent Equipment Ltd. offers a dividend yield of 4.16%, placing it among the top 25% of dividend payers in China, with dividends well covered by earnings and cash flows, evidenced by payout ratios of 49.3% and 66.2%, respectively. Despite past volatility, dividends have increased over the last decade. Recent financial results show net income growth to CNY 122.71 million for Q1 2025, supporting its recent annual dividend increase to CNY 0.897 per share.

- Delve into the full analysis dividend report here for a deeper understanding of Noblelift Intelligent EquipmentLtd.

- Upon reviewing our latest valuation report, Noblelift Intelligent EquipmentLtd's share price might be too pessimistic.

Hirata (TSE:6258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hirata Corporation manufactures and sells manufacturing line systems, industrial robots, and logistic equipment both in Japan and internationally, with a market cap of ¥61.03 billion.

Operations: Hirata Corporation's revenue is primarily derived from its Automobile Related segment at ¥43.06 billion, followed by the Semiconductor Related segment at ¥30.19 billion, and Other Automatic Labor-Saving Devices at ¥13.10 billion.

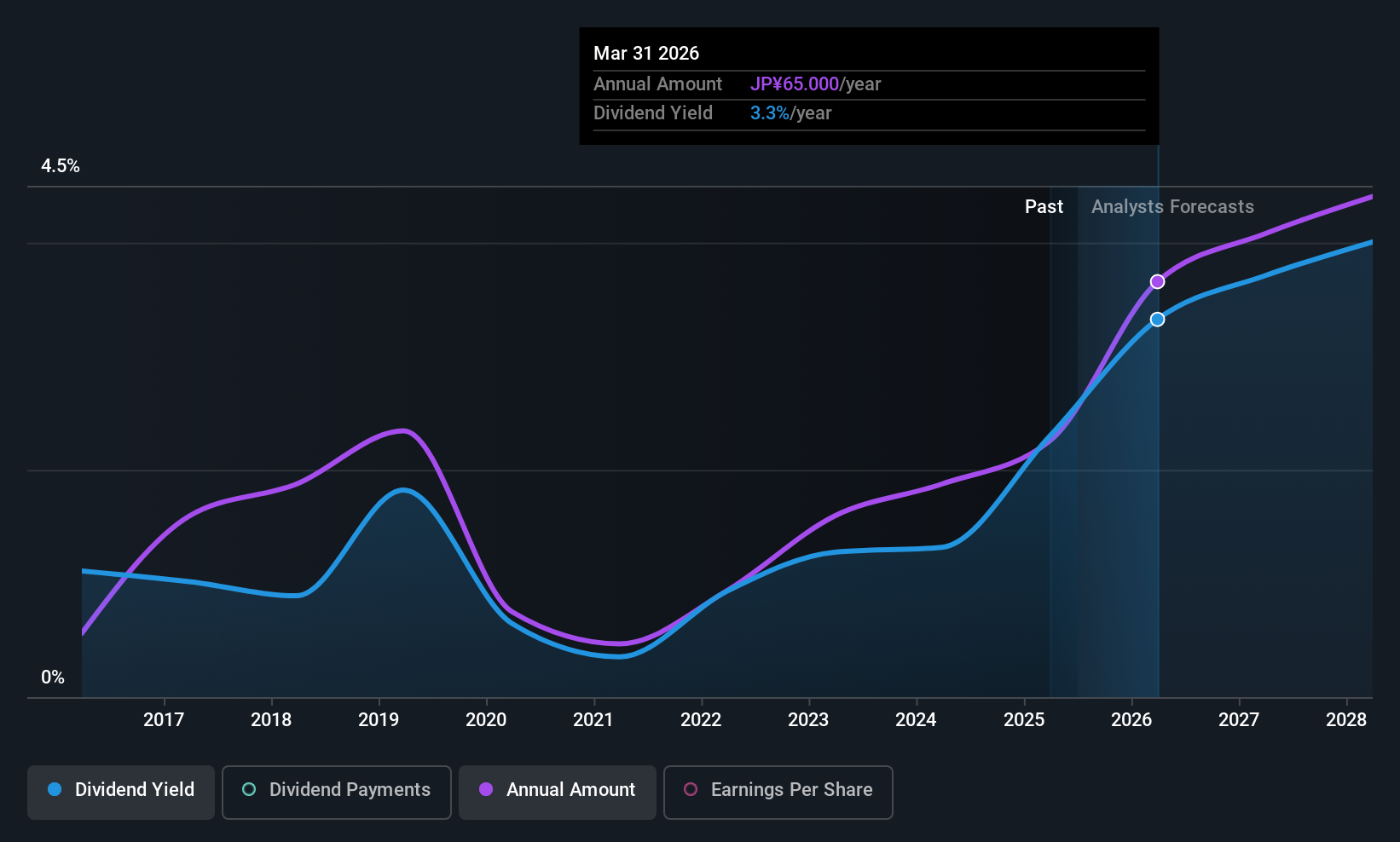

Dividend Yield: 3.3%

Hirata Corporation's dividend payments, despite being well-covered by earnings and cash flows with payout ratios of 25.9% and 27.9%, have shown volatility over the past decade. The recent dividend increase to JPY 120 per share for fiscal year ended March 2025 contrasts with a forecasted drop to JPY 65 per share, reflecting a strategic adjustment post-3-for-1 share split. While its price-to-earnings ratio of 12.8x suggests good value compared to the JP market, investors should consider its unstable dividend history.

- Navigate through the intricacies of Hirata with our comprehensive dividend report here.

- Our expertly prepared valuation report Hirata implies its share price may be too high.

Next Steps

- Navigate through the entire inventory of 1225 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SECB

Security Bank

Provides banking and financial products and services to wholesale and retail clients in the Philippines.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives