As Asian markets experience a lift from recent positive trade developments between the U.S. and China, investors are increasingly turning their attention to dividend stocks as a means of generating steady income amid fluctuating economic conditions. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can offer resilience and potential stability for portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| NCD (TSE:4783) | 4.28% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.03% | ★★★★★★ |

| Daicel (TSE:4202) | 5.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.13% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.11% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

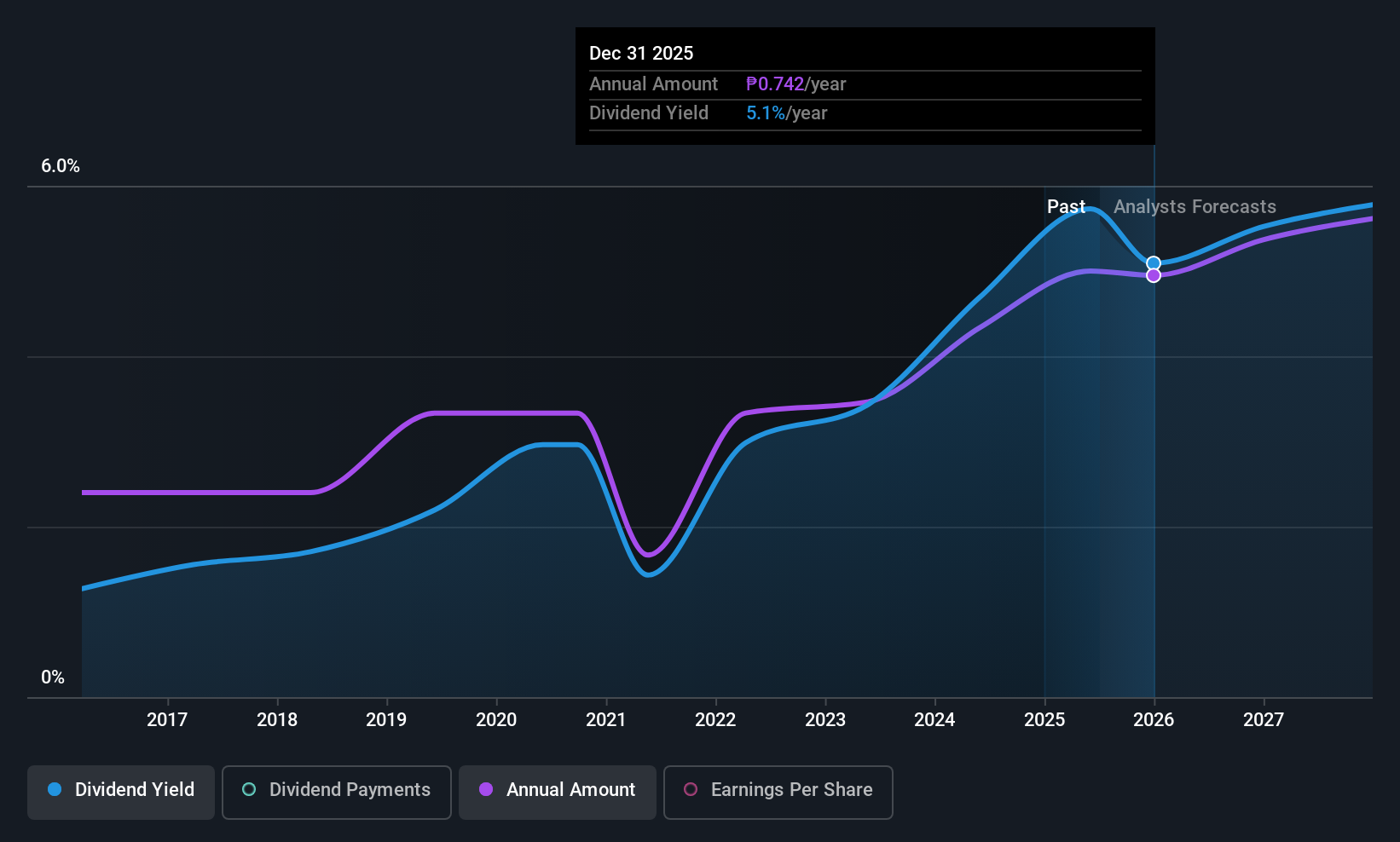

Robinsons Land (PSE:RLC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Robinsons Land Corporation, with a market cap of ₱69.10 billion, is involved in acquiring, developing, operating, leasing, disposing of, and selling real estate properties in the Philippines through its subsidiaries.

Operations: Robinsons Land Corporation's revenue is primarily derived from Robinsons Malls (₱18.28 billion), Robinsons Offices (₱8.81 billion), Residential Division (₱8.22 billion), Robinsons Hotels and Resorts (₱6.16 billion), Chengdu Xin Yao (₱22.85 million), and Robinsons Destination Estates (₱1.23 billion).

Dividend Yield: 5.2%

Robinsons Land Corporation offers a mixed dividend profile, with its dividends well covered by earnings and cash flows, indicated by payout ratios of 28.7% and 20.8%, respectively. However, the dividend yield of 5.22% is below the top tier in the Philippine market, and its track record has been volatile over the past decade despite recent increases. The company trades at a favorable P/E ratio of 5.5x compared to the market average of 9.3x, suggesting relative value for investors seeking growth potential alongside dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Robinsons Land.

- Our comprehensive valuation report raises the possibility that Robinsons Land is priced lower than what may be justified by its financials.

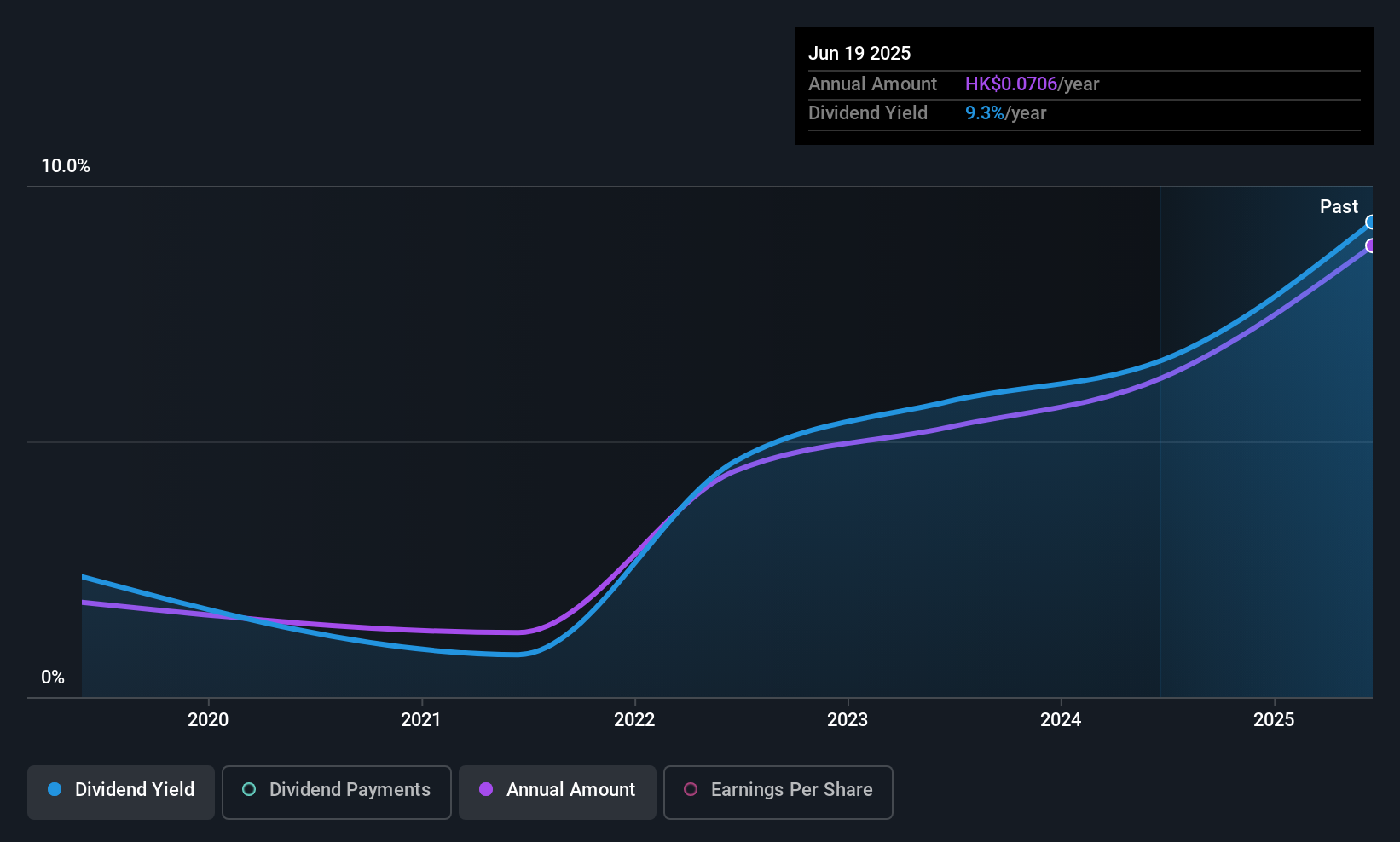

Prosperous Industrial (Holdings) (SEHK:1731)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prosperous Industrial (Holdings) Limited is an investment holding company that designs, develops, manufactures, and sells recreational bags and packs with a market cap of HK$840 million.

Operations: The company's revenue is primarily derived from the manufacturing and sale of sport bags, handbags, and luggage bags, totaling $243.61 million.

Dividend Yield: 9.4%

Prosperous Industrial (Holdings) offers a compelling dividend profile with a yield of 9.42%, placing it in the top 25% of Hong Kong's market. Dividends are well covered by earnings and cash flows, with payout ratios of 33.8% and 40.1%, respectively, indicating sustainability. However, its dividend track record is unstable, having been paid for only six years with volatility noted in payments exceeding a 20% drop annually despite recent growth in earnings by US$100 million over the past year.

- Click to explore a detailed breakdown of our findings in Prosperous Industrial (Holdings)'s dividend report.

- Our expertly prepared valuation report Prosperous Industrial (Holdings) implies its share price may be lower than expected.

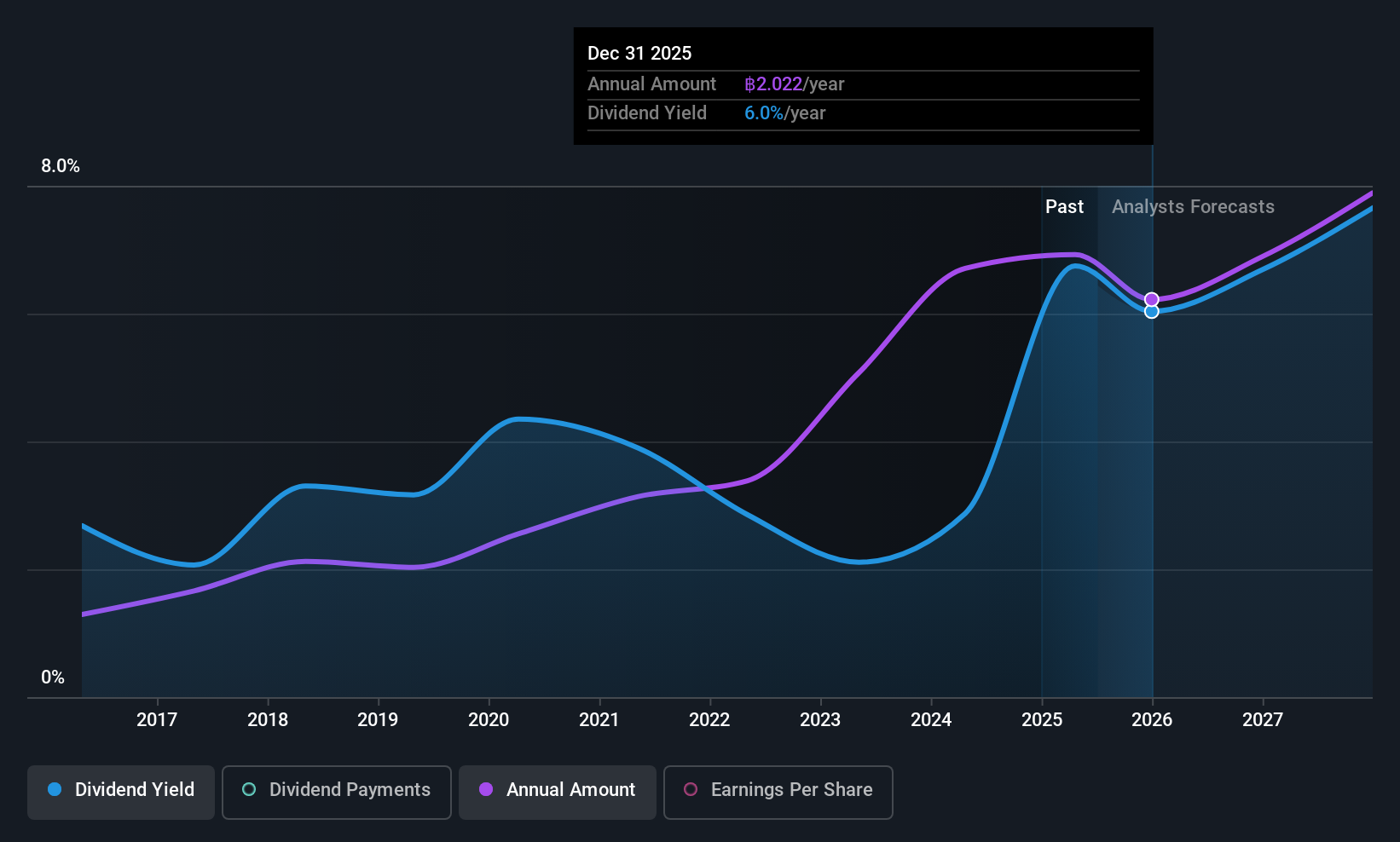

Sappe (SET:SAPPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sappe Public Company Limited, along with its subsidiaries, produces and distributes health drinks, food, and coconut products across Asia, Europe, the United States, and other international markets; it has a market capitalization of approximately ฿9.85 billion.

Operations: Sappe Public Company Limited generates its revenue primarily from health drinking products, which account for ฿5.70 billion, and coconut products, contributing ฿514.92 million.

Dividend Yield: 7.0%

Sappe's dividend profile presents a mixed picture. While dividends have been reliable and growing over the past decade, recent earnings indicate a decline with Q1 2025 revenue and net income dropping compared to the previous year. The company recently approved a THB 2.25 per share dividend from 2024 profits, representing 55.65% of net profit, but this is not well covered by free cash flows. A share buyback program aims to enhance shareholder value amidst excess liquidity concerns.

- Take a closer look at Sappe's potential here in our dividend report.

- The valuation report we've compiled suggests that Sappe's current price could be quite moderate.

Seize The Opportunity

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1220 more companies for you to explore.Click here to unveil our expertly curated list of 1223 Top Asian Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SAPPE

Sappe

Manufactures and distributes health drinking, food, and coconut products in Asia, Europe, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives