- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience declines amid weak trade data from China, investors in the UK are facing a challenging market environment. In such times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate uncertain economic conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.03% | ★★★★★★ |

| Treatt (LSE:TET) | 4.51% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.03% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.63% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.05% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.00% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.56% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.02% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.54% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.75% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £178.90 million.

Operations: City of London Investment Group PLC generates revenue primarily from its Asset Management segment, totaling $72.64 million.

Dividend Yield: 8.5%

City of London Investment Group offers a high dividend yield of 8.47%, ranking in the top 25% among UK dividend payers. However, this yield is not well covered by earnings, with a payout ratio exceeding 100%, indicating potential sustainability issues. Although dividends have grown over the past decade, they have been volatile and unreliable at times. Recent insider selling and upcoming CEO transition may also affect investor confidence in its future stability and performance.

- Unlock comprehensive insights into our analysis of City of London Investment Group stock in this dividend report.

- According our valuation report, there's an indication that City of London Investment Group's share price might be on the cheaper side.

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions across the Republic of Ireland, the United Kingdom, France, the United States, and internationally with a market cap of £4.72 billion.

Operations: DCC plc generates revenue through its DCC Energy segment, which contributes £13.37 billion, and its DCC Technology segment, which adds £4.64 billion.

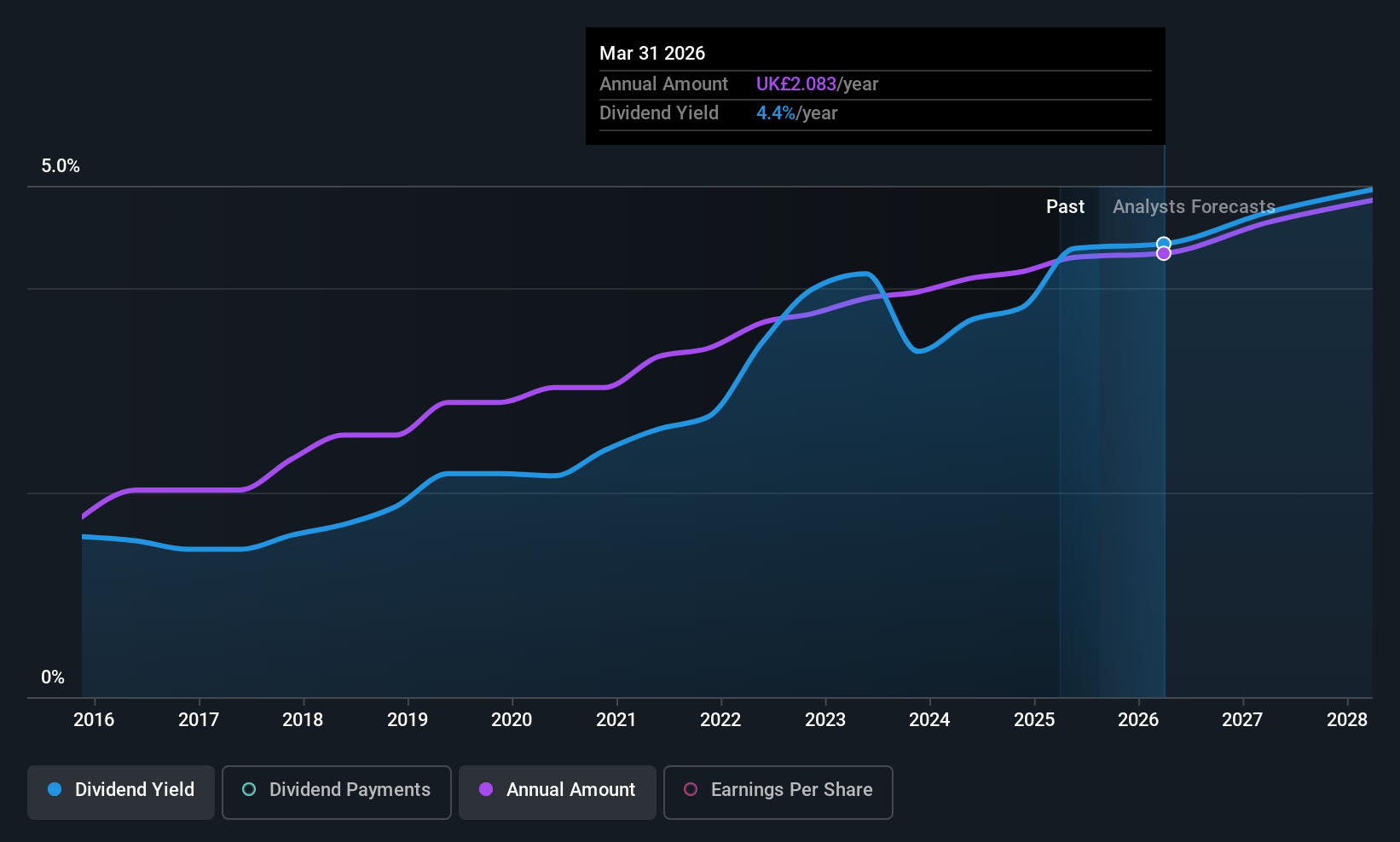

Dividend Yield: 4.3%

DCC's dividend yield of 4.28% falls short of the UK's top tier, and its high payout ratio of 98.1% raises sustainability concerns as it is not well covered by earnings, though cash flows do provide coverage with a 55% cash payout ratio. Despite stable and growing dividends over the past decade, recent financials show decreased net income to £206.49 million from £326.26 million year-on-year, alongside strategic buybacks following an £800 million capital return from selling DCC Healthcare.

- Get an in-depth perspective on DCC's performance by reading our dividend report here.

- Our valuation report unveils the possibility DCC's shares may be trading at a discount.

ITV (LSE:ITV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITV plc is a vertically integrated company involved in production, broadcasting, and streaming, creating and distributing content globally, with a market cap of £3.30 billion.

Operations: ITV plc generates revenue through its integrated operations in production, broadcasting, and streaming, distributing content across various global platforms.

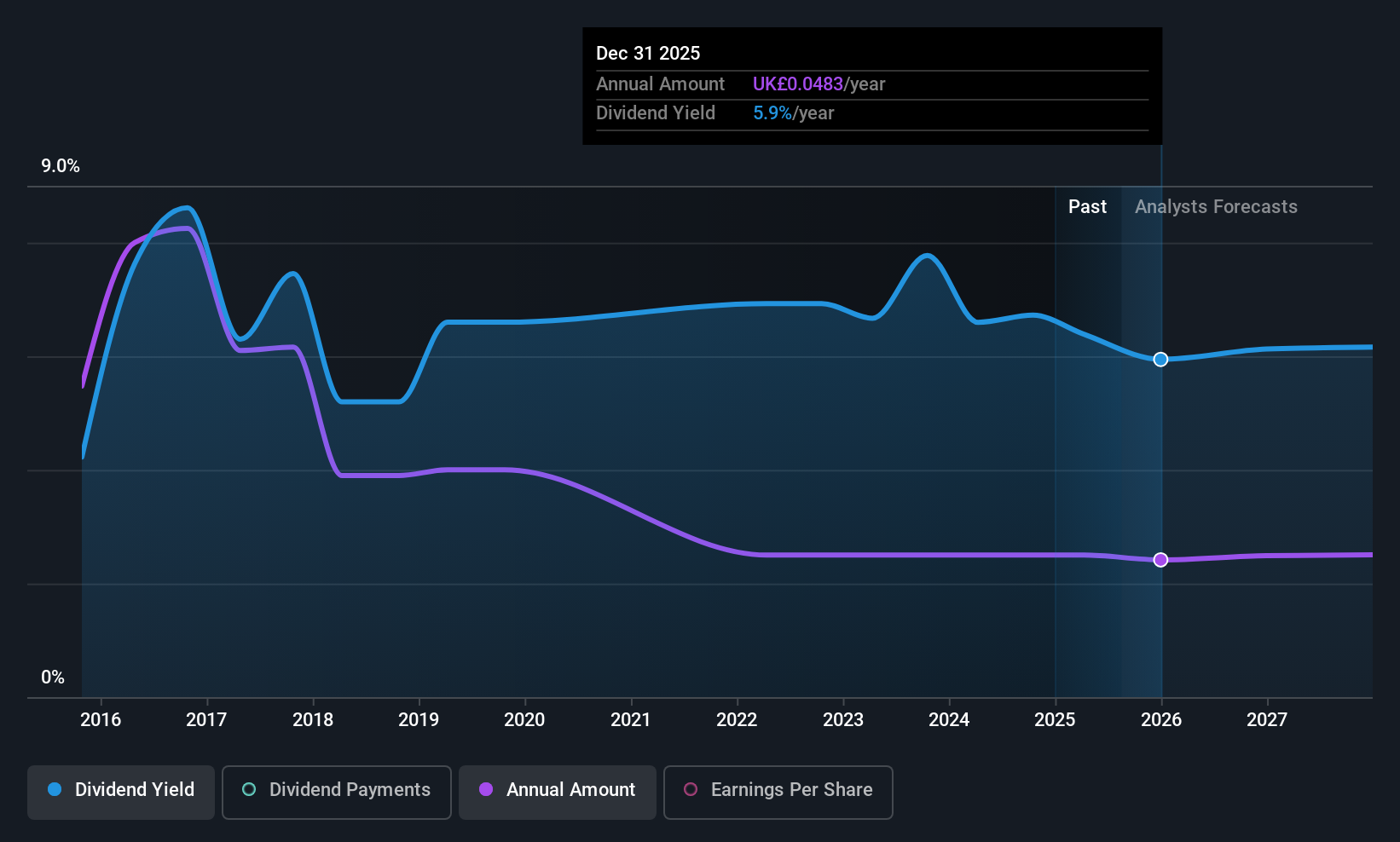

Dividend Yield: 5.7%

ITV's dividend yield is among the UK's top 25%, yet its track record has been unreliable with volatile payments over the past decade. While dividends are covered by earnings and cash flows, recent financials show a significant drop in net income to £44 million from £266 million year-on-year. ITV's strategic value is underlined by M&A discussions, potentially impacting future dividend stability as it navigates competitive pressures from streaming services and explores consolidation opportunities.

- Delve into the full analysis dividend report here for a deeper understanding of ITV.

- Insights from our recent valuation report point to the potential undervaluation of ITV shares in the market.

Summing It All Up

- Investigate our full lineup of 60 Top UK Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives