- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SPTN

Those Who Purchased SpartanNash (NASDAQ:SPTN) Shares Three Years Ago Have A 66% Loss To Show For It

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term SpartanNash Company (NASDAQ:SPTN) shareholders. Regrettably, they have had to cope with a 66% drop in the share price over that period. The more recent news is of little comfort, with the share price down 40% in a year. It's up 3.8% in the last seven days.

View our latest analysis for SpartanNash

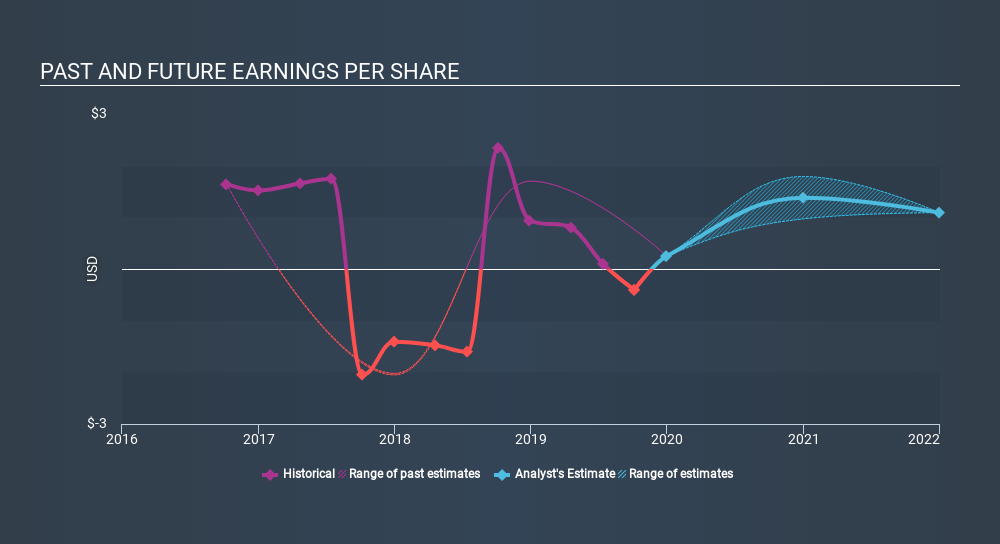

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

SpartanNash saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, SpartanNash's TSR for the last 3 years was -62%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

SpartanNash shareholders are down 37% for the year (even including dividends) , but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand SpartanNash better, we need to consider many other factors. For example, we've discovered 2 warning signs for SpartanNash (1 is a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:SPTN

SpartanNash

A food solutions company, engages in the distribution and retail sale of grocery products in the United States of America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives