Those Who Purchased Solteq Oyj (HEL:SOLTEQ) Shares Three Years Ago Have A 11% Loss To Show For It

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Solteq Oyj (HEL:SOLTEQ) shareholders have had that experience, with the share price dropping 11% in three years, versus a market return of about 34%. It's down 2.0% in the last seven days.

View our latest analysis for Solteq Oyj

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Solteq Oyj moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

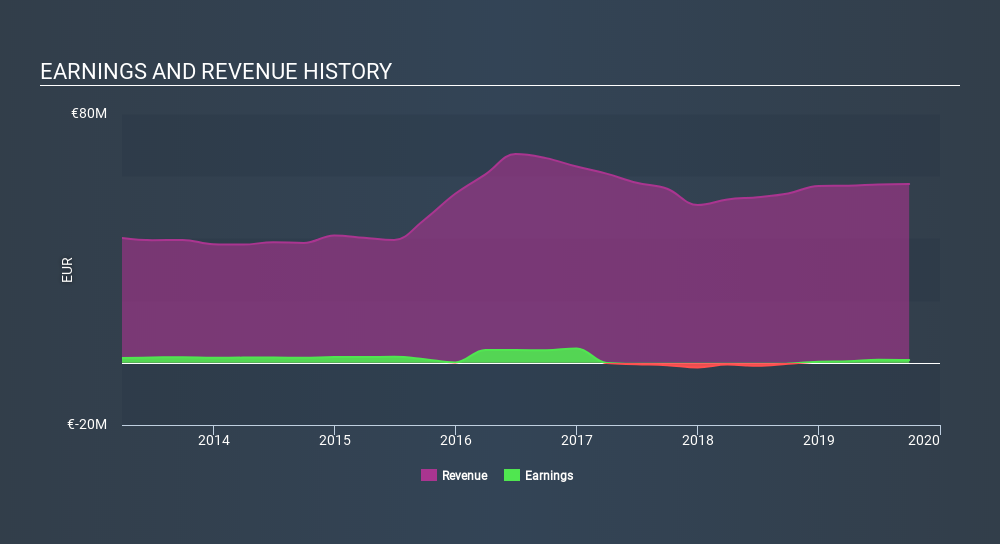

Arguably the revenue decline of 3.8% per year has people thinking Solteq Oyj is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Solteq Oyj has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Solteq Oyj stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

We've already covered Solteq Oyj's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Solteq Oyj's TSR, which was a 8.4% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Solteq Oyj shareholders are up 5.8% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 0.5% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Solteq Oyj better, we need to consider many other factors. Take risks, for example - Solteq Oyj has 2 warning signs (and 1 which is significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:SOLTEQ

Solteq Oyj

An IT services and software solutions company, engages in the digitalization of business and industry-specific software in Finland, Sweden, Norway, Denmark, Poland, and the United Kingdom.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives