- Spain

- /

- Commercial Services

- /

- BME:CASH

Those Who Purchased Prosegur Cash (BME:CASH) Shares A Year Ago Have A 24% Loss To Show For It

Prosegur Cash, S.A. (BME:CASH) shareholders should be happy to see the share price up 26% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 24% in one year, under-performing the market.

Check out our latest analysis for Prosegur Cash

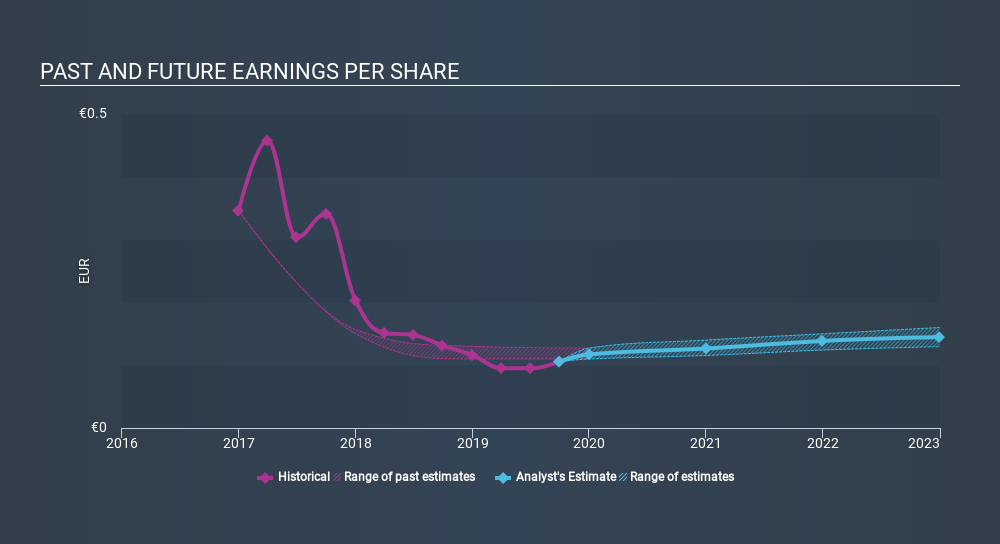

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Prosegur Cash reported an EPS drop of 19% for the last year. This proportional reduction in earnings per share isn't far from the 24% decrease in the share price. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Prosegur Cash the TSR over the last year was -21%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While Prosegur Cash shareholders are down 21% for the year (even including dividends) , the market itself is up 12%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 26%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Prosegur Cash better, we need to consider many other factors. For example, we've discovered 2 warning signs for Prosegur Cash that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BME:CASH

Prosegur Cash

Provides integrated cash cycle management solutions and automating payments in retail establishments and ATM management for financial institutions, retail establishments, business, government agencies, central banks, mints, and jewellery stores in Europe, LATAM, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives