- United States

- /

- Capital Markets

- /

- NasdaqCM:AGMH

Those Who Purchased AGM Group Holdings (NASDAQ:AGMH) Shares A Year Ago Have A 41% Loss To Show For It

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by AGM Group Holdings Inc. (NASDAQ:AGMH) shareholders over the last year, as the share price declined 41%. That falls noticeably short of the market return of around 30%. AGM Group Holdings may have better days ahead, of course; we've only looked at a one year period. Even worse, it's down 14% in about a month, which isn't fun at all.

View 4 warning signs we detected for AGM Group Holdings

Because AGM Group Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year AGM Group Holdings saw its revenue fall by 90%. If you think that's a particularly bad result, you're statistically on the money No surprise, then, that the share price fell 41% over the year. It's always work digging deeper, but we'd probably need to see a strong balance sheet and bottom line improvements to get interested in this one.

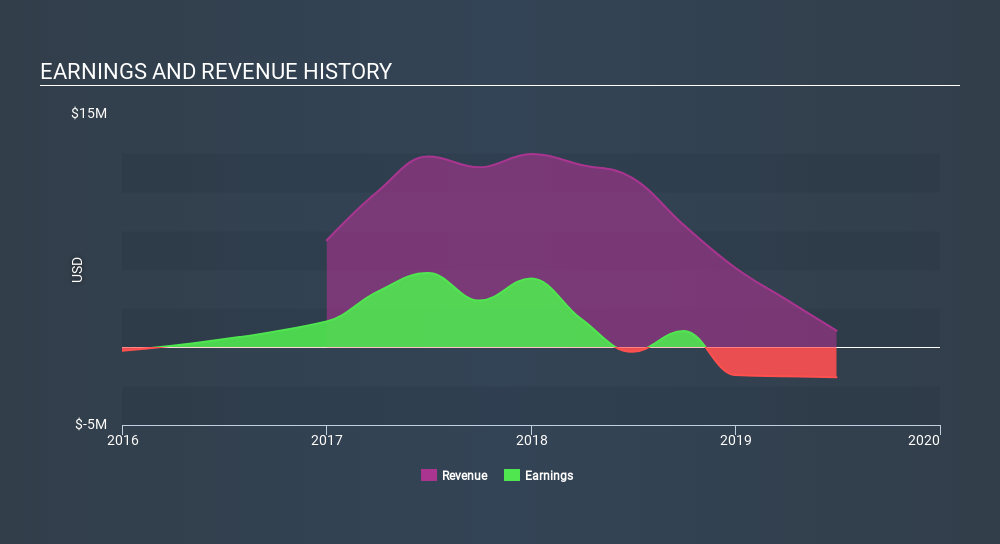

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 4 warning signs for AGM Group Holdings (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

While AGM Group Holdings shareholders are down 41% for the year, the market itself is up 30%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 0.2%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You could get a better understanding of AGM Group Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course AGM Group Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:AGMH

AGM Group Holdings

A technology company, engages in the research, development, and sale of cryptocurrency mining machines and standardized computing equipment in Hong Kong, Singapore, and Mainland China.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives