Those Who Purchased Actinogen Medical (ASX:ACW) Shares Five Years Ago Have A 81% Loss To Show For It

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Actinogen Medical Limited (ASX:ACW) for half a decade as the share price tanked 81%. And some of the more recent buyers are probably worried, too, with the stock falling 70% in the last year. Shareholders have had an even rougher run lately, with the share price down 53% in the last 90 days. But this could be related to the weak market, which is down 35% in the same period.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Actinogen Medical

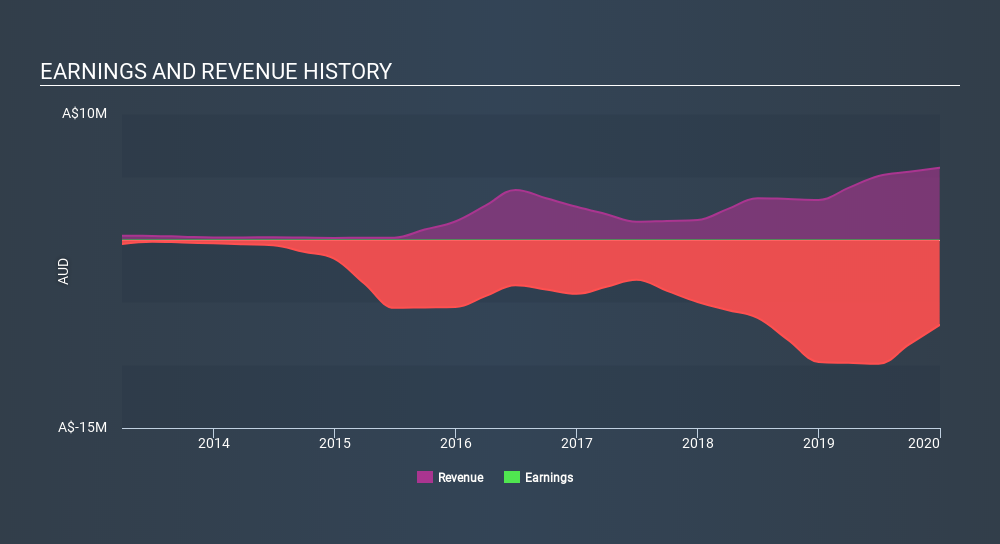

Because Actinogen Medical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Actinogen Medical grew its revenue at 34% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 28% throughout that time. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Actinogen Medical's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Actinogen Medical shareholders are down 70% for the year. Unfortunately, that's worse than the broader market decline of 25%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 28% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Actinogen Medical has 7 warning signs (and 2 which are significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:ACW

Actinogen Medical

A biotechnology company, develops therapies for neurological and neuropsychiatric diseases associated with dysregulated brain cortisol in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives