- United States

- /

- Banks

- /

- NasdaqGS:CBSH

This Insider Has Just Sold Shares In Commerce Bancshares, Inc. (NASDAQ:CBSH)

We wouldn't blame Commerce Bancshares, Inc. (NASDAQ:CBSH) shareholders if they were a little worried about the fact that David Kemper, the Executive Chairman recently netted about US$2.1m selling shares at an average price of US$68.35. However, it's crucial to note that they remain very much invested in the stock and that sale only reduced their holding by 2.2%.

View our latest analysis for Commerce Bancshares

The Last 12 Months Of Insider Transactions At Commerce Bancshares

The Director, Jonathan Kemper, made the biggest insider sale in the last 12 months. That single transaction was for US$5.0m worth of shares at a price of US$64.63 each. That means that an insider was selling shares at slightly below the current price (US$69.98). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. This single sale was just 5.8% of Jonathan Kemper's stake.

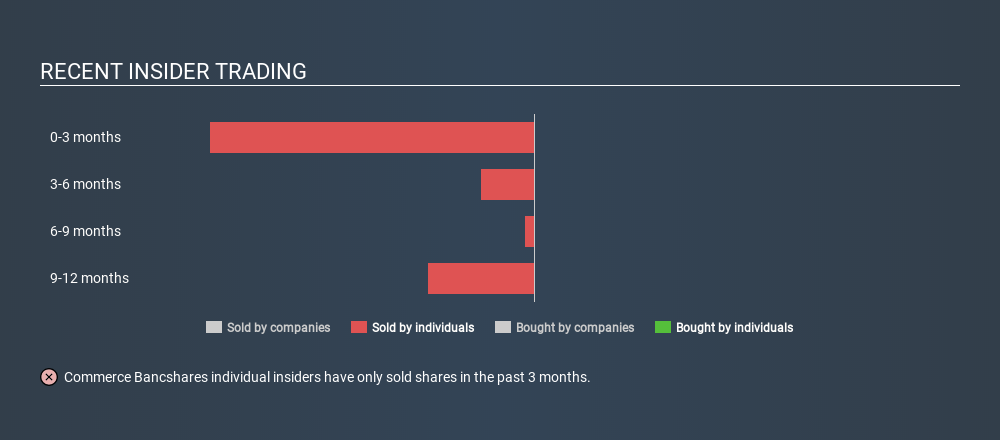

Insiders in Commerce Bancshares didn't buy any shares in the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Commerce Bancshares

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Commerce Bancshares insiders own 3.1% of the company, currently worth about US$245m based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Commerce Bancshares Tell Us?

Insiders sold Commerce Bancshares shares recently, but they didn't buy any. And even if we look to the last year, we didn't see any purchases. It is good to see high insider ownership, but the insider selling leaves us cautious. Of course, the future is what matters most. So if you are interested in Commerce Bancshares, you should check out this free report on analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CBSH

Commerce Bancshares

Operates as the bank holding company for Commerce Bank that provides retail, mortgage banking, corporate, investment, trust, and asset management products and services to individuals and businesses in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives