- United States

- /

- Trade Distributors

- /

- NYSE:AIT

This Insider Has Just Sold Shares In Applied Industrial Technologies, Inc. (NYSE:AIT)

We wouldn't blame Applied Industrial Technologies, Inc. (NYSE:AIT) shareholders if they were a little worried about the fact that Jerry Thornton, the Director recently netted about US$857k selling shares at an average price of US$53.45. That sale reduced their total holding by 22.6% which is hardly insignificant, but far from the worst we've seen.

Check out our latest analysis for Applied Industrial Technologies

The Last 12 Months Of Insider Transactions At Applied Industrial Technologies

In fact, the recent sale by Director Jerry Thornton was not their only sale of Applied Industrial Technologies shares this year. Earlier in the year, they fetched US$53.45 per share in a -US$856.8k sale. So we know that an insider sold shares at around the present share price of US$53.39. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

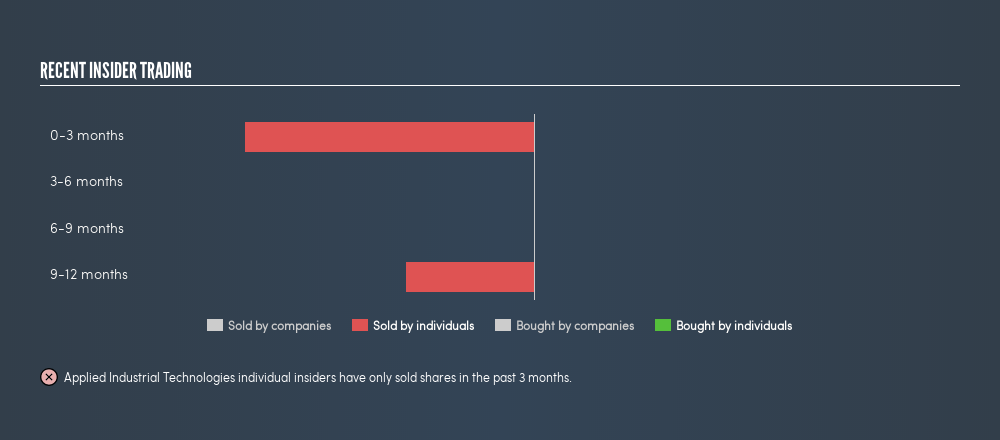

In the last twelve months insiders netted US$1.3m for 23121 shares sold. Insiders in Applied Industrial Technologies didn't buy any shares in the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Insider Ownership

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 1.3% of Applied Industrial Technologies shares, worth about US$26m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The Applied Industrial Technologies Insider Transactions Indicate?

An insider hasn't bought Applied Industrial Technologies stock in the last three months, but there was some selling. And even if we look to the last year, we didn't see any purchases. But since Applied Industrial Technologies is profitable and growing, we're not too worried by this. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:AIT

Applied Industrial Technologies

Distributes industrial motion, power, control, and automation technology solutions in the United States, Canada, Mexico, Australia, New Zealand, Singapore, and Costa Rica.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives