These 4 Measures Indicate That TCPL Packaging (NSE:TCPLPACK) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies TCPL Packaging Limited (NSE:TCPLPACK) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for TCPL Packaging

What Is TCPL Packaging's Net Debt?

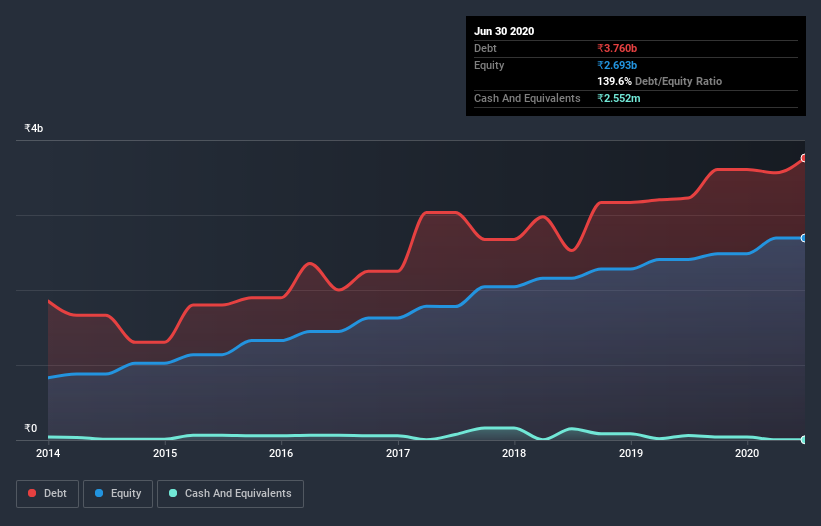

You can click the graphic below for the historical numbers, but it shows that as of March 2020 TCPL Packaging had ₹3.56b of debt, an increase on ₹3.23b, over one year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is TCPL Packaging's Balance Sheet?

According to the last reported balance sheet, TCPL Packaging had liabilities of ₹3.20b due within 12 months, and liabilities of ₹2.10b due beyond 12 months. Offsetting these obligations, it had cash of ₹2.55m as well as receivables valued at ₹1.64b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹3.65b.

Given this deficit is actually higher than the company's market capitalization of ₹3.31b, we think shareholders really should watch TCPL Packaging's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about TCPL Packaging's net debt to EBITDA ratio of 3.0, we think its super-low interest cover of 2.2 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. The good news is that TCPL Packaging improved its EBIT by 5.2% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since TCPL Packaging will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, TCPL Packaging created free cash flow amounting to 11% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On the face of it, TCPL Packaging's level of total liabilities left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to grow its EBIT isn't such a worry. Overall, it seems to us that TCPL Packaging's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 5 warning signs for TCPL Packaging (2 are potentially serious!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade TCPL Packaging, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TCPL Packaging might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TCPLPACK

TCPL Packaging

Manufactures and sells paperboard-based packaging materials and flexible packaging products in India.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Applied Digital Corp. (APLD) The AI Factory Architect: Infrastructure at the Speed of Light

MDxHealth SA (MDXH) Precision Diagnostics: Bridging the Gap to Profitability

Regencell Bioscience Holdings Ltd. (RGC) The TCM Biotech Lottery Ticket: High Hopes and Extreme Volatility

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion