- United States

- /

- Auto Components

- /

- NYSE:LEA

These 4 Measures Indicate That Lear (NYSE:LEA) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Lear Corporation (NYSE:LEA) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Lear

What Is Lear's Net Debt?

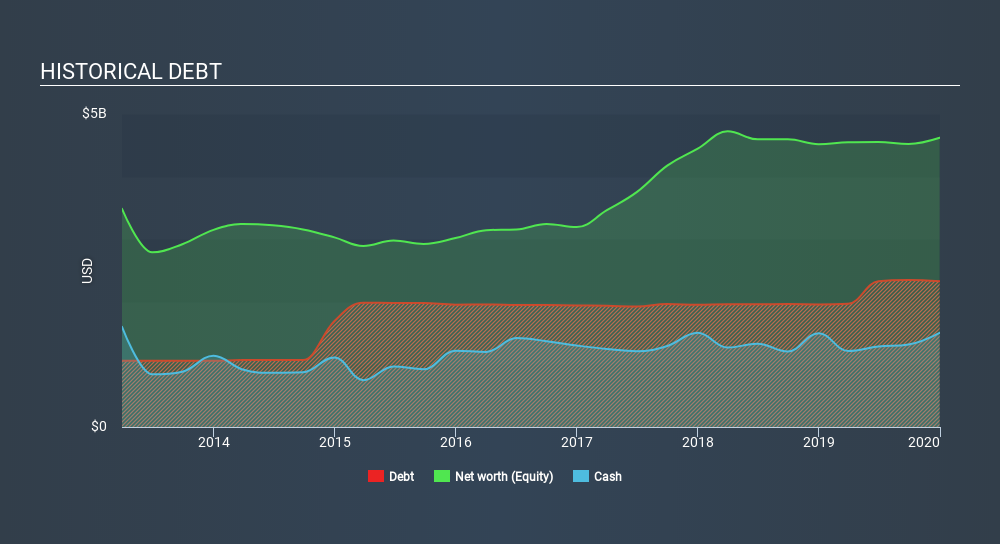

The image below, which you can click on for greater detail, shows that at December 2019 Lear had debt of US$2.33b, up from US$1.96b in one year. On the flip side, it has US$1.50b in cash leading to net debt of about US$822.2m.

How Strong Is Lear's Balance Sheet?

The latest balance sheet data shows that Lear had liabilities of US$4.67b due within a year, and liabilities of US$3.40b falling due after that. Offsetting these obligations, it had cash of US$1.50b as well as receivables valued at US$3.14b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.42b.

While this might seem like a lot, it is not so bad since Lear has a market capitalization of US$6.17b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Lear has a low net debt to EBITDA ratio of only 0.46. And its EBIT covers its interest expense a whopping 13.7 times over. So we're pretty relaxed about its super-conservative use of debt. It is just as well that Lear's load is not too heavy, because its EBIT was down 26% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Lear can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Lear produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Lear's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Lear's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Lear you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:LEA

Lear

Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives