- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

These 4 Measures Indicate That ArcelorMittal (AMS:MT) Is Using Debt Extensively

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, ArcelorMittal (AMS:MT) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for ArcelorMittal

What Is ArcelorMittal's Net Debt?

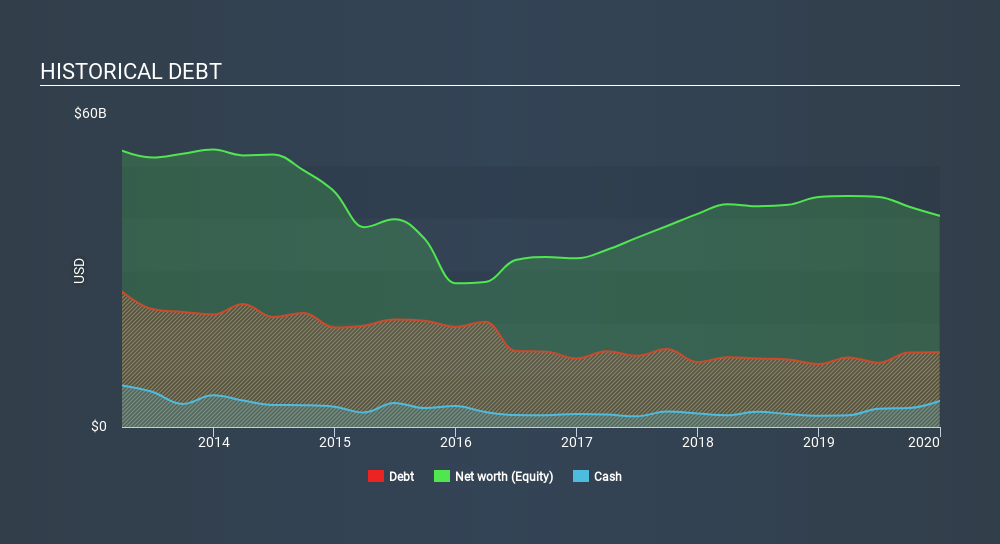

As you can see below, at the end of December 2019, ArcelorMittal had US$12.8b of debt, up from US$12.1b a year ago. Click the image for more detail. However, it does have US$5.00b in cash offsetting this, leading to net debt of about US$7.85b.

How Healthy Is ArcelorMittal's Balance Sheet?

The latest balance sheet data shows that ArcelorMittal had liabilities of US$21.3b due within a year, and liabilities of US$26.1b falling due after that. Offsetting this, it had US$5.00b in cash and US$3.57b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$38.9b.

The deficiency here weighs heavily on the US$18.1b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, ArcelorMittal would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

ArcelorMittal's net debt is sitting at a very reasonable 1.5 times its EBITDA, while its EBIT covered its interest expense just 3.5 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. Importantly, ArcelorMittal's EBIT fell a jaw-dropping 69% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if ArcelorMittal can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, ArcelorMittal's free cash flow amounted to 35% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both ArcelorMittal's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Taking into account all the aforementioned factors, it looks like ArcelorMittal has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Even though ArcelorMittal lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives