These 4 Measures Indicate That 361 Degrees International (HKG:1361) Is Using Debt Safely

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, 361 Degrees International Limited (HKG:1361) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for 361 Degrees International

How Much Debt Does 361 Degrees International Carry?

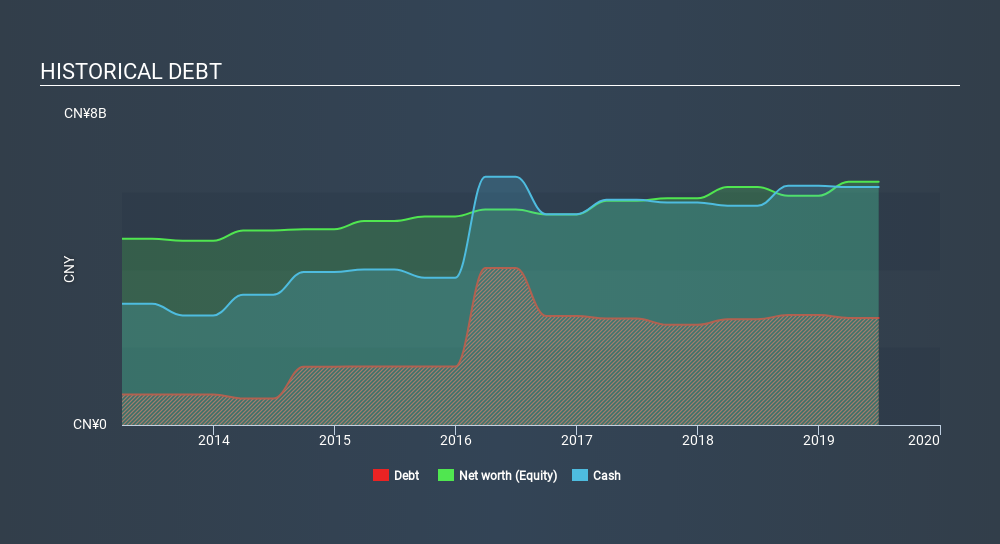

The chart below, which you can click on for greater detail, shows that 361 Degrees International had CN¥2.75b in debt in June 2019; about the same as the year before. However, its balance sheet shows it holds CN¥6.12b in cash, so it actually has CN¥3.37b net cash.

How Strong Is 361 Degrees International's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that 361 Degrees International had liabilities of CN¥3.41b due within 12 months and liabilities of CN¥2.65b due beyond that. Offsetting this, it had CN¥6.12b in cash and CN¥3.09b in receivables that were due within 12 months. So it actually has CN¥3.16b more liquid assets than total liabilities.

This surplus liquidity suggests that 361 Degrees International's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is just as strong as misogynists are weak. Simply put, the fact that 361 Degrees International has more cash than debt is arguably a good indication that it can manage its debt safely.

But the bad news is that 361 Degrees International has seen its EBIT plunge 19% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if 361 Degrees International can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While 361 Degrees International has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, 361 Degrees International recorded free cash flow worth 70% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case 361 Degrees International has CN¥3.37b in net cash and a strong balance sheet. And it impressed us with free cash flow of CN¥294m, being 70% of its EBIT. So we don't think 361 Degrees International's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with 361 Degrees International (including 1 which is shouldn't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1361

361 Degrees International

An investment holding company, manufactures and trades in sporting goods in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives