- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (NYSE:TMO) Gains FDA Approval for Rapid Cancer Diagnostic Tool

Reviewed by Simply Wall St

Thermo Fisher Scientific (NYSE:TMO) recently achieved a 7% price increase following the FDA approval of its Oncomine™ Dx Express Test. This approval, enabling rapid genomic testing, bolsters the company's position in precision oncology and positively impacts investor sentiment. The FDA's decision in early July underscored Thermo Fisher's commitment to advancing diagnostic solutions, which aligns with industry trends toward expedited drug development. Additionally, its strategic collaborations and new contracts, such as with the U.S. Department of Defense, provide further support to its market performance. Despite a broader market dip earlier this year, Thermo Fisher's recent achievements contributed to its stock recovery.

Find companies with promising cash flow potential yet trading below their fair value.

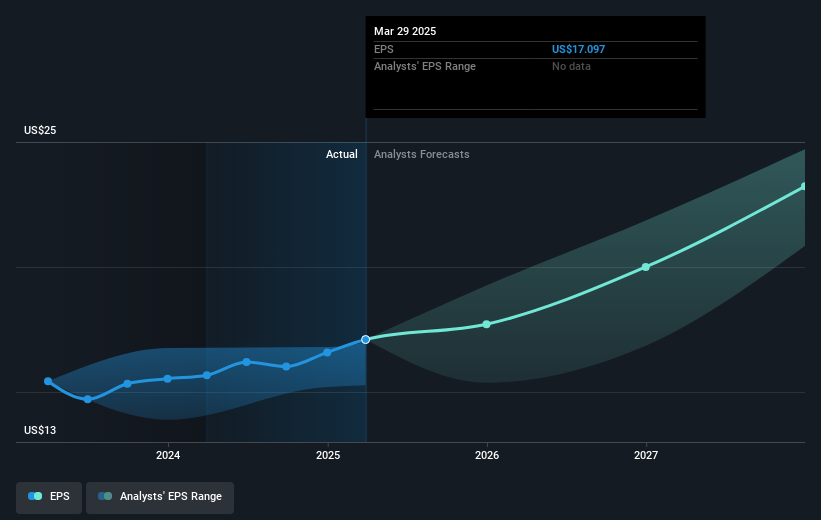

The FDA approval of Thermo Fisher's Oncomine™ Dx Express Test may bolster its long-term revenue prospects by enhancing its precision oncology portfolio. This is expected to propel Thermo Fisher's market position within the fast-growing biopharma services sector. The company's revenue and earnings forecasts might see positive adjustments as this product gains market traction, aligning with its focus on innovative diagnostic solutions. The integration of these advancements could support further share price increases toward the consensus price target of US$554.04, representing a potential appreciation from the current share price.

Over a five-year period, Thermo Fisher's total shareholder return, including dividends, amounted to 12.13%. This shows moderate growth compared to the challenging conditions experienced by the broader market, particularly over the past year when Thermo Fisher underperformed the US Life Sciences industry, which recorded a 15.6% decline. Analyzing this context, the recent uptick in share price highlights a rebound from earlier market pressures, as investors respond positively to decisive company actions and innovations. Thermo Fisher's recent initiatives and developments aim to counter macroeconomic challenges, although potential risks from tariffs and policy changes remain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives