- Italy

- /

- Gas Utilities

- /

- BIT:SRG

The Snam (BIT:SRG) Share Price Has Gained 26% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Snam S.p.A. (BIT:SRG) share price is up 26% in the last year, clearly besting the market return of around 14% (not including dividends). That's a solid performance by our standards! However, the longer term returns haven't been so impressive, with the stock up just 1.5% in the last three years.

See our latest analysis for Snam

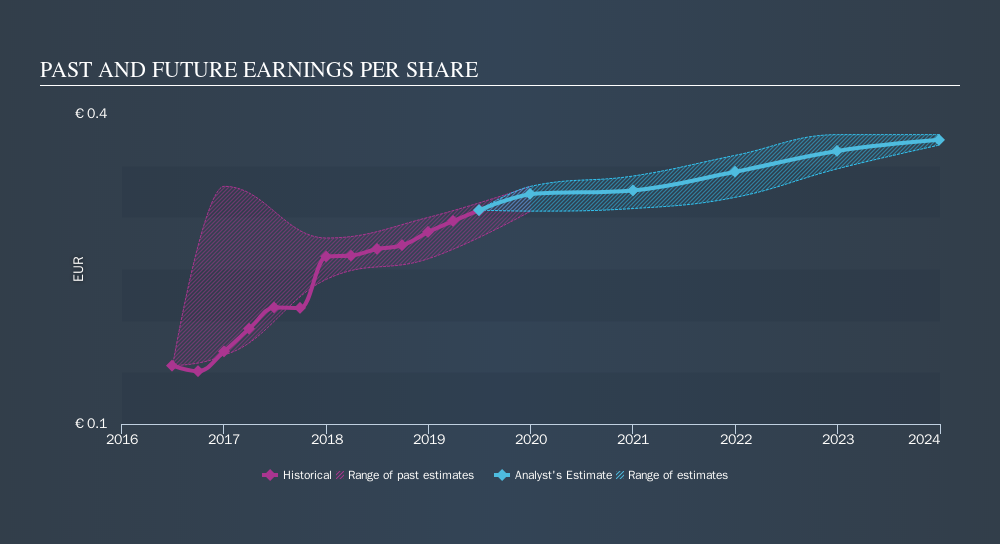

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Snam was able to grow EPS by 14% in the last twelve months. The share price gain of 26% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The image below shows how EPS has tracked over time.

We know that Snam has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Snam, it has a TSR of 32% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Snam has rewarded shareholders with a total shareholder return of 32% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Importantly, we haven't analysed Snam's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:SRG

Snam

Engages in the operation of natural gas transport and storage infrastructure.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives