The Mobotix (ETR:MBQ) Share Price Is Down 49% So Some Shareholders Are Getting Worried

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Mobotix AG (ETR:MBQ) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 13%. The falls have accelerated recently, with the share price down 12% in the last three months.

Check out our latest analysis for Mobotix

Given that Mobotix only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years Mobotix saw its revenue shrink by 2.0% per year. That is not a good result. The annual decline of 20% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

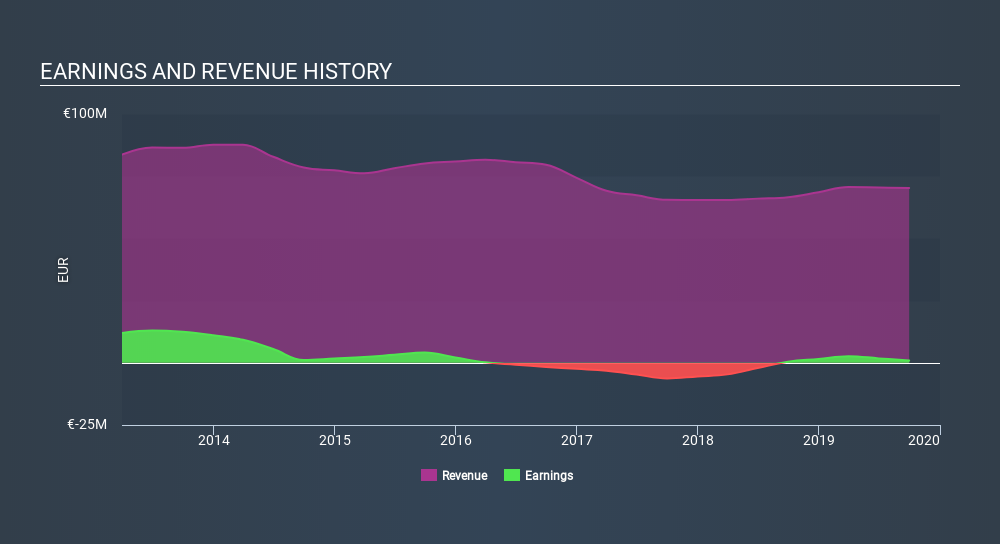

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Mobotix has grown profits over the years, but the future is more important for shareholders. This free interactive report on Mobotix's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Mobotix's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Mobotix's TSR of was a loss of 48% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Mobotix shareholders are down 20% for the year (even including dividends) , but the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Mobotix better, we need to consider many other factors. Take risks, for example - Mobotix has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:MBQ

Mobotix

Manufactures and sells video security systems in Germany and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives