- Canada

- /

- Oil and Gas

- /

- TSXV:MCM.A

The Matachewan Consolidated Mines (CVE:MCM.A) Share Price Is Down 53% So Some Shareholders Are Wishing They Sold

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Matachewan Consolidated Mines, Limited (CVE:MCM.A) shareholders. Unfortunately, they have held through a 53% decline in the share price in that time. The more recent news is of little comfort, with the share price down 21% in a year. It's up 23% in the last seven days.

View our latest analysis for Matachewan Consolidated Mines

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Matachewan Consolidated Mines became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

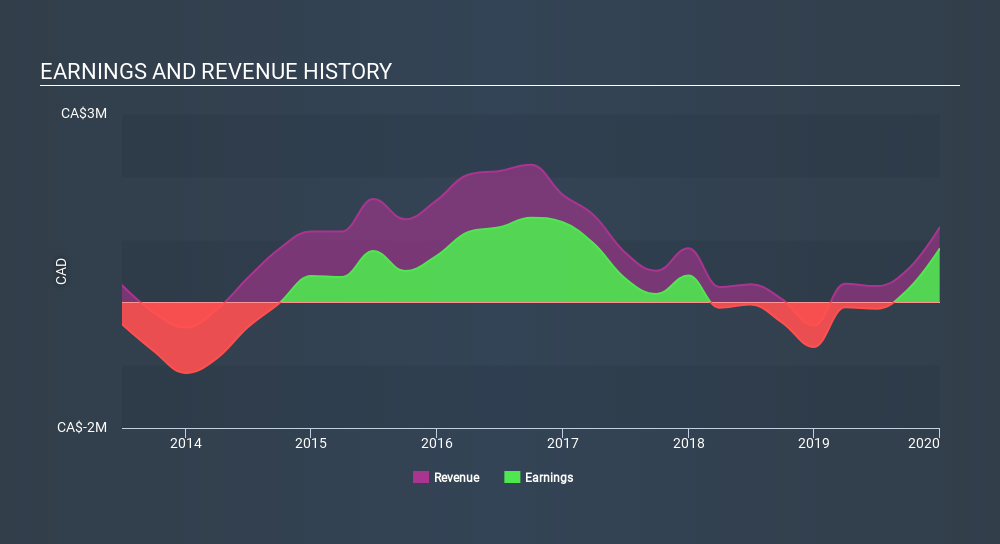

Arguably the revenue decline of 43% per year has people thinking Matachewan Consolidated Mines is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Matachewan Consolidated Mines's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Matachewan Consolidated Mines's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Matachewan Consolidated Mines's TSR of was a loss of 53% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 12% in the twelve months, Matachewan Consolidated Mines shareholders did even worse, losing 21%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Matachewan Consolidated Mines better, we need to consider many other factors. Even so, be aware that Matachewan Consolidated Mines is showing 5 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:MCM.A

Flawless balance sheet with solid track record.

Market Insights

Community Narratives