- United States

- /

- Machinery

- /

- NYSE:SCX

The L.S. Starrett Company’s (NYSE:SCX) Investment Returns Are Lagging Its Industry

Today we are going to look at The L.S. Starrett Company (NYSE:SCX) to see whether it might be an attractive investment prospect. To be precise, we'll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First of all, we'll work out how to calculate ROCE. Second, we'll look at its ROCE compared to similar companies. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. All else being equal, a better business will have a higher ROCE. Ultimately, it is a useful but imperfect metric. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.'

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for L.S. Starrett:

0.057 = US$9.0m ÷ (US$184m - US$28m) (Based on the trailing twelve months to March 2019.)

So, L.S. Starrett has an ROCE of 5.7%.

Check out our latest analysis for L.S. Starrett

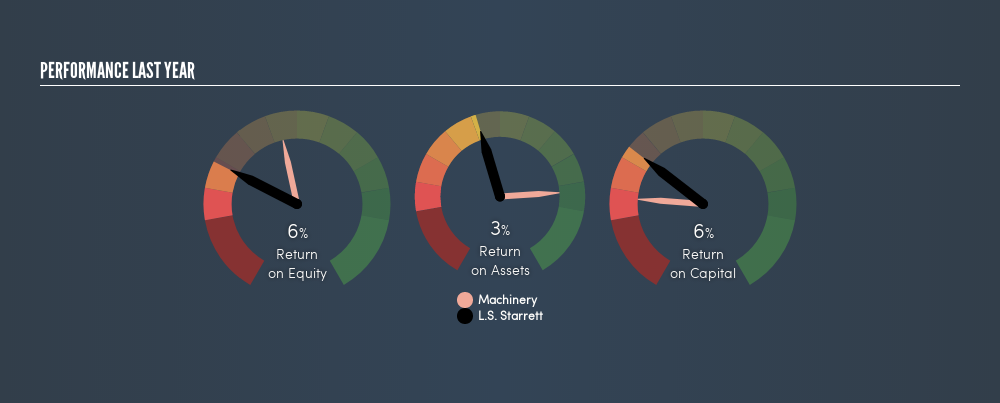

Does L.S. Starrett Have A Good ROCE?

When making comparisons between similar businesses, investors may find ROCE useful. In this analysis, L.S. Starrett's ROCE appears meaningfully below the 12% average reported by the Machinery industry. This could be seen as a negative, as it suggests some competitors may be employing their capital more efficiently. Separate from how L.S. Starrett stacks up against its industry, its ROCE in absolute terms is mediocre; relative to the returns on government bonds. It is possible that there are more rewarding investments out there.

In our analysis, L.S. Starrett's ROCE appears to be 5.7%, compared to 3 years ago, when its ROCE was 1.7%. This makes us think the business might be improving.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. ROCE is only a point-in-time measure. If L.S. Starrett is cyclical, it could make sense to check out this free graph of past earnings, revenue and cash flow.

L.S. Starrett's Current Liabilities And Their Impact On Its ROCE

Liabilities, such as supplier bills and bank overdrafts, are referred to as current liabilities if they need to be paid within 12 months. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counteract this, we check if a company has high current liabilities, relative to its total assets.

L.S. Starrett has total assets of US$184m and current liabilities of US$28m. As a result, its current liabilities are equal to approximately 15% of its total assets. This very reasonable level of current liabilities would not boost the ROCE by much.

Our Take On L.S. Starrett's ROCE

If L.S. Starrett continues to earn an uninspiring ROCE, there may be better places to invest. Of course, you might also be able to find a better stock than L.S. Starrett. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SCX

L.S. Starrett

Manufactures and sells industrial, professional, and consumer measuring and cutting tools, and related products in North America, Brazil, and China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives