The Immutep (ASX:IMM) Share Price Is Down 84% So Some Shareholders Are Rather Upset

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Immutep Limited (ASX:IMM) for five whole years - as the share price tanked 84%. And it's not just long term holders hurting, because the stock is down 52% in the last year. The falls have accelerated recently, with the share price down 62% in the last three months. Of course, this share price action may well have been influenced by the 25% decline in the broader market, throughout the period.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Immutep

Immutep isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Immutep grew its revenue at 40% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price has averaged a fall of 31% each year, in the same time period. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

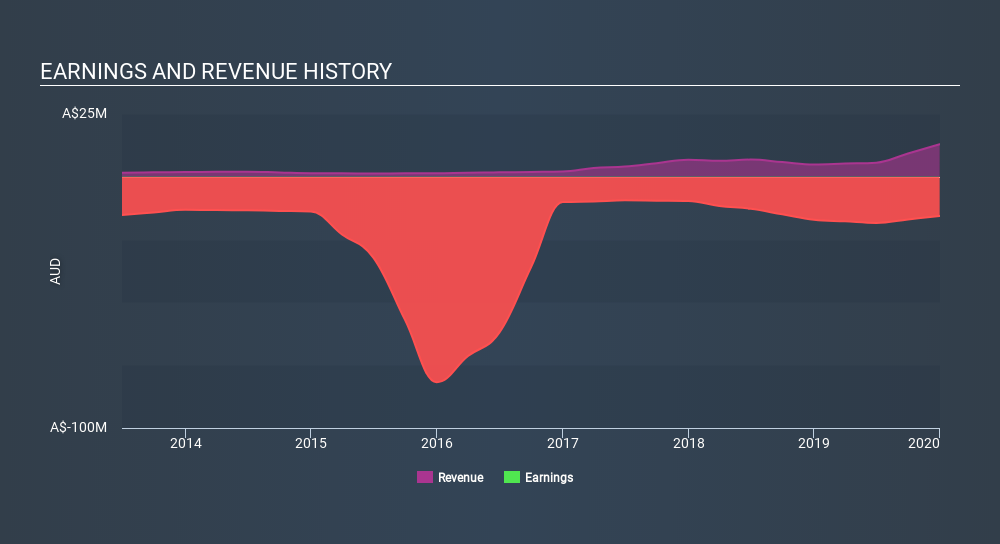

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Immutep's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 13% in the twelve months, Immutep shareholders did even worse, losing 51%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 31% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Immutep is showing 3 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:IMM

Immutep

A late-stage biotechnology company, engages in developing novel LAG-3 related immunotherapies for cancer and autoimmune diseases in Australia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives