- United States

- /

- Office REITs

- /

- NYSEAM:FSP

The Franklin Street Properties (NYSEMKT:FSP) Share Price Is Down 41% So Some Shareholders Are Getting Worried

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Franklin Street Properties Corp. (NYSEMKT:FSP) shareholders for doubting their decision to hold, with the stock down 41% over a half decade. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Franklin Street Properties

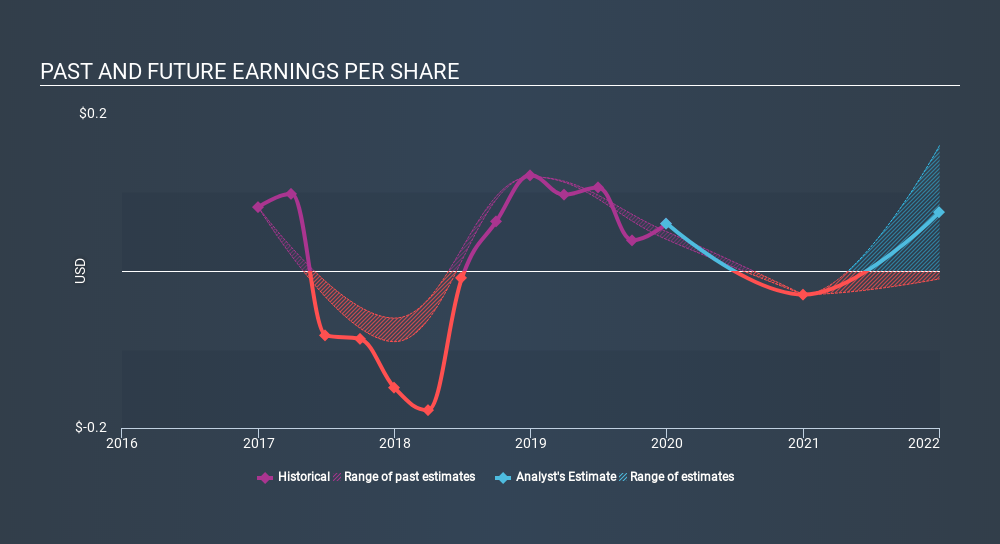

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Franklin Street Properties's share price and EPS declined; the latter at a rate of 14% per year. The share price decline of 10% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around. With a P/E ratio of 122.88, it's fair to say the market sees a brighter future for the business.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Franklin Street Properties's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Franklin Street Properties the TSR over the last 5 years was -22%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Franklin Street Properties shareholders gained a total return of 7.2% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4.7% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Franklin Street Properties is showing 2 warning signs in our investment analysis , you should know about...

But note: Franklin Street Properties may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:FSP

Franklin Street Properties

Franklin Street Properties Corp., based in Wakefield, Massachusetts, is focused on infill and central business district (CBD) office properties in the U.S.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives