- New Zealand

- /

- Medical Equipment

- /

- NZSE:FPH

The Fisher & Paykel Healthcare (NZSE:FPH) Share Price Has Soared 346%, Delighting Many Shareholders

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Fisher & Paykel Healthcare Corporation Limited (NZSE:FPH) share price has soared 346% over five years. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 38% in about a quarter.

See our latest analysis for Fisher & Paykel Healthcare

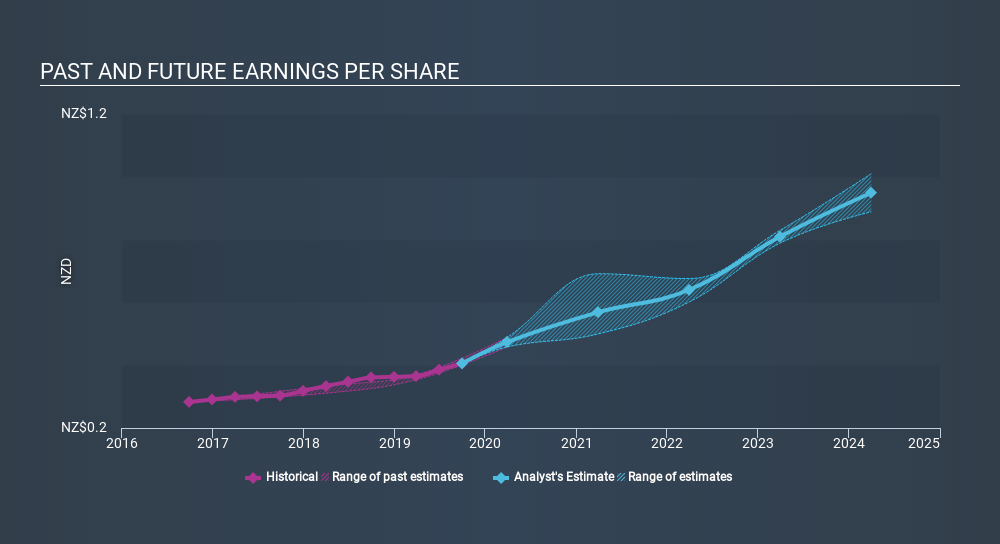

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Fisher & Paykel Healthcare achieved compound earnings per share (EPS) growth of 17% per year. This EPS growth is slower than the share price growth of 35% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 75.22.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Fisher & Paykel Healthcare's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Fisher & Paykel Healthcare's TSR for the last 5 years was 394%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Fisher & Paykel Healthcare shareholders have received a total shareholder return of 102% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 38%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Fisher & Paykel Healthcare you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NZSE:FPH

Fisher & Paykel Healthcare

Designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives