- United States

- /

- Basic Materials

- /

- NYSE:LOMA

The Consensus EPS Estimates For Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) Just Fell A Lot

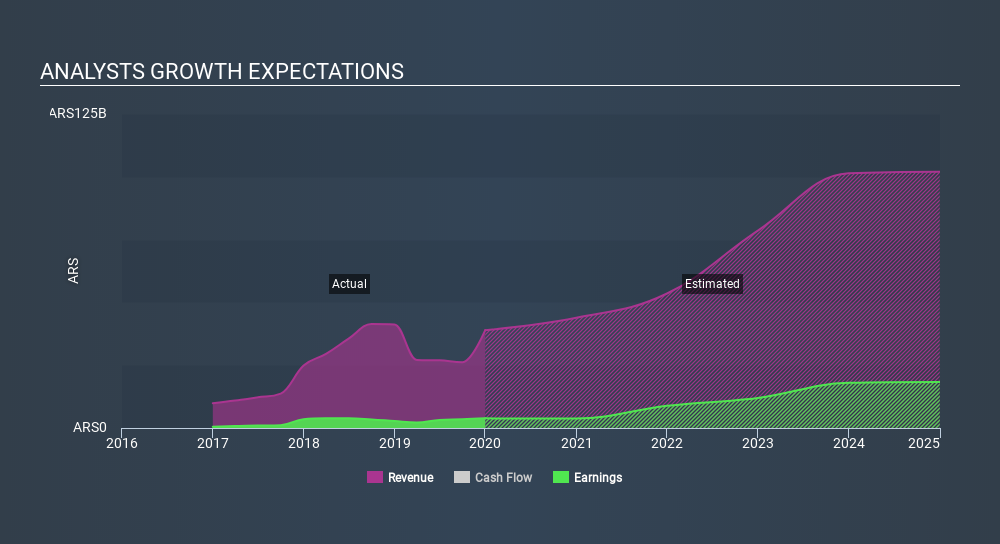

The analysts covering Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the downgrade, the consensus from seven analysts covering Loma Negra Compañía Industrial Argentina Sociedad Anónima is for revenues of AR$37b in 2020, implying a discernible 3.8% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of AR$46b in 2020. It looks like forecasts have become a fair bit less optimistic on Loma Negra Compañía Industrial Argentina Sociedad Anónima, given the substantial drop in revenue estimates.

See our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima

Notably, the analysts have cut their price target 6.5% to US$8.44, suggesting concerns around Loma Negra Compañía Industrial Argentina Sociedad Anónima's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Loma Negra Compañía Industrial Argentina Sociedad Anónima analyst has a price target of US$13.90 per share, while the most pessimistic values it at US$5.90. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 3.8% revenue decline a notable change from historical growth of 29% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.8% annually for the foreseeable future. It's pretty clear that Loma Negra Compañía Industrial Argentina Sociedad Anónima's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Loma Negra Compañía Industrial Argentina Sociedad Anónima this year. They also expect company revenue to perform worse than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Loma Negra Compañía Industrial Argentina Sociedad Anónima.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Loma Negra Compañía Industrial Argentina Sociedad Anónima's financials, such as a weak balance sheet. For more information, you can click here to discover this and the 2 other risks we've identified.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives