- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

The Consensus EPS Estimates For eXp World Holdings, Inc. (NASDAQ:EXPI) Just Fell Dramatically

Market forces rained on the parade of eXp World Holdings, Inc. (NASDAQ:EXPI) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

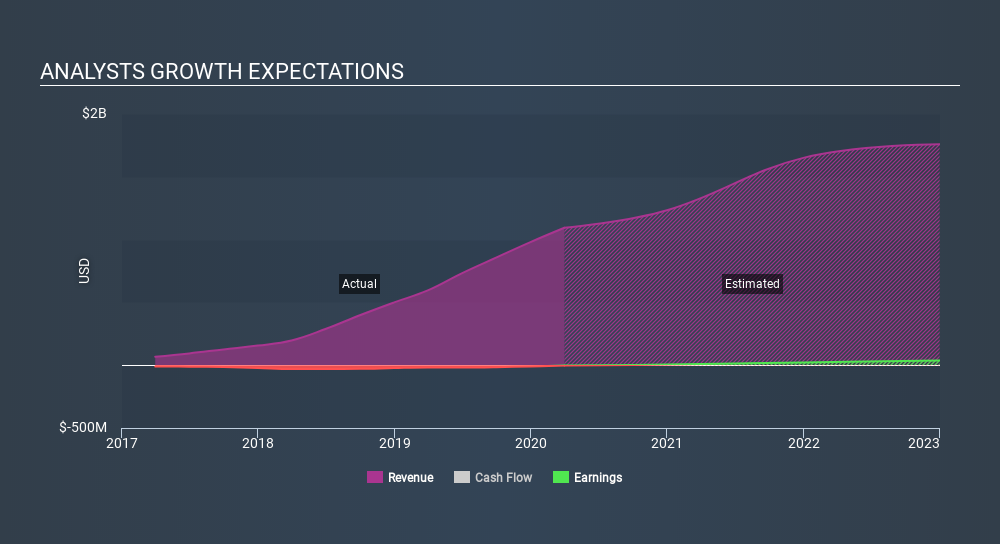

Following the downgrade, the most recent consensus for eXp World Holdings from its three analysts is for revenues of US$1.2b in 2020 which, if met, would be a decent 13% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.07 per share this year. Before this latest update, the analysts had been forecasting revenues of US$1.4b and earnings per share (EPS) of US$0.10 in 2020. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

View our latest analysis for eXp World Holdings

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that eXp World Holdings' revenue growth will slow down substantially, with revenues next year expected to grow 13%, compared to a historical growth rate of 68% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 6.7% next year. So it's pretty clear that, while eXp World Holdings' revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Given the serious cut to this year's outlook, it's clear that analysts have turned more bearish on eXp World Holdings, and we wouldn't blame shareholders for feeling a little more cautious themselves.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple eXp World Holdings analysts - going out to 2022, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

A case for Ridgeline Minerals: Base case CAD$2.00, Bull case CAD$5.00+

CSL: The Dip Is the Opportunity

Apple will shine with a 6% revenue growth in the next 5 years

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026