- United States

- /

- Medical Equipment

- /

- NasdaqCM:CFMS

The Conformis (NASDAQ:CFMS) Share Price Is Up 139% And Shareholders Are Boasting About It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Conformis, Inc. (NASDAQ:CFMS) share price has soared 139% return in just a single year. Better yet, the share price has gained 263% in the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. In contrast, the longer term returns are negative, since the share price is 47% lower than it was three years ago.

See our latest analysis for Conformis

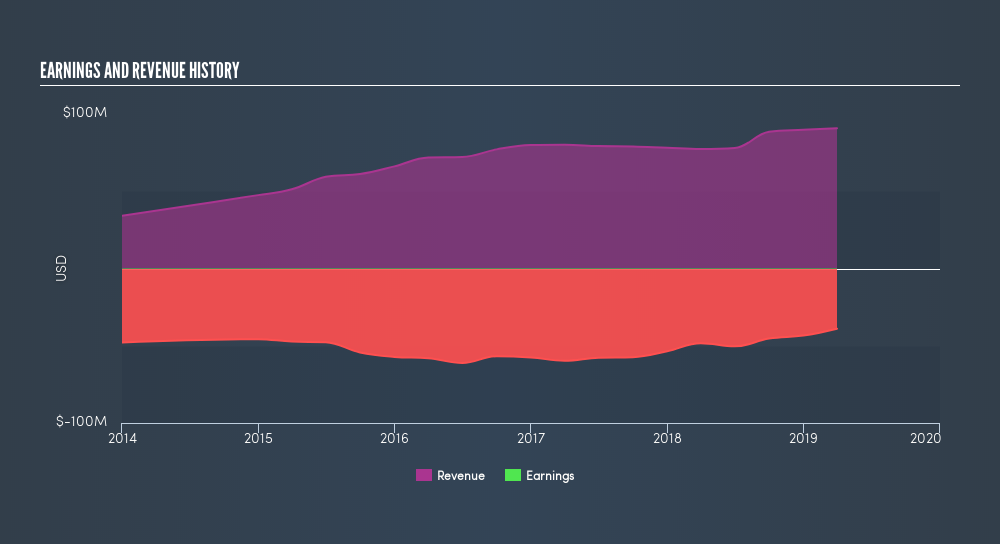

Given that Conformis didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Conformis grew its revenue by 17% last year. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 139% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Conformis shareholders have gained 139% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 19% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. If you would like to research Conformis in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges. We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:CFMS

Conformis

Conformis, Inc., a medical technology company, develops, manufactures, and sells patient-specific products and instrumentation.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives