- Singapore

- /

- Water Utilities

- /

- SGX:U9E

The China Everbright Water (SGX:U9E) Share Price Is Down 81% So Some Shareholders Are Rather Upset

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held China Everbright Water Limited (SGX:U9E) for five years would be nursing their metaphorical wounds since the share price dropped 81% in that time. We also note that the stock has performed poorly over the last year, with the share price down 53%. The falls have accelerated recently, with the share price down 33% in the last three months. Of course, this share price action may well have been influenced by the 20% decline in the broader market, throughout the period.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for China Everbright Water

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, China Everbright Water actually saw its earnings per share (EPS) improve by 15% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It's not immediately clear to us why the stock price is down but further research might provide some answers.

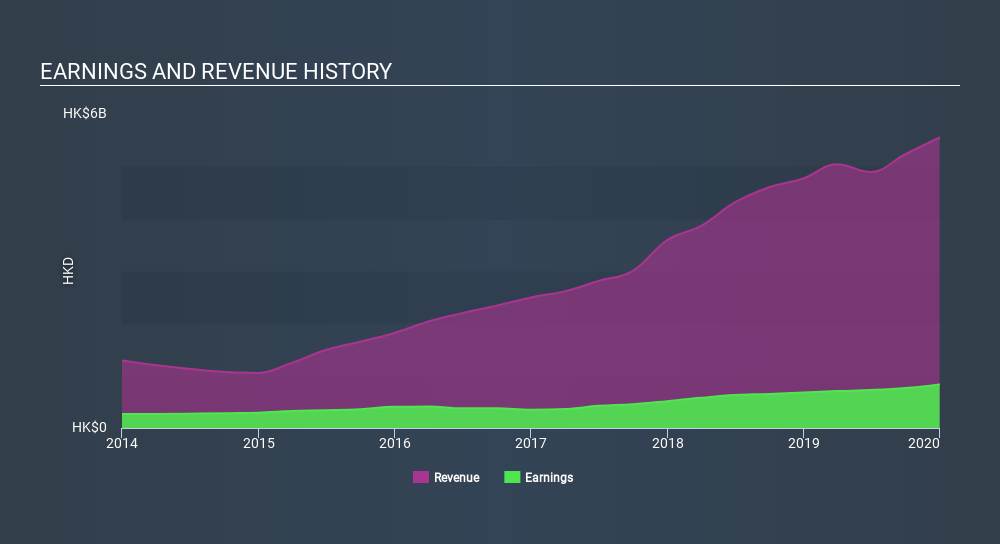

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that China Everbright Water has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling China Everbright Water stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between China Everbright Water's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. China Everbright Water's TSR of was a loss of 80% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 21% in the twelve months, China Everbright Water shareholders did even worse, losing 52% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 27% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand China Everbright Water better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with China Everbright Water (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:U9E

China Everbright Water

Engages in the water environment management business in Mainland China and Germany.

Undervalued with moderate growth potential.

Market Insights

Community Narratives