- Hong Kong

- /

- Trade Distributors

- /

- SEHK:217

The China Chengtong Development Group (HKG:217) Share Price Is Down 57% So Some Shareholders Are Wishing They Sold

China Chengtong Development Group Limited (HKG:217) shareholders should be happy to see the share price up 29% in the last month. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 57% in that time. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for China Chengtong Development Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, China Chengtong Development Group actually managed to grow EPS by 21% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 12% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching China Chengtong Development Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

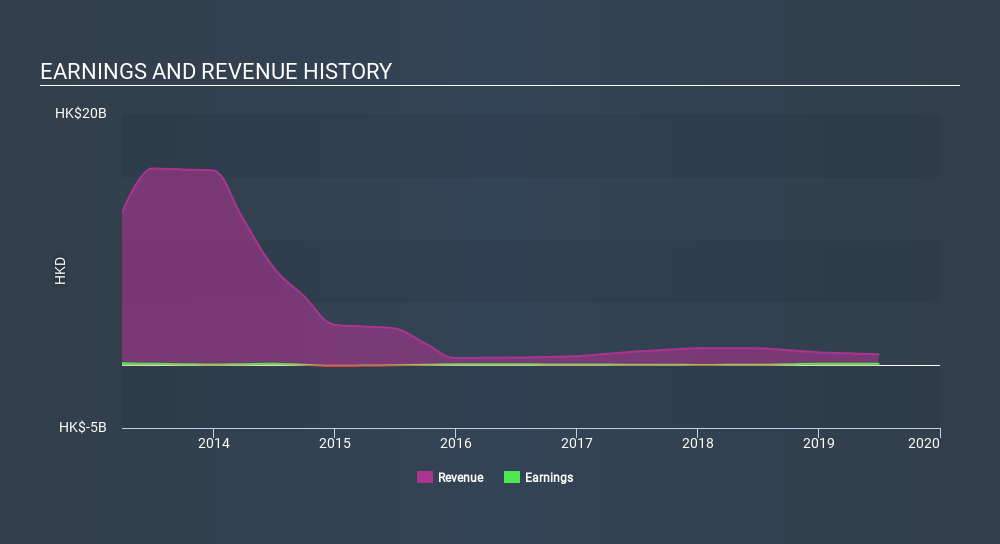

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

While share prices often depend primarily on earnings and revenue, they can be sensitive to an investment's risk level as well. For example, we've discovered 1 warning sign for China Chengtong Development Group (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

It's good to see that China Chengtong Development Group has rewarded shareholders with a total shareholder return of 50% in the last twelve months. That certainly beats the loss of about 14% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Is China Chengtong Development Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:217

China Chengtong Development Group

An investment holding company, engages in the leasing, property development and investment, and marine recreation services and hotel business in the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives