- United Kingdom

- /

- Professional Services

- /

- LSE:CPI

The Capita (LON:CPI) Share Price Is Down 88% So Some Shareholders Are Rather Upset

Capita plc (LON:CPI) shareholders should be happy to see the share price up 25% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 88% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Capita

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

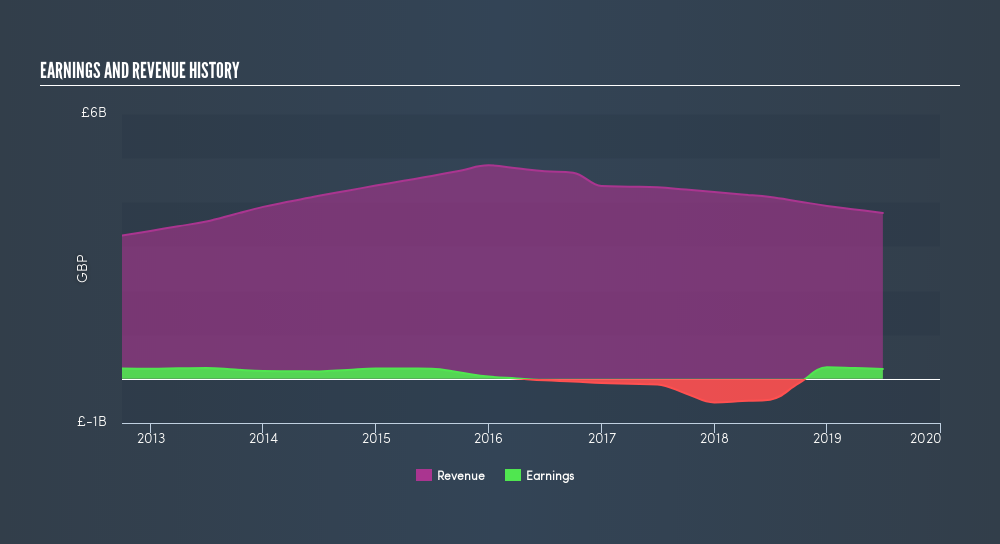

During five years of share price growth, Capita moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 3.0% per year is viewed as evidence that Capita is shrinking. This has probably encouraged some shareholders to sell down the stock.

Capita is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, Capita generated a TSR of -78%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

It's nice to see that Capita shareholders have received a total shareholder return of 5.8% over the last year. Notably the five-year annualised TSR loss of 26% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. If you would like to research Capita in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Capita better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives