The Audioboom Group (LON:BOOM) Share Price Is Down 82% So Some Shareholders Are Rather Upset

It's nice to see the Audioboom Group plc (LON:BOOM) share price up 10% in a week. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 82% in that time. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Audioboom Group

Because Audioboom Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

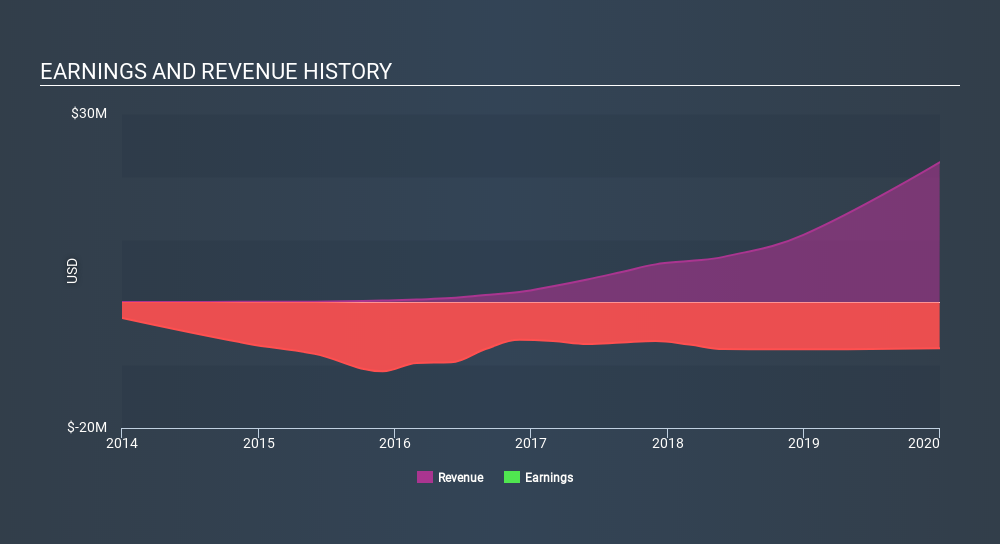

In the last half decade, Audioboom Group saw its revenue increase by 89% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 29% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Audioboom Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 18% in the twelve months, Audioboom Group shareholders did even worse, losing 35%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 29% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Audioboom Group better, we need to consider many other factors. For example, we've discovered 5 warning signs for Audioboom Group (1 is potentially serious!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:BOOM

Audioboom Group

A podcast company, operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives