The 48North Cannabis (CVE:NRTH) Share Price Has Gained 15% And Shareholders Are Hoping For More

It hasn't been the best quarter for 48North Cannabis Corp. (CVE:NRTH) shareholders, since the share price has fallen 27% in that time. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. In that time we've seen the stock easily surpass the market return, with a gain of 15%.

Check out our latest analysis for 48North Cannabis

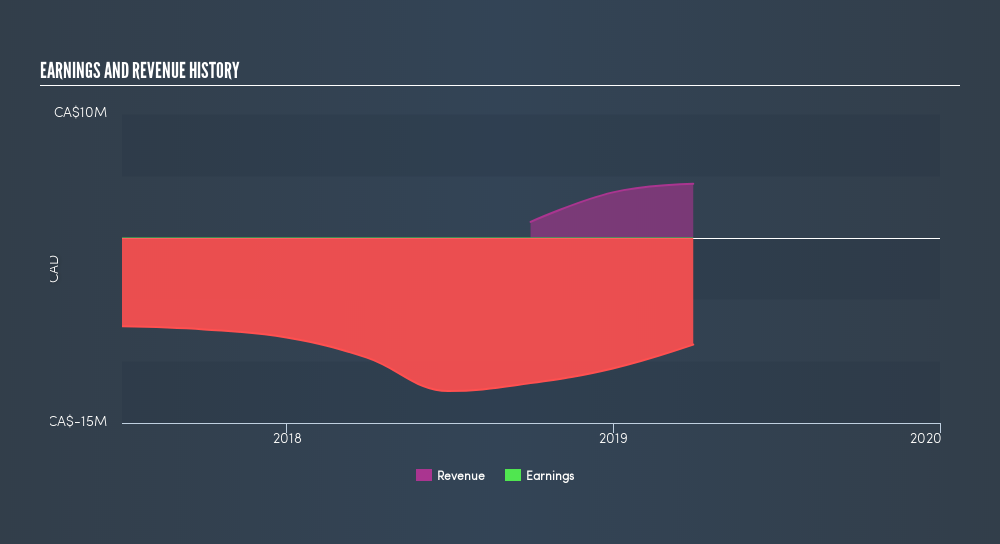

Because 48North Cannabis is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on 48North Cannabis

A Different Perspective

48North Cannabis shareholders should be happy with the total gain of 15% over the last twelve months. We regret to report that the share price is down 27% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives