- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Showcases 5G Innovation at New York Sail Grand Prix

Reviewed by Simply Wall St

T-Mobile US (NasdaqGS:TMUS) recently announced exciting innovations in 5G technology at the Mubadala New York Sail Grand Prix, alongside affirming a cash dividend. These events added positive sentiment to the market's prevailing optimism, as evidenced by the company's 2% price increase last week. During the same period, major indexes such as the S&P 500 reported gains due to strong economic indicators, including a solid employment report. T-Mobile's integration of advanced technologies in sports and consistent shareholder returns contributed to this upward momentum, aligning with the broader market's trend.

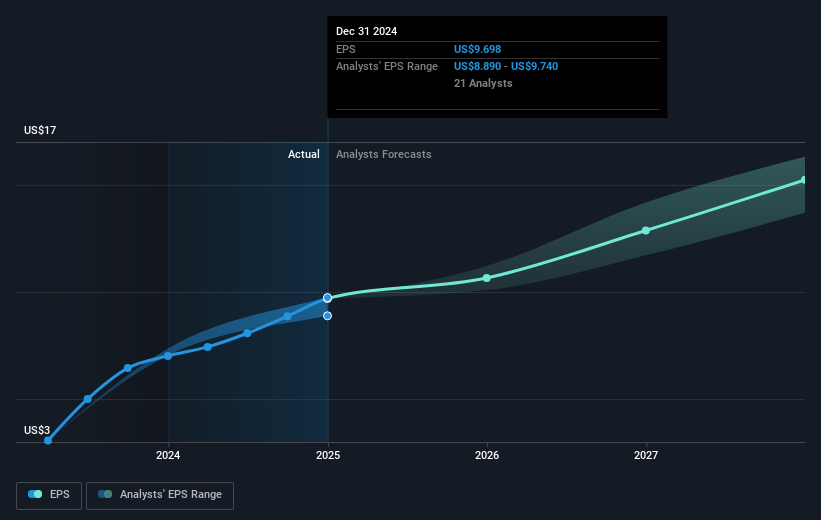

The recent advancements in 5G technology by T-Mobile US, along with the affirmation of a cash dividend, have likely bolstered the company's narrative centered on growth and innovation. These developments could enhance revenue and earnings potential, with T-Mobile's strategic fiber expansions and innovations in 5G and digital platforms potentially driving future profitability. Analysts forecast a 5.1% annual revenue growth and an increase in profit margins to 16.7% by mid-2028, aligning these expectations with the company's focus on expanding its postpaid and broadband customer base.

Over the past five years, T-Mobile's total shareholder returns, inclusive of share price appreciation and dividends, soared 149.60%. This performance contrasts with the company's one-year return, which matched the US Wireless Telecom industry at 36.4%. Despite the recent 2% weekly price increase, T-Mobile's current share price of US$253.80 shows a 5.7% discount to the consensus analyst price target of US$269.25. This relatively narrow gap suggests that market expectations are fairly aligned with analyst projections, with some analysts having divergent views ranging from US$202.99 to US$305.0. These circumstances invite investors to contemplate future growth potential alongside the company's current valuation metrics.

Understand T-Mobile US' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives