- United States

- /

- Consumer Finance

- /

- NYSE:SYF

Synchrony Financial (NYSE:SYF) Partners With Future 5 To Empower Stamford's Youth

Reviewed by Simply Wall St

Synchrony Financial (NYSE:SYF) marked a significant milestone with the launch of its Future 5 hub in Stamford, reinforcing its commitment to community and youth development. Over the last quarter, the company's shares experienced a 19% price increase, a notable move as the S&P 500 approached all-time highs and gained 11% over twelve months. Synchrony's initiatives like the Future 5 program, coupled with strategic partnerships and a 20% dividend increase, likely helped bolster investor confidence, while the market also saw general optimism due to strong earnings and economic data.

You should learn about the 2 risks we've spotted with Synchrony Financial.

The launch of Synchrony Financial's Future 5 hub may enhance investor sentiment by emphasizing its commitment to community and youth development, potentially reinforcing brand loyalty. In turn, this initiative could support revenue growth by attracting more partners and expanding customer engagement. As of today, Synchrony's shares have delivered a total return of 182.66% over the past five years, demonstrating significant growth compared to the company's shorter-term and longer-term outlook. Looking at the past year, its stock performance outpaced both the US market and the US Consumer Finance industry, which have seen considerable returns themselves.

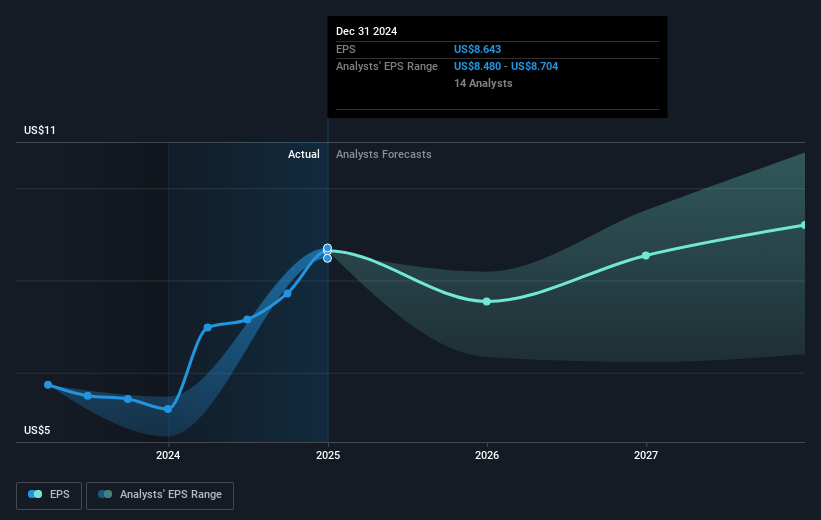

The Future 5 hub, alongside robust partnerships and expanded card offerings, could positively influence revenue and earnings forecasts, as these efforts may lead to increased customer acquisition and loyalty. Analysts expect revenue to grow 23.7% annually over the next three years, though they anticipate a decline in profit margins to 19.4% by 2028. Currently, the share price is at $53.40, trading at a discount compared to the consensus price target of $64.14, indicating potential upside if the expected growth justifies the target. The alignment of strategic initiatives with these projections could see positive reception from both investors and market analysts in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYF

Synchrony Financial

Operates as a consumer financial services company in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives