- United Kingdom

- /

- Consumer Services

- /

- AIM:MLVN

Such Is Life: How Malvern International (LON:MLVN) Shareholders Saw Their Shares Drop 68%

Investing in stocks comes with the risk that the share price will fall. And unfortunately for Malvern International plc (LON:MLVN) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 68% in that time. We note that it has not been easy for shareholders over three years, either; the share price is down 56% in that time. The falls have accelerated recently, with the share price down 35% in the last three months.

See our latest analysis for Malvern International

Malvern International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Malvern International increased its revenue by 66%. That's well above most other pre-profit companies. In contrast the share price is down 68% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

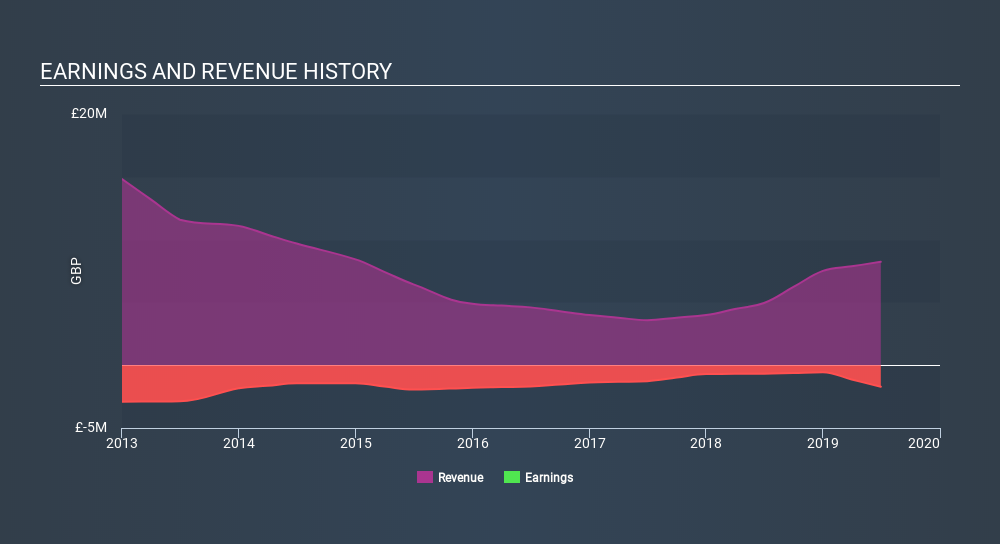

You can see below how earnings and revenue have changed over time.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Malvern International in this interactive graph of future profit estimates.

A Different Perspective

Malvern International shareholders are down 68% for the year, but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Malvern International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:MLVN

Malvern International

Provides educational services in the United Kingdom.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives