- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap Inc (NYSE: SNAP)’s Path To Profitability Might Be Harder Than You Think

With restless millennials who want to hop from one trend to another, social media companies need to keep up and innovate, or if nothing else works, imitate, in order to keep the attention on their platforms. Snap Inc ( NYSE: SNAP ), the owner of the social media company Snapchat is one of the latest companies to imitate another social media company’s product feature in order to keep up with shifting user habits. The company announced the launch of a new in-app feature, Spotlight, which imitates ByteDance’s TikTok. With the new feature, users can create short video clips, or “snaps”.

Along with the announcement, Snapchat also revealed that creators of the most engaging snaps will win a share of $1 million every day until the end of the year.

See our latest analysis for Snap

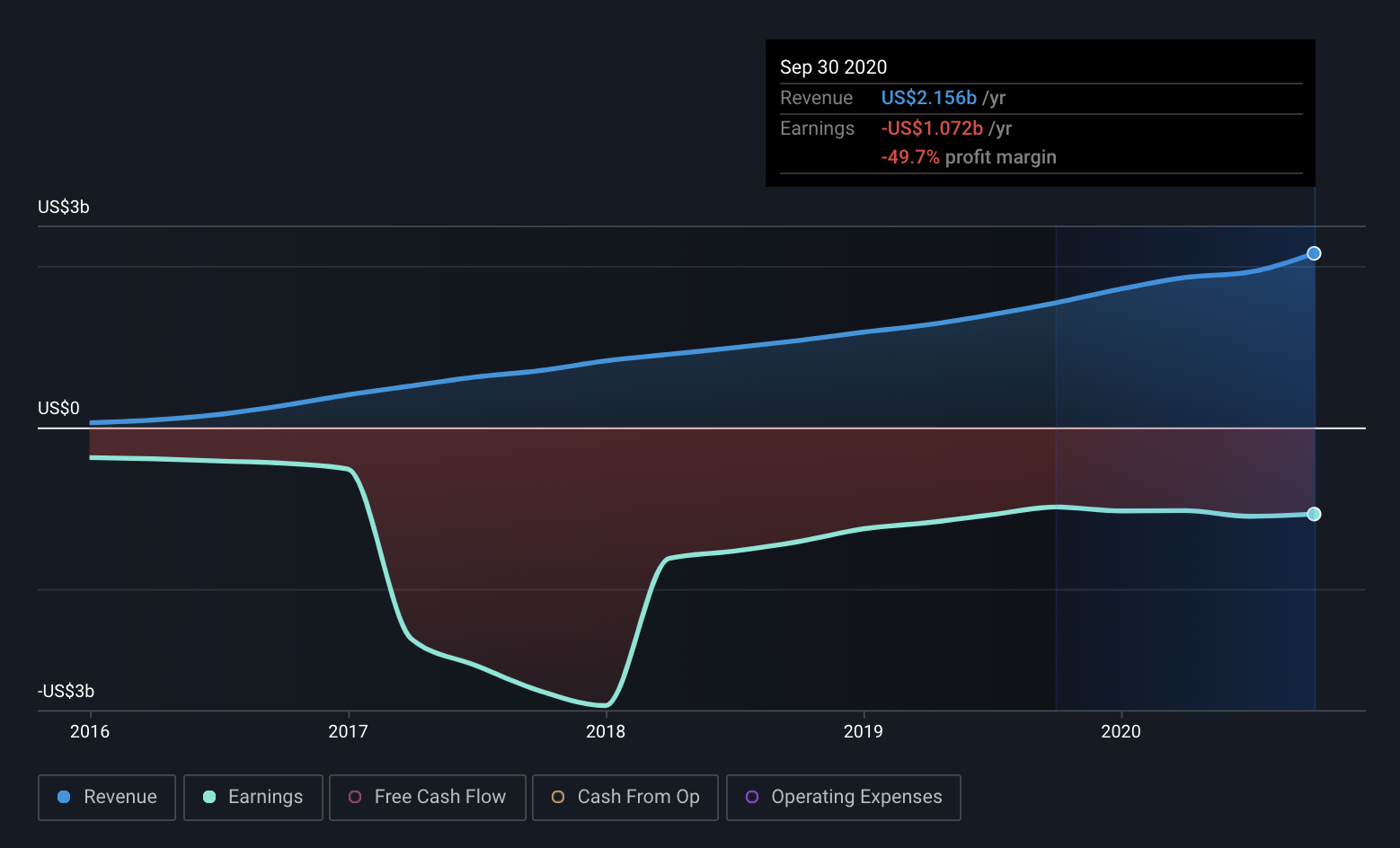

Spotlight’s launch comes on the back of strong Q3 2020 results. Overall, the company has seen a sustained increase in its revenue and earnings this year, amid the COVID-19 pandemic, with last twelve months (LTM) of revenue rising to $2.1b versus $1.5b in the comparable LTM period last year. LTM loss per share on the other hand hasn’t seen much improvement, widening slightly from $0.72 per share in 2019 to $0.75 loss per share in the last twelve months ended September 30.

NYSE: SNAP Earnings and Revenue History (Source: Simply Wall St )

NYSE: SNAP Earnings and Revenue History (Source: Simply Wall St )

Unfortunately, in the long run, investors usually care more about profits than they do about revenue growth. SNAP isn’t profitable even after 3 years since it launched its IPO and is another 3 years away from breaking even according to analysts' estimates.

Before we dive into why profits haven’t grown with revenue, let's try and understand the company’s revenue growth trends.

Where Is Snap’s Revenue Growth Coming From?

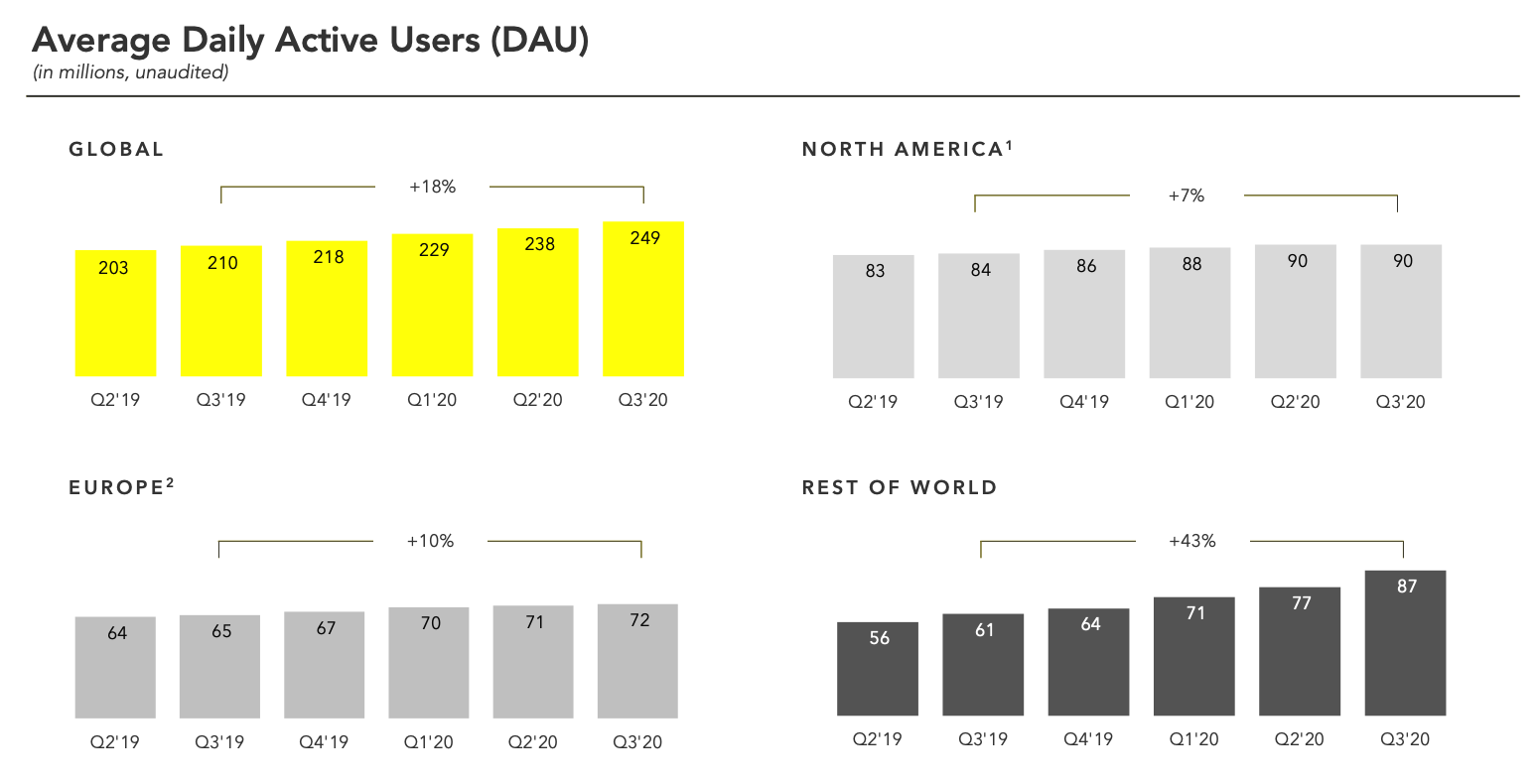

SNAP earns its revenues by selling advertising space to promoters looking to gain exposure to the 249 million daily average users (DAU) of the app.

The chart below portrays SNAP’s average DAU as of Q3 2020 and as we can see, while the company has seen user growth across all geographies of operation, “Rest of World” stands out with its 43% year-over-year (YoY) growth.

Source: Company presentation

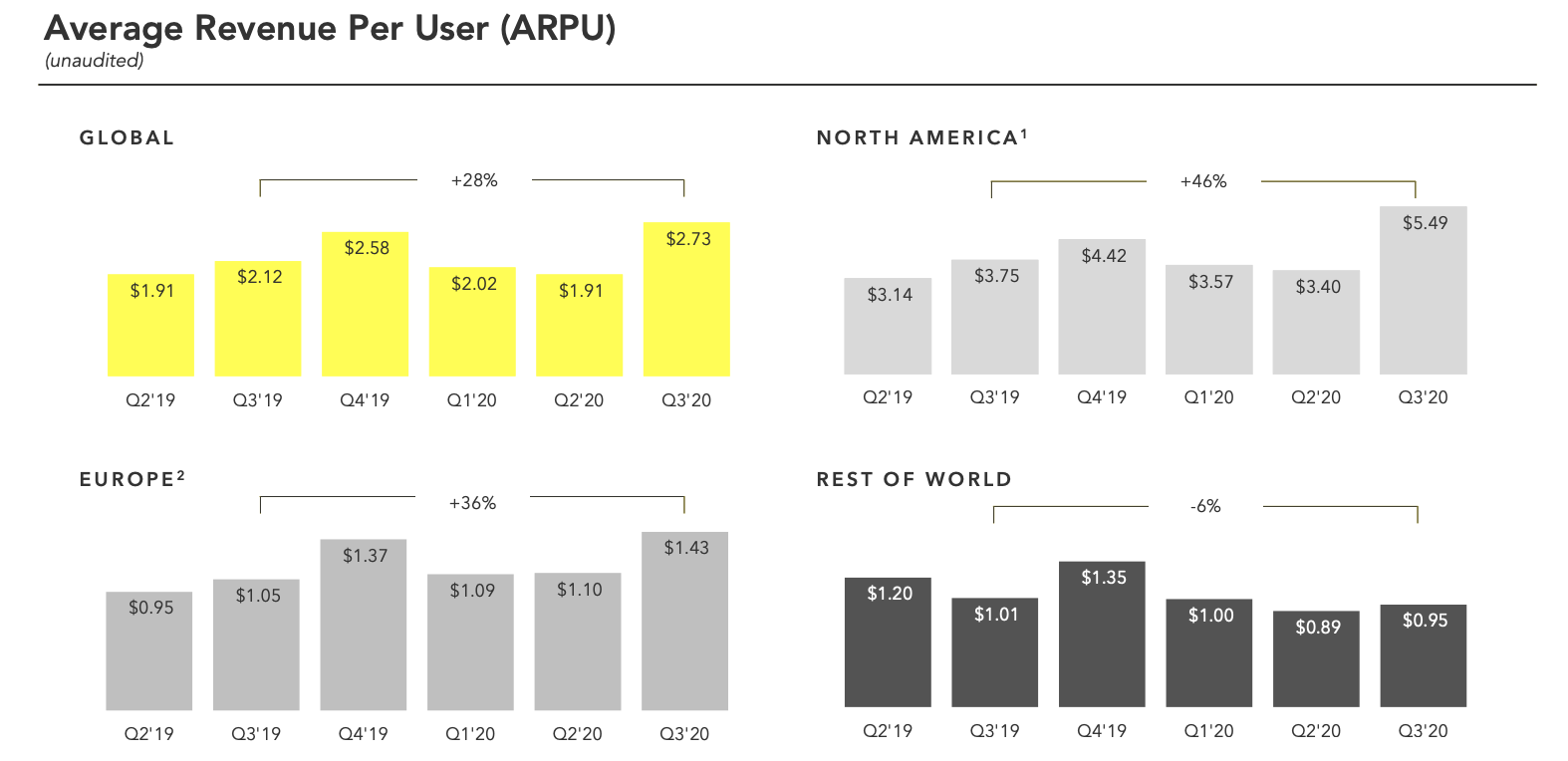

However, SNAP’s revenue growth is not just a function of expanded user base, but also the revenue it earns per user, or ARPU (average revenue per user). Here’s where things get a little interesting. The chart below shows that Snap’s ARPU in the most recent quarter actually declined under the “Rest of World” segment, but increased by over 45% in North America.

Source: Company presentation

Evidently, North America’s ARPU is over 5 times the ARPU of Rest of World meaning that North America is where the company earns the most money. As a result, the segment is a key contributor to the company’s overall revenues. For the nine months ended September 30, 2020, almost 64% of its revenues came from North America. In comparison, Rest of World accounted for only 15%.

What we deduce from this is that, while SNAP’s revenue growth so far was supported by the lucrative North American market, more recently the user growth there has been slowing down. This could potentially put the company’s future revenue growth at risk.

Why Profits Haven’t Grown With Revenues

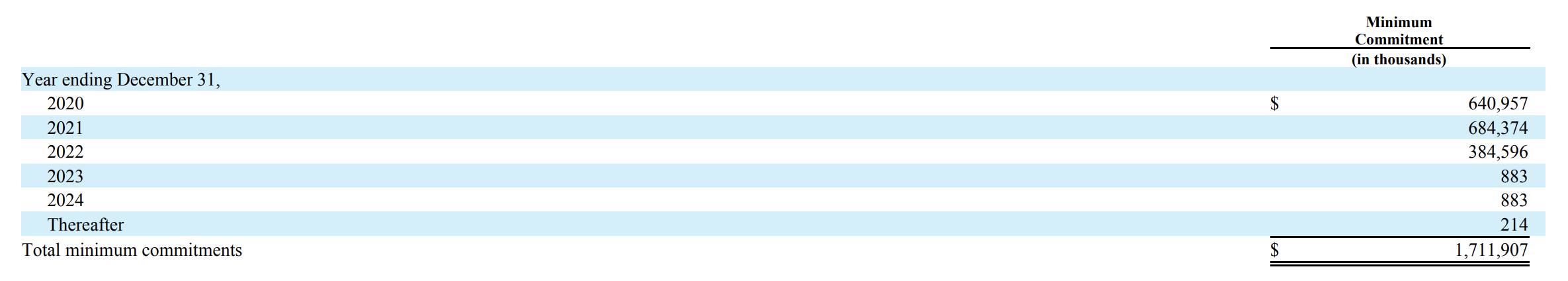

Snap heavily relies on Google Cloud and Amazon web services (AWS)’s cloud hosting services to support its users. Costs associated with hosting were $657m for the LTM period ended September 30. These expenses labeled as “infrastructure costs” accounted for approximately 34% of the total expenses incurred by the company to operate its business for the LTM period ended September 30.

R&D or research and development expenses (the bulk of which include stock-based compensation) have also been keeping the company’s total costs high. R&D expenses made up 33% of Snap’s total expenses for the LTM period ended September 30.

Together, these two line-items have greatly contributed to the company’s total costs and operating expenses staying over 100% of revenues and this has hurt profitability even though revenues have grown.

What Challenges Does Snap Face In Its Path To Profitability?

While it’s true that Snap’s user growth seems to be approaching a saturation point in the region where it matters the most- North America, let us for a moment assume that user growth somehow picks up. Say for example Snapchat develops a product or a feature that is aimed at an older-age audience (over 30 years in social media terms) to capture that demographic. It would still need to pay all those infrastructure costs to support that growth. This could be challenging as the company expects to reduce its infrastructure costs significantly after 2022.

The below image portrays the infrastructure costs it has agreed to pay to Google Cloud and AWS through 2022 as a part of an agreement signed with them in 2017 .

Source: Company filings

So it could end up being a catch-22 situation for the company, where it needs to expand its users so it can grow its revenues and increase its profits but it probably can’t do that without incurring higher infrastructure costs. This could potentially result in those costs sticking around even after 2022, and the possibility that the company might stay in red beyond 2022.

Another way the company could approach the lack of profitability could be from a monetization perspective. Snap’s global average revenue per user was a paltry $2.73 compared to Facebook’s $39.63 . While it might be hard to match Facebook’s ARPU given its size and scale, improved monetization on the same user growth and cost base could be a key catalyst to increase Snap’s profits.

In Summary

Unless Snap sees a growth in its user base along with improved monetizations, combined with lower expenses, profitability might remain a distant possibility.

Lowering costs such as sales and marketing or other operating costs in the face of tough competition might be easier said than done. The company needs to keep shelling out dollars to constantly innovate and market its products to increase engagement. Recent example being, the $1 million per day award announced at the launch of Spotlight.

As a result, the company’s path to profitability heavily depends on reducing its infrastructure or cloud hosting costs. However, that comes with its own challenges as they are direct costs the company needs to incur to grow its business.

Going forward, investors should pay close attention to SNAP’s infrastructure costs and monetization of its user base to build a thesis around the trajectory of the company’s profits.

For those of you who don’t like to speculate on a stock’s future growth opportunities, here’s a free list of companies that are profitable and undervalued.

When trading Snap or any other investment, use the platform considered by many to be the Professional's Gateway to the World’s Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds, and funds worldwide from a single integrated account.

Neither Simply Wall St analyst Kshitija Bhandaru nor Simply Wall st hold any position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com .

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and fair value.