Stock Analysis

- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

Century Aluminum (NASDAQ:CENX) delivers shareholders favorable 14% CAGR over 5 years, surging 3.8% in the last week alone

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Century Aluminum share price has climbed 94% in five years, easily topping the market return of 71% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 72% in the last year.

Since it's been a strong week for Century Aluminum shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Century Aluminum

Century Aluminum isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Century Aluminum saw its revenue grow at 8.2% per year. That's a pretty good long term growth rate. While the share price has beat the market, compounding at 14% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. There's no doubt that it can be difficult to value pre-profit companies.

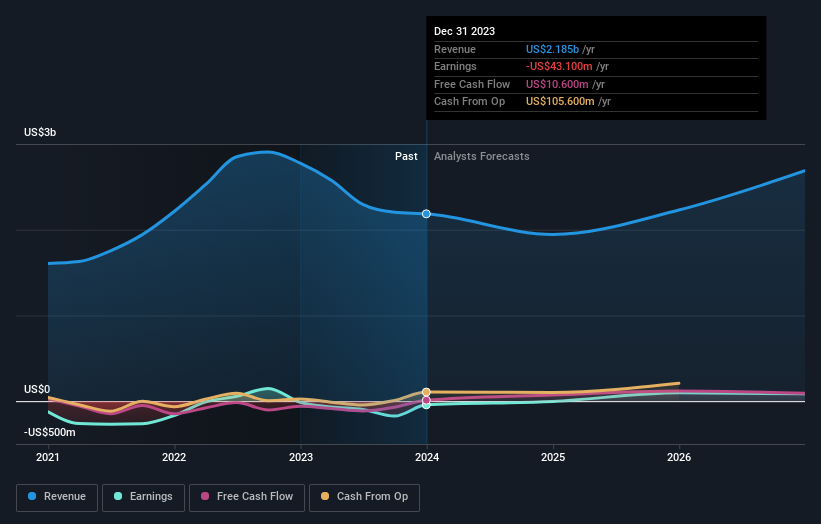

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Century Aluminum will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Century Aluminum shareholders have received a total shareholder return of 72% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Century Aluminum is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CENX

Century Aluminum

Century Aluminum Company, together with its subsidiaries, engages in the production of standard-grade and value-added primary aluminum products in the United States and Iceland.

Acceptable track record and slightly overvalued.