Stock Analysis

- South Korea

- /

- Industrials

- /

- KOSE:A000880

Hanwha Corporation (KRX:000880) Screens Well But There Might Be A Catch

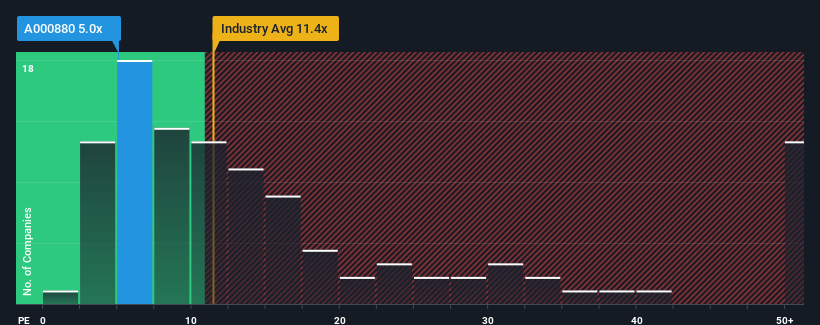

Hanwha Corporation's (KRX:000880) price-to-earnings (or "P/E") ratio of 5x might make it look like a strong buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 13x and even P/E's above 26x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Hanwha as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Hanwha

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Hanwha would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 70%. Still, the latest three year period has seen an excellent 141% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 22% per year over the next three years. With the market only predicted to deliver 19% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Hanwha's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Hanwha's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hanwha's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Hanwha (1 is concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Hanwha is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000880

Hanwha

Hanwha Corporation manufactures and sells explosives and industrial machinery.

Good value with limited growth.