- South Korea

- /

- Food and Staples Retail

- /

- KOSE:A026960

Dong Suh Companies Inc.'s (KRX:026960) Share Price Not Quite Adding Up

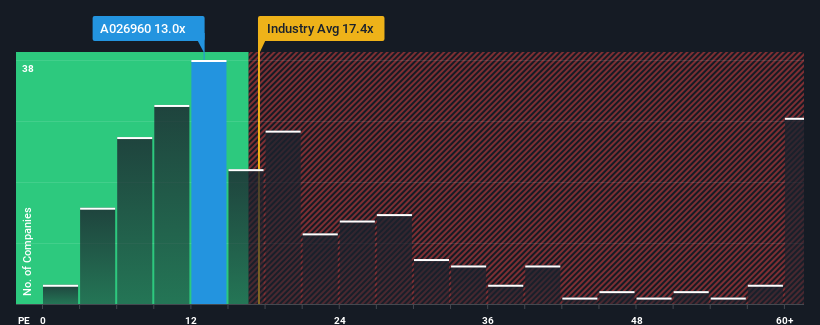

It's not a stretch to say that Dong Suh Companies Inc.'s (KRX:026960) price-to-earnings (or "P/E") ratio of 13x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Dong Suh Companies' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Dong Suh Companies

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Dong Suh Companies' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 29% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Dong Suh Companies is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Dong Suh Companies' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Dong Suh Companies revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Dong Suh Companies that you need to be mindful of.

If you're unsure about the strength of Dong Suh Companies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A026960

Dong Suh Companies

Engages in the food, packaging, tea, logistics, and import and export businesses.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives