- United States

- /

- Specialty Stores

- /

- NasdaqGS:SFIX

Some Stitch Fix (NASDAQ:SFIX) Shareholders Have Copped A Big 55% Share Price Drop

Stitch Fix, Inc. (NASDAQ:SFIX) shareholders should be happy to see the share price up 15% in the last week. But that isn't much consolation to those who have suffered through the declines of the last year. Like a receding glacier in a warming world, the share price has melted 55% in that period. Some might say the recent bounce is to be expected after such a bad drop. You could argue that the sell-off was too severe.

View our latest analysis for Stitch Fix

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

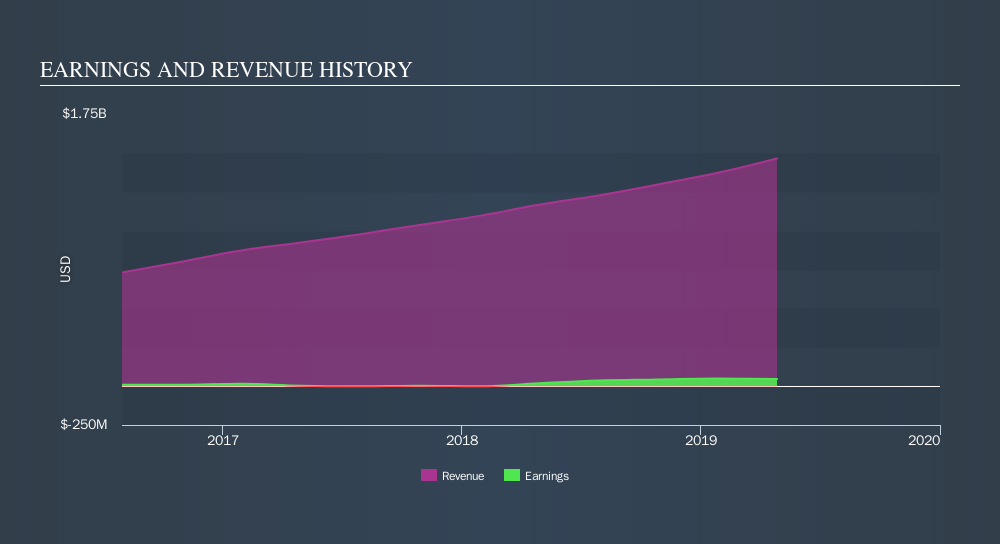

Even though the Stitch Fix share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

Stitch Fix managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Stitch Fix

A Different Perspective

While Stitch Fix shareholders are down 55% for the year, the market itself is up 4.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 27% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. If you would like to research Stitch Fix in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SFIX

Stitch Fix

Sells a range of apparel, shoes, and accessories for women’s, petite, maternity, men’s, plus, and kids through its website and mobile application in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives