- United States

- /

- Hotel and Resort REITs

- /

- NasdaqCM:SOHO

Some Sotherly Hotels (NASDAQ:SOHO) Shareholders Are Down 13%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Sotherly Hotels Inc. (NASDAQ:SOHO) shareholders for doubting their decision to hold, with the stock down 13% over a half decade. It's down 4.3% in the last seven days.

Check out our latest analysis for Sotherly Hotels

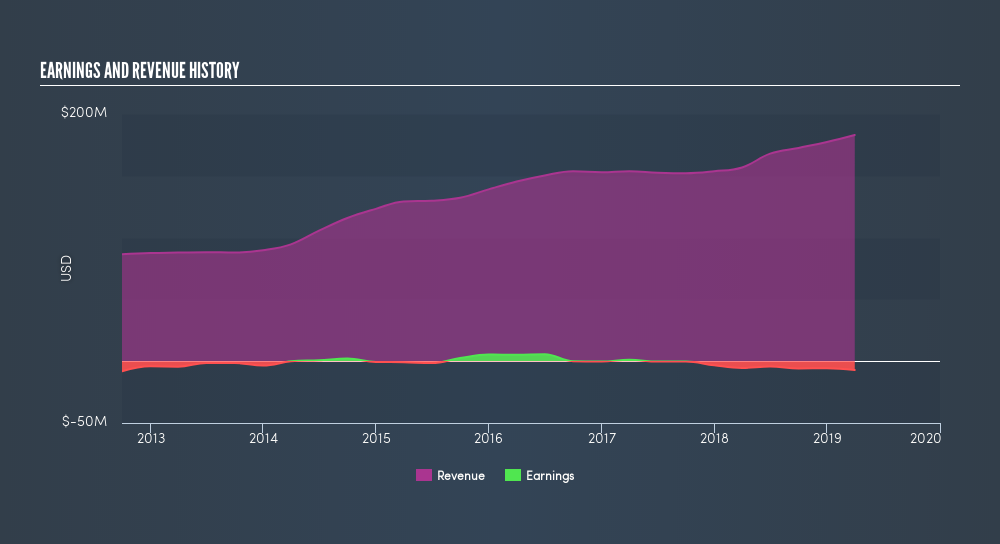

Sotherly Hotels isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Sotherly Hotels grew its revenue at 9.8% per year. That's a pretty good rate for a long time period. We doubt many shareholders are ok with the fact the share price has fallen 2.7% each year for half a decade. Those who bought back then clearly believed in stronger growth - and maybe even profits. The lesson is that if you buy shares in a money losing company you could end up losing money.

This free interactive report on Sotherly Hotels's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Sotherly Hotels, it has a TSR of 18% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Sotherly Hotels's TSR for the year was broadly in line with the market average, at 5.5%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 3.4%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. If you would like to research Sotherly Hotels in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:SOHO

Sotherly Hotels

A self-managed and self-administered lodging REIT focused on the acquisition, renovation, upbranding and repositioning of upscale to upper-upscale full-service hotels in the Southern United States.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

QDay is coming - 01 Quantum hold the key

Alexandria Real Estate Equities Is Going to Transform With a 27.2% Future Pe Ratio

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).