Some Rapala VMC (HEL:RAP1V) Shareholders Have Copped A Big 56% Share Price Drop

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. To wit, the Rapala VMC Corporation (HEL:RAP1V) share price managed to fall 56% over five long years. That's not a lot of fun for true believers. And it's not just long term holders hurting, because the stock is down 26% in the last year. Even worse, it's down 30% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 30% in the same time period.

Check out our latest analysis for Rapala VMC

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Rapala VMC became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

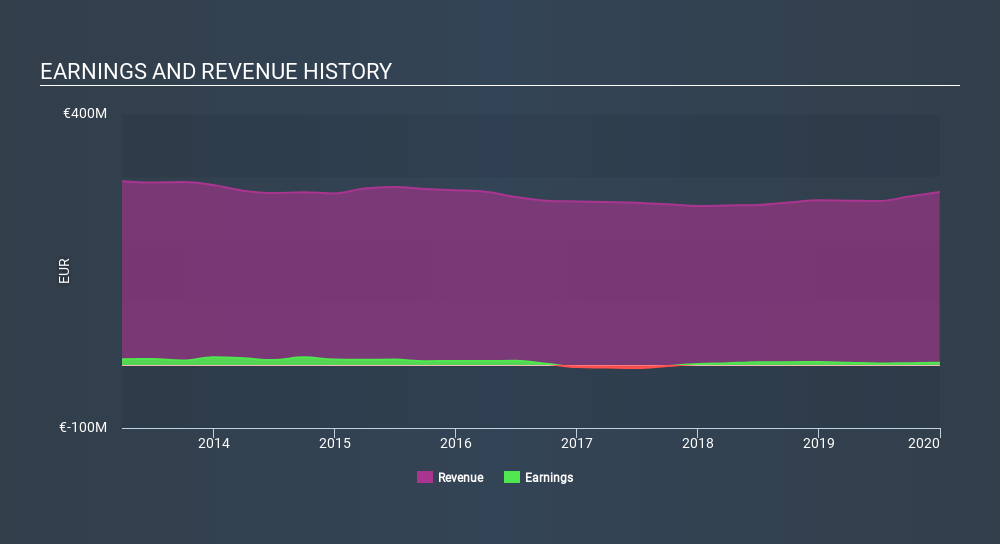

The revenue decline of 1.3% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Rapala VMC has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Rapala VMC's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Rapala VMC's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Rapala VMC's TSR, which was a 50% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 20% in the twelve months, Rapala VMC shareholders did even worse, losing 25%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Rapala VMC that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:RAP1V

Undervalued with excellent balance sheet.

Market Insights

Community Narratives