Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in MAV Beauty Brands Inc. (TSE:MAV) have tasted that bitter downside in the last year, as the share price dropped 47%. That's disappointing when you consider the market returned -0.3%. We wouldn't rush to judgement on MAV Beauty Brands because we don't have a long term history to look at.

See our latest analysis for MAV Beauty Brands

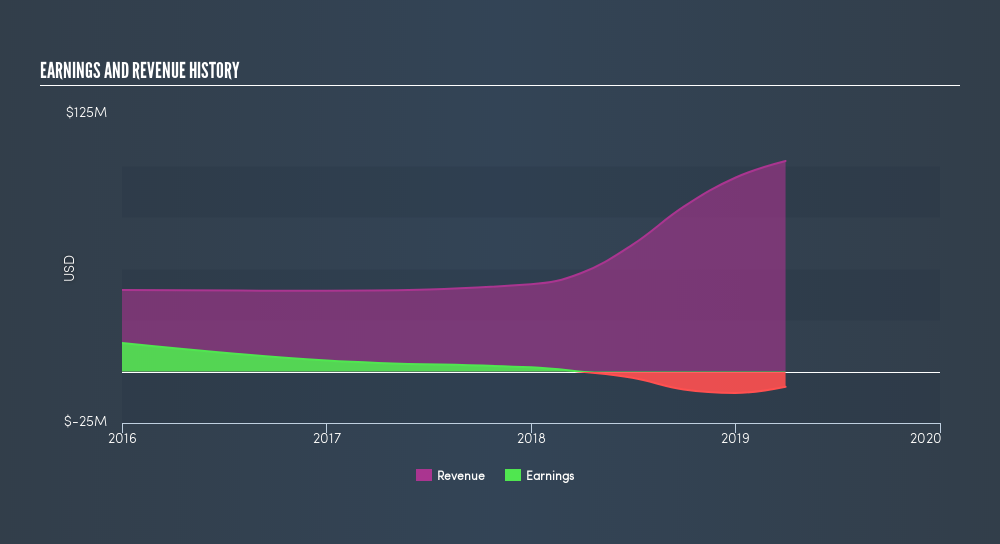

Given that MAV Beauty Brands didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, MAV Beauty Brands increased its revenue by 114%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 47% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling MAV Beauty Brands stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

MAV Beauty Brands shareholders are down 47% for the year, even worse than the market loss of 0.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 5.8% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:MAV

Old MAV Wind-Down

Old MAV Wind-Down Ltd. operates as a personal care company worldwide.

Good value with imperfect balance sheet.

Market Insights

Community Narratives