- United States

- /

- Machinery

- /

- NYSE:SCX

Some L.S. Starrett (NYSE:SCX) Shareholders Have Taken A Painful 72% Share Price Drop

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the The L.S. Starrett Company (NYSE:SCX) share price is a whole 72% lower. We certainly feel for shareholders who bought near the top. There was little comfort for shareholders in the last week as the price declined a further 1.2%.

See our latest analysis for L.S. Starrett

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

L.S. Starrett became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The revenue decline of 2.1% isn't too bad. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

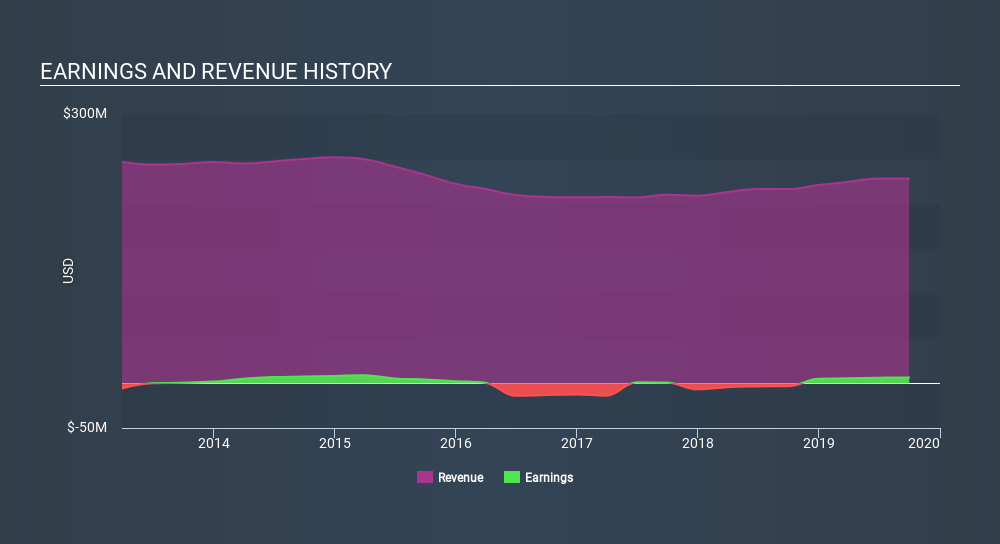

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on L.S. Starrett's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between L.S. Starrett's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for L.S. Starrett shareholders, and that cash payout explains why its total shareholder loss of 68%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

L.S. Starrett shareholders are up 3.2% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 21% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand L.S. Starrett better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with L.S. Starrett .

L.S. Starrett is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SCX

L.S. Starrett

Manufactures and sells industrial, professional, and consumer measuring and cutting tools, and related products in North America, Brazil, and China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives