As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term HNI Corporation (NYSE:HNI) shareholders have had that experience, with the share price dropping 28% in three years, versus a market return of about 49%. It's down 2.9% in the last seven days.

See our latest analysis for HNI

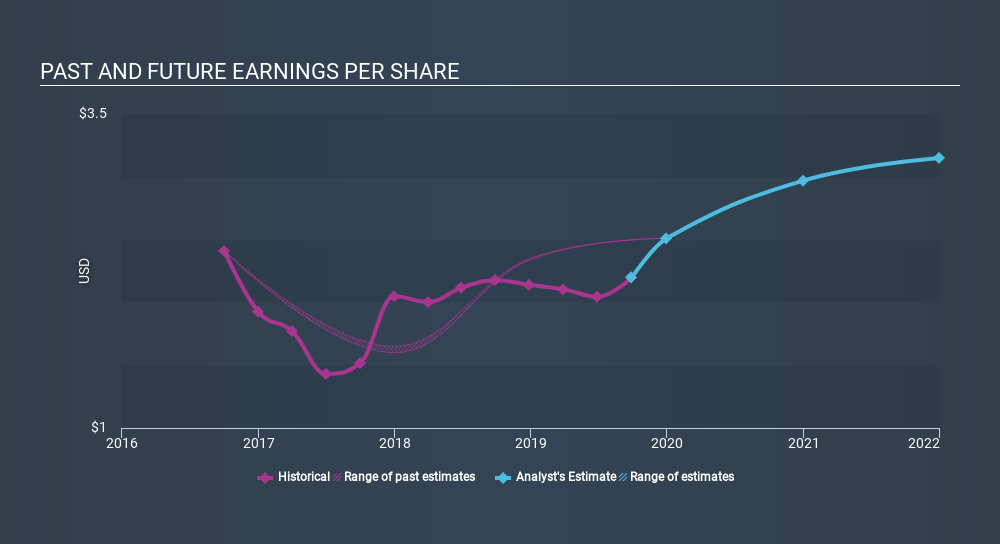

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, HNI's earnings per share (EPS) dropped by 3.0% each year. This reduction in EPS is slower than the 10% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on HNI's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for HNI the TSR over the last 3 years was -21%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 25% in the last year, HNI shareholders lost 1.0% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 2.7% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand HNI better, we need to consider many other factors. For example, we've discovered 1 warning sign for HNI that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:HNI

HNI

Engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives