- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (NasdaqGS:SEDG) Sees 15% Stock Price Increase in the Past Month

Reviewed by Simply Wall St

SolarEdge Technologies (NasdaqGS:SEDG) has seen its stock price rise by 15% in the past month. This increase followed the company's announcement of improved first-quarter earnings and narrowed net losses, against a backdrop of market volatility. The launch of new products, including a solar-powered EV charging solution and a ONE Controller for the German market, suggests a focus on innovation. Meanwhile, the broader market faced downturns due to trade tensions and tech sector declines, yet SolarEdge’s developments provided counterweight, reflecting optimism around its potential growth and resilience amidst these broader challenges.

We've spotted 2 risks for SolarEdge Technologies you should be aware of.

SolarEdge Technologies' recent share price rise of 15% reflects a market response to the company's innovation-driven announcements. However, over a longer period, the company's total return, including dividends and share price movement, was a sharp 68.34% decline over the last year. Compared to the broader US Market's positive return of 10.5% over the same period, SolarEdge underperformed significantly, and similarly, it fell short against the US Semiconductor industry's 12.8% annual return.

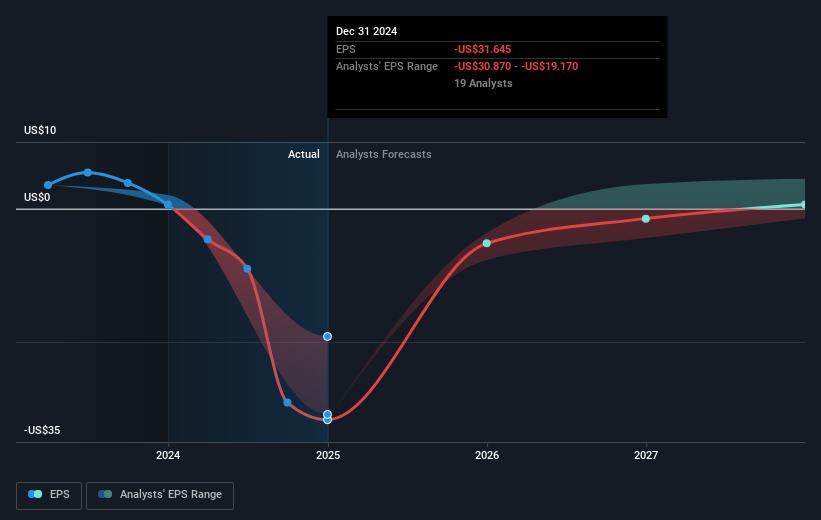

The company's new product introductions, like the solar-powered EV charging solution and the ONE Controller, may influence analysts' revenue and earnings forecasts positively by enhancing product offerings and potentially regaining market share. These developments could facilitate revenue growth, although challenges remain, such as high operational costs and competition from Chinese rivals, which could pressure profitability.

Considering SolarEdge's current share price of US$12.84, it trades below analysts' consensus price target of US$15.44, representing an opportunity for potential upside if these positive developments materialize as expected. However, the significant discount of 24.4% to the estimated fair value suggests caution from investors. As SolarEdge's journey forward includes addressing operational hurdles and market pressures, the alignment of its price appreciation with the consensus price target depends on effectively improving financial metrics and executing its strategic initiatives.

Review our growth performance report to gain insights into SolarEdge Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion