Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Sirius Real Estate Limited (LON:SRE) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Sirius Real Estate

What Is Sirius Real Estate's Net Debt?

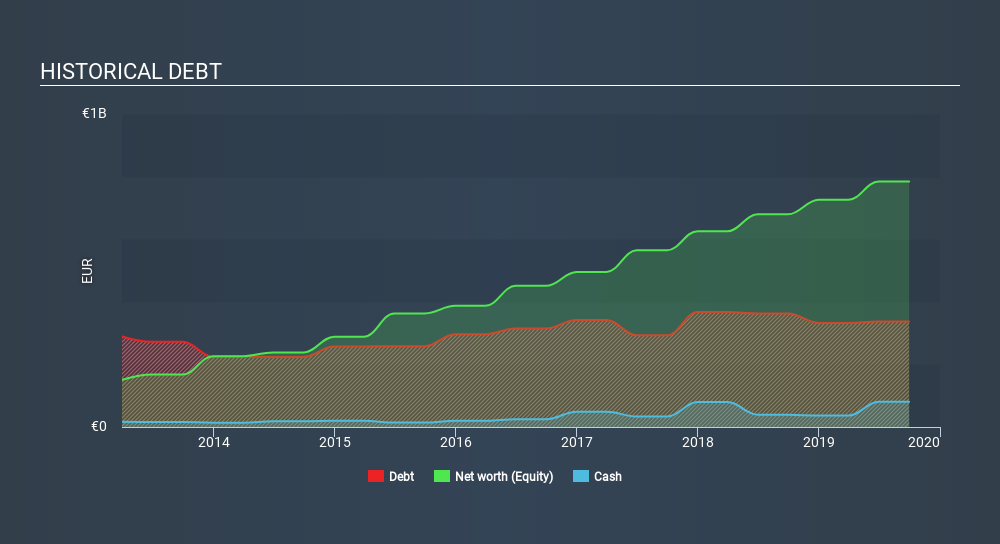

As you can see below, at the end of September 2019, Sirius Real Estate had €337.3m of debt, up from €362 a year ago. Click the image for more detail. However, because it has a cash reserve of €81.0m, its net debt is less, at about €256.3m.

How Healthy Is Sirius Real Estate's Balance Sheet?

We can see from the most recent balance sheet that Sirius Real Estate had liabilities of €53.1m falling due within a year, and liabilities of €383.5m due beyond that. Offsetting this, it had €81.0m in cash and €13.8m in receivables that were due within 12 months. So it has liabilities totalling €341.9m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Sirius Real Estate is worth €1.09b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Sirius Real Estate has a debt to EBITDA ratio of 4.3 and its EBIT covered its interest expense 6.5 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. We note that Sirius Real Estate grew its EBIT by 23% in the last year, and that should make it easier to pay down debt, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Sirius Real Estate's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Sirius Real Estate recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

When it comes to the balance sheet, the standout positive for Sirius Real Estate was the fact that it seems able to grow its EBIT confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit handle its debt, based on its EBITDA,. When we consider all the elements mentioned above, it seems to us that Sirius Real Estate is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Sirius Real Estate is showing 5 warning signs in our investment analysis , and 2 of those are concerning...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:SRE

Sirius Real Estate

Engages in the investment, development, and operation of commercial and industrial properties in Germany and the United Kingdom.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives