- United Kingdom

- /

- Life Sciences

- /

- AIM:GDR

Should You Worry About genedrive plc's (LON:GDR) CEO Salary Level?

David Budd became the CEO of genedrive plc (LON:GDR) in 2016. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for genedrive

How Does David Budd's Compensation Compare With Similar Sized Companies?

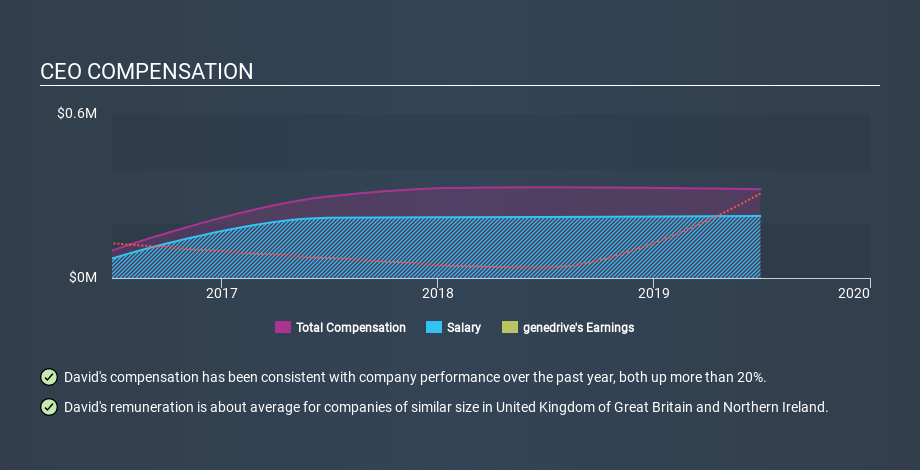

Our data indicates that genedrive plc is worth UK£59m, and total annual CEO compensation was reported as UK£325k for the year to June 2019. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£227k. We examined a group of similar sized companies, with market capitalizations of below UK£165m. The median CEO total compensation in that group is UK£275k.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where genedrive stands. Speaking on an industry level, we can see that nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. genedrive is paying a higher share of its remuneration through a salary in comparison to the overall industry.

So David Budd receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. The graphic below shows how CEO compensation at genedrive has changed from year to year.

Is genedrive plc Growing?

Over the last three years genedrive plc has seen earnings per share (EPS) move in a positive direction by an average of 25% per year (using a line of best fit). Its revenue is down 30% over last year.

This demonstrates that the company has been improving recently. A good result. While it would be good to see revenue growth, profits matter more in the end. Shareholders might be interested in this free visualization of analyst forecasts.

Has genedrive plc Been A Good Investment?

Most shareholders would probably be pleased with genedrive plc for providing a total return of 300% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Remuneration for David Budd is close enough to the median pay for a CEO of a similar sized company .

The company is growing earnings per share and total shareholder returns have been pleasing. Indeed, many might consider the pay rather modest, given the solid company performance! On another note, we've spotted 5 warning signs for genedrive that investors should look into moving forward.

If you want to buy a stock that is better than genedrive, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:GDR

genedrive

Engages in the design, development, and manufacture of molecular diagnostics testing equipment for use in genotyping, pathogen detection, infectious disease detection, and other clinical indications.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

TLX... a Market's Overreaction or a Falling Knife?

Rally in sustainable practices over value recyclable metal stock

Regeneron Pharmaceuticals Inc. (REGN): The Biotech Stalwart – Defensive Growth Amid Biosimilar Headwinds in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion