- United States

- /

- Life Sciences

- /

- NYSE:CRL

Should You Worry About Charles River Laboratories International, Inc.'s (NYSE:CRL) CEO Pay Cheque?

In 1992 James Foster was appointed CEO of Charles River Laboratories International, Inc. (NYSE:CRL). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Charles River Laboratories International

How Does James Foster's Compensation Compare With Similar Sized Companies?

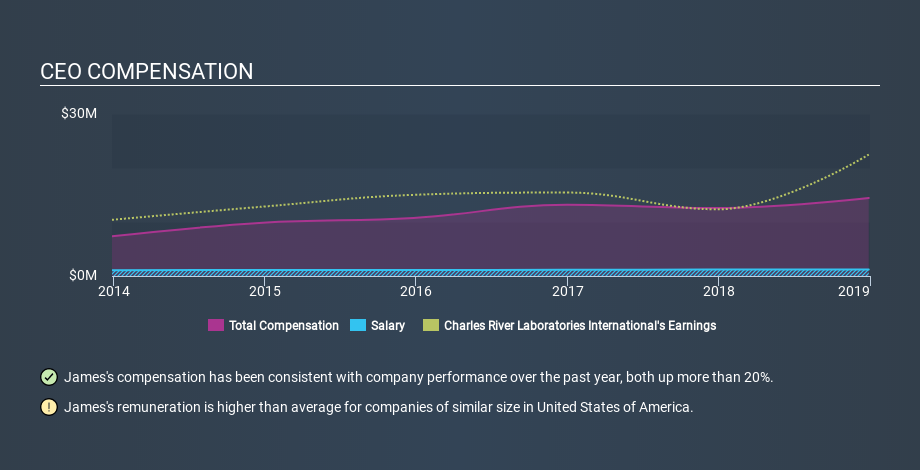

According to our data, Charles River Laboratories International, Inc. has a market capitalization of US$7.0b, and paid its CEO total annual compensation worth US$14m over the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at US$1.2m. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. We examined companies with market caps from US$4.0b to US$12b, and discovered that the median CEO total compensation of that group was US$7.2m.

It would therefore appear that Charles River Laboratories International, Inc. pays James Foster more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see, below, how CEO compensation at Charles River Laboratories International has changed over time.

Is Charles River Laboratories International, Inc. Growing?

Charles River Laboratories International, Inc. has increased its earnings per share (EPS) by an average of 15% a year, over the last three years (using a line of best fit). It achieved revenue growth of 16% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. It could be important to check this free visual depiction of what analysts expect for the future.

Has Charles River Laboratories International, Inc. Been A Good Investment?

I think that the total shareholder return of 60%, over three years, would leave most Charles River Laboratories International, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We compared total CEO remuneration at Charles River Laboratories International, Inc. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. In addition, shareholders have done well over the same time period. Considering this fine result for shareholders, we daresay the CEO compensation might be apt. Moving away from CEO compensation for the moment, we've identified 1 warning sign for Charles River Laboratories International that you should be aware of before investing.

Important note: Charles River Laboratories International may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives